This interview was originally released on January 26, 2014. Mr. Alperovitz tells Paul Jay that if you concentrate wealth at the top, there’s not enough purchasing power to make the rest of the system work.

PAUL JAY, SENIOR EDITOR, TRNN: Welcome back to The Real News Network. I’m Paul Jay in Baltimore. And this is Reality Asserts Itself with Gar Alperovitz.

Now we get sort of to the meat of where we’re headed with the interview series with Gar. And Gar now joins us again in the studio.

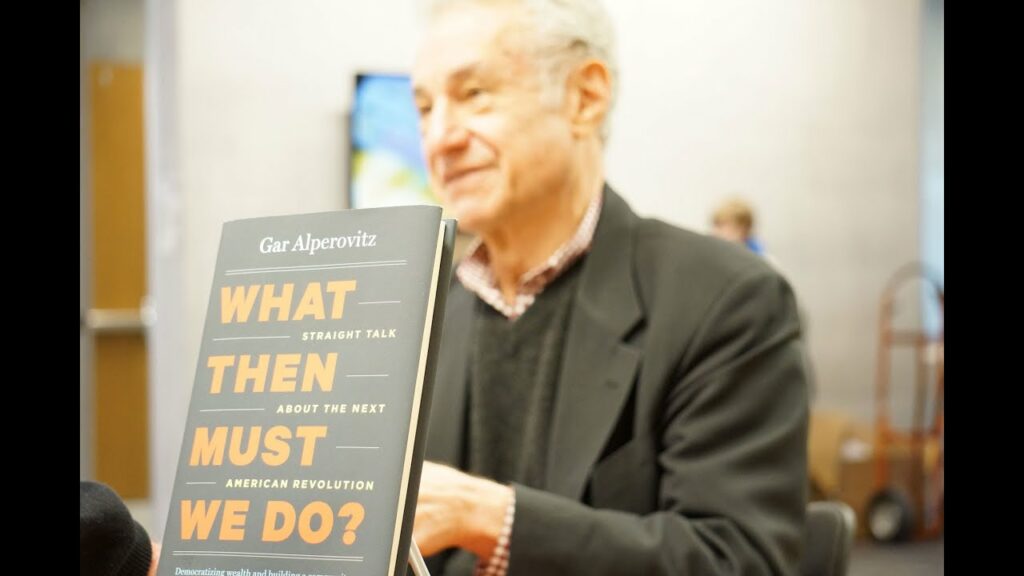

Once again, Gar is the Lionel R. Bauman Professor of Political Economy at the University of Maryland and cofounder of the Democracy Collaborative. And his most recent book is What Then Must We Do? Straight Talk about the Next American Revolution.

Thanks for joining us again.

GAR ALPEROVITZ, COFOUNDER, DEMOCRACY COLLABORATIVE: Thanks for having me.

JAY: So, before we get into what next shall we do, let’s just get a lie of the land of the current situation. The traditional theory of capitalist economies is you go through a business cycle, there’s ups, there’s downs. If you’re rich enough, you’ll make money up and down. If you’re rich and stupid, maybe you’ll lose some, but if you’re good at it, you probably won’t. When the economy is down, tens of thousands, hundreds of thousands, millions of people have their lives destroyed. Sometimes the business cycle is talked about like it’s some antiseptic thing or just a formula. You know, the millions of people lose their homes and lose their jobs and whose families are destroyed, that’s also part of the normal business cycle.

But a lot of people are saying that we’re no longer in a normal business cycle, that we’ve reached a point of long-term stagnation, even if there might be little ups and downs. And increasingly, many more people will have their lives destroyed by all of this.

So let’s start with–before we talk about what a new economy would look like, why would you think the economy as we have won’t just kind of come back and life will be okay again for most people?

ALPEROVITZ: Well, there’s lots of reasons why the economy is in trouble. I mean, the most obvious one is that when you concentrate all the income at the top, people don’t buy. They can’t buy enough. They can invest it or they can put it under the mattress or they can put it in stock speculation, but they’ve got a house, they’ve got two houses, three cars–they can’t purchase enough. The Keynesian idea is to stimulate the economy. So that’s the same–you have this in Marxist theory in another way. By and large, if you concentrate it all at the top, there’s not enough purchasing power to make the rest of the system work. So what happens is you throw people out of work and you have an economy within a large population, large numbers of whom are out of work. So I think that’s the central phenomenon that’s going on, concentration of income and wealth at the top and no way to reallocate it through purchasing power.

The second thing that’s gone on, to really answer your question: that has typically led at some point to a big crisis, a Great Depression style crisis. But the oddity of the modern era now is that, you know, in 1929 before the Depression, government was 11 percent of the economy. That’s the floor. It’s now about 32 percent. So if the floor is at a very different level, you can go down, but you’ve got a buffer that brings it back. You’ve also get some Keynesian policies. When trouble really hits, the corporations go to the government and say, spend money–some money. So it keeps it within a certain frame.

And the language that some economists are now using and they never used before because it was too left-wing is this is a secular stagnation.

JAY: As opposed to cyclical.

ALPEROVITZ: As opposed to cyclical–well, it’s always going to come back and boom again. No, it’s going to be decay and secular–I call it stalemate, political stalemate, stagnation, and decay. And that’s the very different model of where we are and where we’re going. And I think that’s the most likely model. We’ll get some ripples, but I think that’s the most likely model, because the inherent structure is so concentrated at the top that you can’t really run a serious economic full-employment program, unless you had the political muscle. And they don’t have the political muscle to do it.

JAY: And there’s another part to it, too, I think. You know, if you’re sitting on a mound of cash–which a certain percentage of the population is, you know, whether it’s 1, 5, or 10 percent, sometimes maybe a little more, but in terms of having investment capital that’s of significance, it’s probably less than 5 percent, and the big amounts are less than 1 percent. You know, it used to be you would look for places to invest in the conventional economy, but that requires, as you were saying, some demand. There has to be a conventional economy worth investing in and no better alternative. Now there’s such a speculative world to invest in that I think, you know, the size of the derivatives markets, if I understand correctly, are something like three times the global GDP. You can just gamble with your money.

ALPEROVITZ: And that’s what they’re doing.

JAY: And it’s a higher return. So you’d–in some ways you don’t give a damn what’s happening in the rest of the economy.

ALPEROVITZ: Well, that’s–at the very top, that’s what’s going on. It’s a gambling casino. And that is true.

There used to be–the other piece of this is there used to be a capacity–and many liberal economists still kind of wish this were true–that you could get the government to intervene and spend money–build bridges, build highways, housing, everything–which would stimulate the economy in Keynesian fashion. And I think that would in fact work if you could do it, at least to a certain extent.

But the capacity of liberalism–remember, I worked in the House and Senate at one point for liberals–that’s really over to do that. They don’t have the strength to do that anymore.

And it’s not just the Tea Party. First labor unions used to be–and that’s the muscle of the traditional liberal program, and we’d be better off with a liberal program. A lot of people are getting hurt, so I’m not one of those people who say it’s good that it’s getting worse. Much better to have people helped out. But that depended on a very strong labor movement. Thirty-five percent, 34 percent of the country was organized in the 1950s. It’s now down to 11 percent in unions, 6 percent in the private sector. So the muscle behind the old liberal program, it just isn’t there to push a Keynesian solution or a big stimulus program. It just isn’t there. Which is another reason why stagnation is there.

The government is substantially larger. It’s not likely to go all the way down. On the other hand, you can’t get it up. It’s a very decaying–.

One of the things it does: it teaches people that something’s really wrong. It kind of wakes people up to this is–something’s going on here that doesn’t work right for a lot of people.

JAY: I mean, there might be something cyclical here, which is you could have cyclical events like the 2008 crash.

ALPEROVITZ: That’s right.

JAY: So, in other words, a crash, you know, a quasi-stabilization, a floor, a little ripple, and then another crash. But I would think every time that happens, it’s going to be a little bit worse. There’s going to be less ability for the Fed just to throw money at banks and try to stabilize things. You know, each time that decay is going to be in–you know, instead of the official 7 to 9 percent unemployment, we could be getting not very far away, where 13 to 15 percent unemployment starts to become kind of a norm, although many people think it already is.

ALPEROVITZ: Well, right now I think it is closer to 15 percent if you really measure all the people that dropped out of the labor force.

So stagnation, decay within, and cycles within is probably right. How high they’ll go, how deep they go, we don’t know enough about that yet. But it’s–.

JAY: And what do you think of the political ramifications of a decade or two or more of this kind of economy?

ALPEROVITZ: That’s the central and very important point, because in some ways the whole liberal movement, which was able to do progressive programs in the New Deal, the Great Depression, and the postwar boom, in some ways that was a total aberration. It’s really hard to think about it. And what it depended on was a massive global collapse and the fact that there was a Republican in office to take the blame–Hoover. It could have been a Democrat; then the Republicans would have taken it. And we got one boost of legislation, mainly dependent on this crash, global. And then World War II destroying all of our competitors in the postwar boom, cash savings, so forth, very unusual. And those are the heart contexts in which the great liberal programs–and the labor unions were only 11 percent in 1929.

JAY: And add to that a Soviet Union that–whether it was or not in reality is a separate question, but in terms of global perception–was this worker’s economy that had full employment and such and such. And American and Western capitalism are going to say, no, no, we can give you full employment, we can do all this. So there was a kind of pressure to have some of these programs, especially in Europe.

ALPEROVITZ: That’s true. That’s true. But these contexts–.

JAY: Which isn’t here anymore.

ALPEROVITZ: And it’s gone. The context was extremely unusual if you think back on it: a worldwide depression and a worldwide war giving rise in the United States to prosperity. We weren’t bombed. Europe was bombed. And the American working people, the unions, it was a boom period, the postwar period. That’s when you got all your progressive legislation.

And that’s declined. That’s gone. We’ve got competitors everywhere. We haven’t got any labor unions of any great strength anymore. So the whole formation to produce a liberal solution which might have helped–I’m not against that; it would be good to help a lot of people in pain–that’s just not available, which means the context we’re entering, in my view (and what I write about in the book), is a decaying context, but not a collapse.

And that’s a place where people have time to learn and build and begin to develop alternatives. A collapse is very, very difficult to organize in. You might or might not win. But in decay, people learn and are open to new ideas. That’s what we’re finding out on the ground all over the country in some of the work we’ve been doing. Very interesting. They know something’s wrong, and yet this is not a collapse. So what do we do tomorrow? How do we build? That, I think, is a very important way of understanding the next couple of decades.

JAY: So there’s kind of two parts to this. There’s how does one get some kind of political power, political formation to implement policies that lead to a new economy. But I think it’s very difficult to get to that kind of politics unless there actually is a vision that’s fairly worked out about what this new economy might look like. I think it’s very hard for ordinary people to buy in, to vote for something or fight for something which is just some slogans.

ALPEROVITZ: Absolutely.

JAY: So, you know, there’s a few people around–and you’re one of them, and the group you’re working with–that have been trying to put some meat on the bones of what would a new economy look like, both in terms of the economics and the democratic politics of that. So let’s kind of start with the outlines.

ALPEROVITZ: Well, it’s even more profound than that from where I sit. We need to do something that makes sense, because there’s a lot of people who’ve tried to do progressive things and it doesn’t make sense what they’re trying to do. So you need to think it through to have integrity to the vision, you know, starting with yourself. And also it’s not just about a vision that’s necessary.

But one step down from a vision–vision’s about values, equality, liberty, community, ecological sustainability–what are the institutions that make up a system that would actually produce those values?

JAY: And let me just add one thing. When I say vision, I don’t have a technical version of what vision means, ’cause for me when it’s a vision, it’s how would you implement it. But I think it’s very important that it’s not some utopian thing that someday in the future we will have this model society. It’s like, if you took over your city tomorrow or your state tomorrow, what does that actually look like. And in terms of knowing, for example, the kind of reforms you might want to implement, there are going to be a lot of people fighting against you. I mean, you can look at Latin America, where various governments are trying this in one form or another. It’s a war. It’s a class war.

ALPEROVITZ: And I think that’s critical.

What is interesting, if you begin to understand the context of an emerging long-term context of decay, in which you are operating for–there are on the ground in the United States today, there are literally hundreds of examples that begin to point towards the new society, practical things. And people are doing it across the country. But the press does not cover what’s going on.

In one form or another, there are 10,000 worker-owned companies in the United States on the ground, some good, some bad, some better. But they show you what you can do. And we’ve been working with some very interesting advanced models in cities like Cleveland, where the largest–and they’re large. They’re not little companies. So if you want to do–changing who gets to own wealth–and who owns wealth is the heart of any system, whether it’s–feudal system it was land, or a capitalist system the corporations, or some of the state socialism of the Soviet Union, the state. Is there a way to own capital in a way that’s much more democratic and builds a different model? Worker ownership is part of it, and you can find it in America today, many parts of the country, the precedent. And it’s very vibrant. Co-op’s a part of this. If you want to talk about electricity, for instance, cities, publicly owned utilities, public companies are common in the United States. There are 2,000 of them. Twenty-five percent of American electricity is co-ops and city-owned governments.

JAY: And if you go back to what Marx said–and on The Real News, we actually do reference Marx once in a while. It doesn’t happen on much media in the United States. He said socialism is born in the womb of capitalism. And these are–and I think the right wing is quite correct when they attack things like public ownership and say this is socialism. It’s not yet socialism, but it is an embryo of the beginnings of such things.

ALPEROVITZ: Yeah. It’s–and even more, it begins to be a very community-based, democratic form where people participate directly, land trusts, for instance, who owns the land in a neighborhood. Many, many cities now–this used to be a very radical idea–draw a circle around land in an urban area, set up a nonprofit corporation or a city corporation, take over the land to prevent gentrification. That used to be crazy. There are hundreds of them around the country now, and they are another form of changing who gets to own the wealth that begins to point a new direction.

So what’s exciting about this and one of the really interesting things about the New Deal is if you look on the ground, all of the experiments in the two decades before the New Deal were kind kind of the principles that later could be applied nationally. So I see this development–and the press doesn’t cover much of it, but I’ll give you a website: Community-Wealth.org (put the dash in) covers kind of what’s going on. In my book What Then Must We Do we summarize it.

But just beneath the surface, if you wanted–25 years ago, when I was working on this, or 30 years ago, you wanted to set up a worker-owned company, nobody to call. No expert. Now if you want to do it, there are hundreds of people who can help you. If you wanted to do a land trust, you want to do city ownership, you can do that. You want to do state ownership, that’s also–27 states invest directly in owning companies.

JAY: Okay. Well, in the next segment of our interview, we’re going to talk about one of the world’s most advanced, most developed worker-owned company, MONDRAGON in Spain, and the failure of one of their biggest units, because it shows what’s possible in worker-owned enterprises, but it also shows how it ain’t enough.

ALPEROVITZ: Exactly.

JAY: Alright. So join us for the next segment of our interview with Gar Alperovitz on Reality Asserts Itself on The Real News Network.

Never miss another story

Subscribe to theAnalysis.news – Newsletter

“Gar Alperovitz is an American historian and political economist. Alperovitz served as a fellow of King’s College, Cambridge; a founding fellow of the Harvard Institute of Politics; a founding Fellow at the Institute for Policy Studies; a guest scholar at the Brookings Institution; and the Lionel R. Bauman Professor of Political Economy at the University of Maryland Department of Government and Politics from 1999 to 2015. He also served as a legislative director in the US House of Representatives and the US Senate and as a special assistant in the US Department of State.”