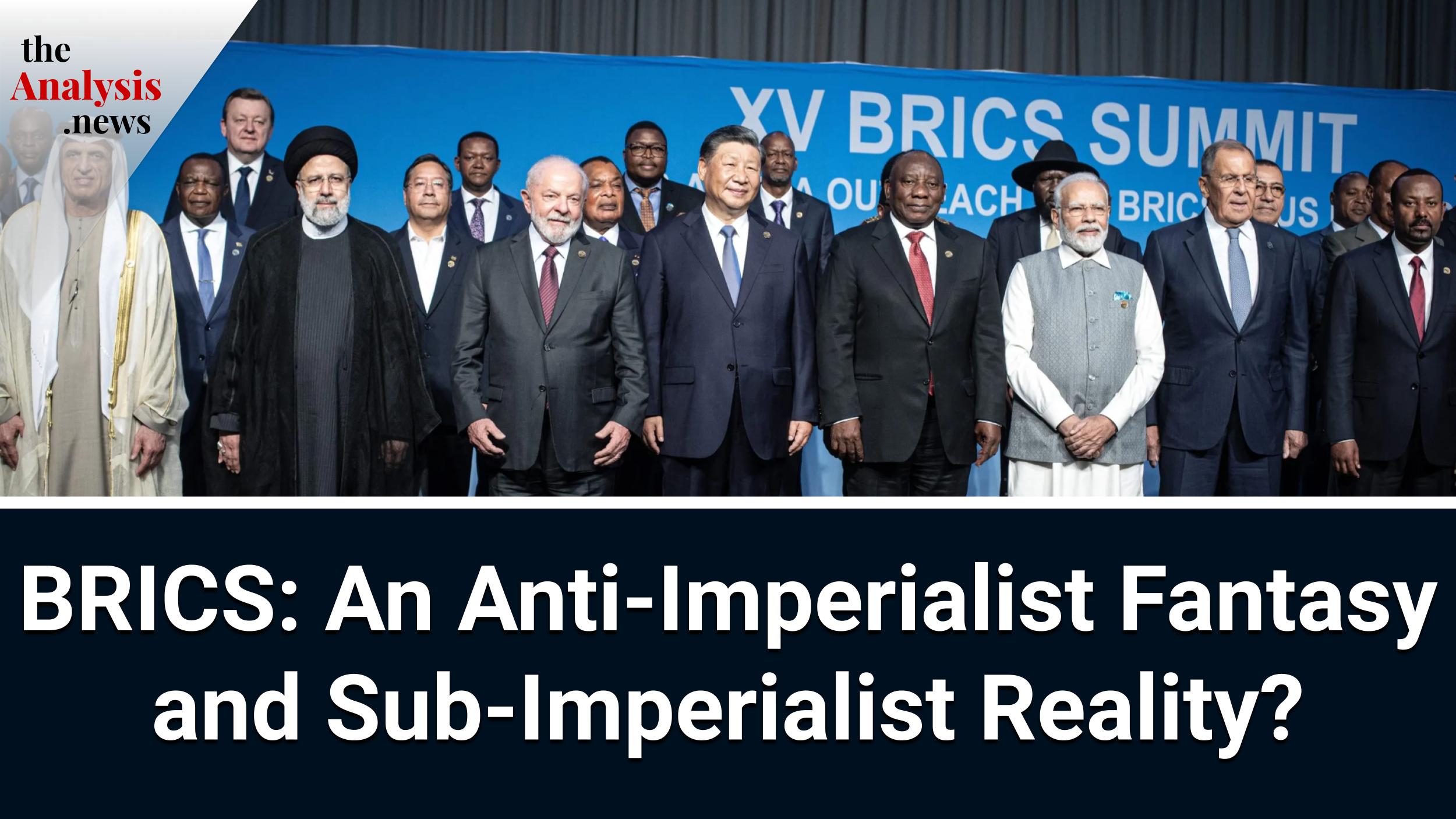

Patrick Bond, political economist, Professor of Sociology at the University of Johannesburg, and Director of the Centre for Social Change, discusses the recent BRICS summit in Johannesburg. The BRICS countries continue to call for greater representation within Bretton Woods institutions, while their opposition to US-dollar hegemony has been feeble at best. Patrick Bond lays out the complicity of the BRICS and soon-to-be BRICS+ elite in corruption networks as they profit from Big Oil and Gas contracts and accelerate environmental disasters. This is part 1 of 2.

BRICS: Talk Left, Walk Right – Patrick Bond (pt 2/2)

Talia Baroncelli

Hi, I’m Talia Baroncelli, and you’re watching theAnalysis.news. You’re watching part one of my discussion with political economist Patrick Bond on the BRICS countries and what they represent. These discussions are made possible by your contributions, however big or small. So, if you’re in a position to donate, please go to our website, theAnalysis.news, and hit the donate button at the top right corner of the screen. You can get onto our mailing list so that you’re notified every time there’s a new episode and like and subscribe to our podcast on whichever podcast platforms you use. You can also like, subscribe and hit the bell on our YouTube channel, theAnalysis-news. See you in a bit for my discussion with Patrick Bond.

Joining me now is Patrick Bond. He’s a political economist and professor of sociology at the University of Johannesburg. He directs the Center for Social Change. He’s also the author of numerous books, including BRICS: An Anti-Capitalist Critique, which he wrote together with Ana Garcia. It’s really great to have you here today, Patrick.

Patrick Bond

Thanks for the chat, Talia.

Talia Baroncelli

The BRICS countries recently got together at the BRICS summit in Johannesburg, South Africa, at the end of August. In response to the summit, you wrote a piece characterizing the BRICS as being sub-imperialist. So they’re not even a halfway house to neoliberalism, but they’re fully integrated into a neoliberal economic system. Would you say that this perception or characterization of the BRICS forming a new alternative to the Bretton Woods institutions or being opposed to the U.S. dollar hegemony is, in fact, completely unfounded?

Patrick Bond

Well, Talia, a lot of the terrain on which we are operating here is what we could call “talk left, walk right.” That means that there’s a tendency to try to get popular support for some process and to dress it up as if it is in some populist mode, going to help ordinary people. The reality is that the elites get stronger and stronger, and often, they do so using the rhetoric of alternatives. The harsh reality, once you get the devil in the details into your radar screen, is that nearly everything that the BRICS have been doing in some of the key countries like South Africa, which, although is the smallest in population and in economic size, has a certain historic function and credibility, given that we’ve come out of apartheid by fighting imperialism and its support for white, sub-imperialist South Africa. The dilemma is that there are so many continuities, not changes, especially in economic interests.

As Samir Amin put it, the sub-imperialism of South Africa rests upon the failure of our government to make changes away from an economic structure that has been grounded in a minerals energy complex or, as he put it, the monopoly capitalism of Anglo-American and the mining houses. While there have been some changes and there’s a bit of de-racialization at the top, nevertheless, the basic economic structure has amplified oppression and what we would call super-exploitation. It’s not even just the worker at the point of production in a factory; it’s all the other terrains: the gender oppression that goes with long-distance migrant labor, the ecological appropriation, and non-renewable resources stripped from the ground. That’s why the term sub-imperialism has become popular.

As the originator, Ruy Mauro Marini, a Brazilian dependency theorist who was writing in the ’60s, ’70s, and ’80s, devised an understanding of Brazil after the coup in 1964, in which it fits into imperialism’s expansion as a key nation. The antagonistic cooperation with the West shouldn’t veil the real politics in which the monopoly capital and finance capital structures of those economies also need to expand. They have certain limitations, and they, therefore, have antagonisms with the West. They’re not against Western neoliberal capitalism; they’re within it. What we find, indeed, is that they actually amplify it. That’s why when I hear “talk left,” I look for the “walk right.” I wish many more who think BRICS is an alternative would do so as well.

Talia Baroncelli

Well, another example of the “walk right” would potentially be the declaration that they published. Some of the articles in that declaration state that they would like to have a broader role or greater representation within the Bretton Woods institutions themselves, such as the IMF and the World Bank. So that doesn’t seem like they’re trying to fight that system at all. They actually want to have a greater role within it. So that begs the question, what is then the purpose of the different financial mechanisms they’ve created, such as the Contingency Reserve Arrangement and the other development bank that they have?

Patrick Bond

Well, you’re right. Let’s take that in two steps. One is the attempt to reform, and the other is to figure out alternative institutions. The attempt to reform included actually purchasing a greater share, the major recapitalization of the International Monetary Fund. So I’m sure all your viewers know that this is the institution which is the main policeman for the interests of world finance. They force countries, including South Africa today, to squeeze their budgets in order to be able to repay foreign lenders, even when those loans are demonstrably corrupt. In our case, we also have very high loan commitments to repay coal-fired power plant debt that the World Bank especially led on about 12 years ago. So there’s odious debt, and it’s corrupt debt, and the IMF lends so that we have money to pay the interest on the old debt. It’s a typical function of balancing the payments. The World Bank does project loans.

Now, as far as I’ve seen, the BRICS bloc and their delegates have done absolutely nothing to change that division of labor, the way in which the IMF and the World Bank oppress poor countries. The project loans, like South Africa’s biggest loan and the World Bank’s biggest loan ever, the $3.75 billion Medupi coal-fired power plant loan are often very anti-people and they’re certainly anti-environment. Yet repaying them requires new money. So the IMF regularly goes and says, “We want new money from our members.” The last time they did that was in 2015, and they got from China a 37% increase in China’s voting shares by buying more of IMF’s capital base. For Brazil, it was 23%. For India, 11%. For Russia, it was 8%.

Now, when they buy more, of course, some people lose because they can’t afford it. Those would be Nigeria and Venezuela, each losing 41%. So, yes, the BRICS have done some reforms of what they call “voice.” They have a louder voice. The BRICS together aren’t quite 15%. That’s the sort of veto level for making loans. The U.S. regularly exercises that or uses its power in the IMF. In fact, it was unveiled that it made a loan to Pakistan because the U.S. pushed the IMF to do so in order so that Pakistan would sell weapons to Ukraine. So it’s that sort of, let’s say, functional imperialist politics, not just economics.

There, when we have a reform effort, you’d expect the IMF may be a little bit more pro-BRICS, instead of having a European as its managing director, and then there may be more openness. But instead, the BRICS delegates voted again and again for what were demonstrably corrupt IMF leaders. I say that without hesitation or fear of any lawyers because they were convicted like Christine Lagarde, who was running the IMF in the 2010s. Her successor, Kristalina Georgieva, has been accused of corruption in the data collection during her tenure at the World Bank. Prior to that, IMF leaders like Rodrigo Rato went to jail. Dominique Strauss-Kahn had many prosecutions. So we’re looking at a layer of people that are at the bottom of the barrel internationally, but the BRICS keep reappointing them. The BRICS have never put up a unified candidate against them, and the same is true with the World Bank. Even when Donald Trump put in David Malpass, who was a Sinophobe and a climate denialist, the BRICS didn’t say anything, even China.

Now, this reflects that they go along and they get along in the IMF and World Bank, and they’ve got usually a high-level position. For example, the chief economist at one point was Justin Lin, a Chinese national and the current deputy. The managing director of the World Bank for infrastructure is Chinese. But again, we find them doing nothing different. They go along with the ideologies of the Washington consensus, neoliberalism, and they don’t do anything to assist where countries really need a break or where there are genuine reforms being posed.

The idea that the BRICS want to reform the international financial institutions, I dispute based on this record, and it’s simple to understand. The most conservative people in our governments, in the BRICS countries, especially here in South Africa, are in the Finance Ministry and Reserve Bank. You’ll find the neoliberal bloc very connected. In fact, our leaders here are often also leaders of IMF committees.

Now, these are the sorts of, let’s say, interrelationships and revolving doors that mean I don’t expect the BRICS to lead a progressive reform. In fact, that would be largely regressive, similar to what we’ve seen from the IMF and World Bank. Then, when we got to alternatives, we had hoped for an alternative IMF called a Contingent Reserve Arrangement. A CRA never appeared, even when South Africa needed foreign loans. But even had it appeared, the original declaration in 2014 in the BRICS meeting in Brazil called for a 30% quota that you could borrow. For South Africa, that’s a $10 billion total quota, and we could get $3 billion. But then if we want the other $7 billion, we have to go to the IMF to get a structural adjustment program. In other words, the IMF gets strengthened, and its leverage increases because of this supposed alternative, which doesn’t even really exist.

We were hoping for an alternative credit rating agency instead of Standard and Poor’s, Fitch and Moody’s, never came to being. We’d hoped for an alternative internet because of the U.S. tapping into the wires. We never got that. We were hoping for a BRICS vaccine center, which was promised here in Johannesburg, which would have been so useful two years later when COVID hit, and that never came. In fact, the BRICS were divided.

Probably the most confusing is the BRICS New Development Bank. One reason it’s confusing is that, unfortunately, the BRICS have five main members, and a few new members, like Uruguay, the U.A.E., Bangladesh, and Egypt, are coming in. The new BRICS Saudi Arabia, Argentina, U.A.E., as I said, is already in. Iran and Egypt are already in, including Ethiopia. Regardless of what happens, the existing bank with 18% ownership by Moscow, suddenly, in March 2022, agreed with Western U.S. financial sanctions against Moscow because they valued more their international credit rating. Then, when you look at their portfolio, the BRICS New Development Bank it really is indistinguishable from a standard international financial institution. Nearly all of the loans are in U.S. dollars: 78%. Dilma Rousseff, the new president, only wants to bring that down to 70% by 2030. They’re either dollars, euros, or yen. That reflects that the BRICS New Development Bank is still working under a model in which they borrow from an international currency and financial markets in hard currencies. Then, they have to have relatively high-interest rates because our currencies are declining, and they really aren’t that much different.

In fact, when I looked at the entire portfolio from South Africa, I actually found it to be a more corrupt and less accountable institution than even the World Bank. So I would dispute anyone who would like to say that there’s progress, even with someone like Dilma Rousseff, who has great left rhetoric against U.S. imperialism and the dollar. We saw in August here in Johannesburg, that the de-dollarization hype absolutely amounted to nothing. There was nothing done except some vague promises that there would be more trade-related currencies.

I hate to say it, but the financial sub-imperial power of the central banks and finance ministries in the BRICS have overwhelmed those who I’m sure with all good intent would love to see, and we desperately do need an alternative to U.S. dollar hegemony, but it’s not coming from the BRICS.

Talia Baroncelli

Well, I do want to get back to U.S. dollar hegemony, but while we were on the topic of structural adjustment and World Bank development loans, would you say a lot of these loans, particularly in the case of South Africa, employ Western consultancies or other Western firms to manage and implement the strategy of these loans? So, in a way, it’s money laundering, getting money from the World Bank and funnelling it through these different consultancies and Western firms. By the time it actually gets to people on the ground, there’s not much left.

Patrick Bond

Well, that’s correct. There’s definitely money that does get into projects, but there’s a lot of siphoning. In fact, one of these consultancies, PwC, PricewaterhouseCoopers, does a biannual survey of corruption. During the 2010s, our South African white bourgeoisie, it’s color-coded because there aren’t too many blacks at the top; they ranked number one in the world for corruption under the economic crime fraud surveys. PwC itself basically was behind wrecking our national airline through corruption. I really trust them when they do these surveys because it takes one to know one. The same can be said of Ernst & Young. KPMG might be the worst of them, and McKinsey. They’ve all had notorious roles in stripping South Africa’s parastatal agencies who go to them for advice.

Yes, there’s a lot of funding from the World Bank and other international lenders. It does often feel like it’s an absolute quicksand of international, financial, and elite corruption and a revolving door that even though our Transparency International rating for government corruption is not that bad, we’re 100th most corrupt out of 180. When you have basically the most corrupt corporate elite in the world from which our own president has emanated, and he’s got his own corruption problem at the moment with apparently millions of dollars of cash stuffed into a couch. You’re not allowed to hold dollars outside the banking system here. There’s a scandal called Phala Phala, and he himself was in the Marikana massacre as the key investor in [inaudible], for which the police killed striking workers in 2012.

So we’re dealing with an utter swamp or a quicksand of corporate elites who have very weak ethics. When we do get IMF and World Bank loans, the latest ones went for COVID, and then you could immediately see how, in that process, a great deal of corruption in procurement occurred.

It’s so bad, Talia, that even in the Treasury, our conservative Finance Ministry, the main official in charge of procurement, Kenneth Brown, has testified publicly that 35% to 40% of every government contract is corrupted by the public-private pilfering, public-private partnerships that are entailing here. Yes, the IMF and World Bank, when they make loans, they don’t give a damn about that. In fact, when we took the Midupi loan, in which $3.75 billion went to a coal-fired power plant, Hitachi was the main beneficiary, and they bribed the local ruling party, and the Foreign Corrupt Practices Act was invoked by the U.S. Security and Exchange Commission. Hitachi paid a big fine, but the World Bank declined to look at it to see that their loan was massively corrupted. We definitely need to be challenging what you could call odious debt, debt that really shouldn’t be paid by victims who are electricity consumers, very poor people getting chopped off with very high increases in the electricity price and by taxpayers.

Talia Baroncelli

Well, you mentioned President Cyril Ramaphosa, president of South Africa, and he also has ties to the head of the Shanduka Group, who was also involved with the corrupt Gupta brothers as well. It seems like it’s a ring of corruption, and we could probably go into more detail on that another time.

I did want to ask you, with regards to the U.S. dollar hegemony and the Petrodollar system, do you think the BRICS, and now with BRICS plus the new countries that they’re letting in, do you think that they’re actually capable of de-dollarizing? Is it a question of capacity or the will to do so? Maybe they just don’t want to do it.

Patrick Bond

I think it’s political will. Before we talk about de-dollarization, just to amplify the point about Ramaphosa, who has been bound up in corruption. His main partner here for a major coal mine called Optimum was Glencore and its leader, Ivan Glasenberg, until last year when he retired. The Johannesburg-raised lad was exceptionally corrupt, and he’s been nailed for that by British, U.S., and Brazilian courts, especially in his African dealings.

Now, the dilemma is that when he did deal with the Guptas, in which the Guptas tried to shake down Glencore to get rid of this Optimum mine after Ramaphosa, the head of Shanduka, had sold it, the crucial question was whether the Guptas could operate a major mining group. They did so with all kinds of scams. Why BRICS is terribly important in this is that Rosatom, the big nuclear company out of Russia, was trying to sell $100 billion of eight nuclear generators to South Africa using the Gupta’s uranium mine. It was in this context that the prior prism basically fell, and it was extreme corruption. It was so bad the courts actually rejected that after civil society activists from Earth Life Africa and the Green Connection intervened.

Now, the main point here is that when we see these sorts of deals involving Jacob Zuma or Cyril Ramaphosa with these BRICS companies, we have learned to expect the worst. Expecting the worst for de-dollarization, as I tend to do, I’m a pessimist when it comes to the elites. I’m obviously an Afro-optimist when it comes to grassroots social forces. But the main point about this de-dollarization is that there are so many ways that other countries have shown. For example, Ecuador defaulted on debts in 2007, and Norwegian debts that were corrupt. Then Ecuador threw out the World Bank and the IMF. Or China putting on exchange controls in 2015-2016 to keep its own funds inside the country. Or the proposal by Hugo Chavez for a Bank of the South with the SUCRE, the proposed Latin American currency. Many, in other words, initiatives have been taken to try to weaken existing international financial power relations. The dilemma about de-dollarization is you’d really need a major commitment from the leaders of economies that are diverse, where, in one case, India’s leaders despise the Chinese elites. That means not only fighting on the border in the Himalayan mountains, over barren strips of land where dozens of soldiers have died, a tragedy, but also the Indians have begun to repel Chinese capital, and they refuse to use Yuan. Even a BRICS enthusiast like Pepe Escobar, a journalist from Brazil, has made this point that, really, we’re looking at elites in the BRICS that haven’t yet cohered behind a common project.

In other words, financially, it’s not that hard. John Maynard Keynes set up a case for national-based instead of international finance for exchange controls and for an international set of relationships that he had hoped would emerge from the Bretton Woods debates. He lost all those debates in 1944 and 1946. The terrain we’re on isn’t foreign. The only things that are probably different would be cyber currencies. The debate there is whether central banks could be trusted to issue these currencies if they’re grounded, for example, in gold. These are some of the innovations people are hoping for. The best we’re going to get in de-dollarization is a little bit more south-south trade financing. But even there, the contradiction is that there are imbalances in the trade.

So India, for example, imports a great deal of energy from Russia but doesn’t have much to export to Russia. So there’s a huge store of rubles that are rupees from India that can’t be turned into rubles because of this trade deficit that India has with Russia. So because of the Indian exchange controls, those Russian exporting energy companies are screwed. And that just goes to show that you need real political will to open up what are currently defense mechanisms that I support, exchange controls, but they are preventing a common currency or even these trade-related currencies from emerging.

Talia Baroncelli

What about gold, though? Because China’s been heavily investing in gold reserves. Is that them looking to the future and trying to potentially back up a different system using the value of gold?

Patrick Bond

It is curious. Below my feet here in Johannesburg, at one point, we could find half of the world’s gold. It was all dug out. We just have holes at the moment. In the process, 40,000 miners lost their lives. It was a terrible, let’s say, investment in human life and ecological degradation. The water system here is messed up by all of the chemicals and radioactivity that go with gold mining. I’m quite a critic of the underdevelopment and resource cursing of gold.

You’re asking, in a way, the wrong person. Here in Johannesburg, we know the worst cases. Some countries, like El Salvador, have even banned gold. In Colombia, villages have said no to Anglo-Americans for gold. So, I think gold is a relic of a time when the leading capitalists didn’t trust their government. They sort of said, “Look, you have to have some grounding for your currency. You need a gold standard.” The quasi-gold standard from 1944 until Richard Nixon defaulted in 1971 on the Bretton Woods system meant that the U.S. dollar was measured at $35 to an ounce of gold. Fort Knox had half the gold, and South Africa had a huge amount. South Africa and the U.S. fought together against the British and all of the debtor countries in these Bretton Woods negotiations.

Since then, since 1971, that stability has ended. The gold price has been haywire. It went up very high in the late ’70s because of inflation in the U.S. It’s been zigzagging around, and you’re asking a good question. If you buy gold, it’s really only as a hedge against what you assume will be a decline in the value of the U.S. dollar, the other major hedge against international financial chaos. Yes, a lot of BRICS and other central banks are buying it, but others are selling it. One reason is it doesn’t get you any interest. It’s gold vaults, probably sitting in a London central repository. As we know from the Venezuela case, those London managers are thieves, and they just stole Venezuela’s gold stocks. These aren’t even particularly safe ways of hedging.

The price has been way, way up, over $2,000 an ounce. But the main point about gold is that because under conditions of stability, it’ll decline in value. It’s not really worth holding unless you do want to set up a new system in which gold is the core to assuring everybody you’ve got value in your currency. But because we’re so far away from that, even the BRICS managers think it could be 30 or 40 years. I’m not sure that anyone holding gold is doing themselves any good, but the Chinese are selling a little bit of U.S. Treasury bills, but they’re still keeping their U.S. corporate stocks and shares, their securities, their credits. So I’m not sure that we’re really seeing a dramatic change aside from the one country that did get the sanctions from the SWIFT system and can’t get loans, and it went into default, and that’s, of course, Russia.

Now Russia has with Iran, a new member of BRICS that in common. They would love to see an alternative payment system. So I would expect a little bit more progress in, let’s just say, the logistical management of trade, finance, and financial transactions instead of going through this obscure Brussels system called SWIFT. But again, we’ve been promised this for more than a decade, and nothing’s happened. So I really, let’s say, regret that most of the BRICS negotiators who come from finance ministries and central banks are not particularly rigorous in wanting to challenge a system that they’re getting used to and that their international corporates are basically needing. They still need to have as much to do with U.S. dollar trading and holding U.S. dollars as a safe hedge as they can in a period in which we have such extreme volatility.

Talia Baroncelli

Well, BRICS are now BRICS plus, so they’ve just let in a bunch of other countries, including Iran, as you mentioned, Saudi Arabia, United Arab Emirates, Egypt, and Argentina. What is the logic in expanding, and also, what are the requirements for joining the BRICS? I’ve heard you speak about how these countries need to be of a certain standing, but clearly, countries like Saudi Arabia have terrible human rights records. So, are those issues just being swept under the rug? Does that not factor into letting them in?

Patrick Bond

Well, you asked for the logic, and I don’t think there is one. I’d love to know. I think these are, let’s say, part of the expansion that may have been easiest at the outset. We haven’t even heard if Saudi Arabia will say yes; they’re kind of playing it. They’re also at the same time negotiating to join the Abraham Accords, which would recognize Israel. So the pressure from the United States to still stay on site, even though Joe Biden called Mohammed bin Salman a pariah, is obvious. Of course, when Biden went to try to lower the oil price by raising production, the Saudis said no. The Saudis also broke the Petrodollar earlier this year, meaning they decided they would sell their oil to China in the renminbi, an international yuan currency.

Saudi Arabia is the subject of an interesting tug-of-war because, as we saw even just weeks ago, they were relatively pro-Ukraine when it came to hosting a peace conference that didn’t include Russia. Yet, Mohammed bin Salman and Vladimir Putin had all sorts of friendly relationships. The most important geopolitical relationship for Russia is to bring Iran in because that’s the source of their drones and other military support, but also because there’s going to be a north-south trade route that goes from Iran up through to Russia. These are part and parcel of expanding the Belt and Road, a horizontal expansion that would then have a vertical component from Iran up through Russia. So, lots of, let’s say, contingencies.

For example, Brazil. Lula desperately wanted Argentina in, partly to try to persuade the Argentine people that there are benefits from not having a far-right president in the wake of Javier Milei’s opposition to the presidential run. He has said he will dollarize the currency and not join BRICS in January if he wins in the October-November vote in Argentina.

Ethiopia was a strange choice because it’s got a civil, in fact, a double civil war going on with Tigray and Amhara. Then Egypt has had this very strong sub-imperial connection to the United States, of course, as have Saudi Arabia and the U.A.E. So we’re looking at six new countries with terribly, let’s say incoherent and diverse approaches. It just makes you think, what is being in good standing all about when we have, for example, popular movements in Iran of women and their supporters rising up and then being literally chopped as executions occur against those protesters who are in solidarity with women who are denied basic rights?

The same, we can add, of the Argentine economy with terrible IMF pressure and also gas and oil offshore. Big protests have emerged, anti-austerity and climate protests called “Debt for Climate,” a very important movement. Those are the sorts of, let’s say, indicators that all is not well in the new BRICS-plus country. Then we anticipate a few more coming in.

Those that have applied include some of the traditional left countries: Nicaragua, Cuba, and Venezuela. Big questions are emerging about whether, for example, Nicaragua is genuinely left, given the character of Daniel Ortega’s rule. But then there’s potentially Mexico, which could be the biggest and most important in Latin America. Coming from Africa, we could expect Nigeria, Senegal, Algeria, and Morocco who are lined up. Even Sudan and Zimbabwe have asked. In Asia, we’d expect Kazakhstan and probably Belarus, a European Eurasian, two crucial countries, and maybe Thailand, Indonesia, and Vietnam. Those are the sort of, let’s say, next couple of dozen countries that we’d anticipate being in the next round, which would be when Russia hosts the BRICS next year.

Is there any logic to this? What do the BRICS do to justify attracting all these new countries? It remains to be seen, but as far as I can tell, it’s more or less symbolic, and it may reflect this, let’s say, the underlying geopolitical conflict between the Russian allied countries and the West. If that’s the case, then the BRICS don’t really seem to have much of a purpose, aside from symbolism as to who is in the club and who’s not. But ironically, in the club, if all the 24 that had applied this year, that actually would have swung the balance against Putin because so many of the new countries that I’ve just mentioned have actually voted against Russia’s invasion of Ukraine in several of the United Nations General Assembly votes. It’s a fluid situation where the logic isn’t particularly evident.

Talia Baroncelli

Well, we could also flip this good standing criteria on its head and argue that countries in the G7 are not of good standing, especially because the United States is a member. I think that would be a topic for another interview. But the intrinsic value of the BRICS itself, I mean, to have a forum where countries can debate certain issues without having other Western countries looking over their shoulder, is there any intrinsic value in that in and of itself, even though we’ve already established that these countries don’t form some sort of anticapitalist unit?

Patrick Bond

Well, not only are they not anticapitalist, if you look at the logic in the single most important bloc formation which we’ve seen so far, it’s called BASIC, but it’s BRICS minus Russia. That group: Brazil, South Africa, India, and China; BASIC came about in 2009 in Copenhagen at the Climate Summit. So they go to the United Nations Framework Convention on Climate Change, Conference of the Parties, Conference of the Polluters, as we call it, and the U.A.E., Dubai is hosting this year. So I do actually anticipate the BRICS now with Saudi Arabia, Iran, the U.A.E., and Egypt, major carbon-addicted economies, coming and playing a reactionary role. So it’s not only that they’re not anti-capitalists, but they’re pro-fossil fuel. They’ll slow down the desperately needed attempts to bring down global CO2 emissions.

Moreover, what we found when BASIC negotiated with Barack Obama to come to your general point that the G7 doesn’t have standing, good standing to manage the world, we’ve always seen the G7 economies led by the U.S. Barack Obama barging into the room in Copenhagen where Wen Jiabao from China, Manmohan Singh from India, Lula da Silva, then, as now, the residing president and our former president Jacob Zuma were sitting. It was in December 2009, Obama had just won the Nobel Peace Prize in Oslo. He jetted over to Copenhagen, and there sat with those four and did a deal— the Copenhagen Accord. The critical thing was to not make emissions cuts top-down of the magnitude we need to save the planet. They were very convinced you could do a bottom-up, they call it in Aurelian terms model, in which people just made their own pledges. Donald Trump then dropped out of the UNCC: no big deal, no punishment. Secondly, what they all have in common is that they hate the idea of climate debt. They refuse to accept liability, or what we call technically polluter pays responsibility. So the reparations that not just the G7, the major historical emitters, but also China, India, Russia, Brazil, and South Africa, five of the major current emitters, and in a few of the cases also very high historical emitters and their refusal to accept that they owe poor countries who are really screwed with what they call loss and damage and they’re just not contributing to a fund in the way we would want them to. We’d love to see a bloc of emerging markets that have power, that have social and ecological responsibility, and that would, like we in South Africa must do help Mozambiqueans, hardest hit by cyclones and the climate crisis. It’s that dilemma that is allowing us to say, I think not Washington, nor Moscow, not Washington, nor Beijing, not Washington, not Delhi, Pretoria, and Brazilia. In other words, we’ve got a critique that works from a general anti-imperialist standpoint but then considers as we do in climate and finance and many other areas. I could also add World Cup software because we hosted the football World Cup in 2010, 2014 it was Brazil, 2018 it was Russia. So, my case is closed. Given [inaudible 00:35:36], the imperialist sitting in Zurich at the time. These sub-imperial, let’s say, facilitators or amplifiers of some of the worst tendencies in the system are not going to be a force for liberation.

Talia Baroncelli

Speaking of liberation, how do you compare the current BRICS to the original Non-Aligned Movement, which formed in 1967 with leaders such as [Josip Broz] Tito from former Yugoslavia, [Gamal Abdel] Nasser, Sukarno from Ceylon, and [Jawaharlal] Nehru from India? The context is completely different. The Non-Aligned Movement emerged within a context or out of a context of decolonization and, of course, the Cold War. So, there are different contingencies there. But how do you compare the aims of the two?

Patrick Bond

Yes. Well, if you go back to what is sometimes called the Bandung Spirit, it was in 1955 when that first non-aligned network from not only the south but it was originally Asia, Africa, and Latin America came along, of course, but the decolonizations, especially in Africa in the ’60s, were supported by Nam and then Yugoslavia was part of it. But the real question emerged in the ’70s with this force, the Non-Aligned Movement promoting a new international economic order which would reform, for example, world commodity trades which create what we would technically term unequal ecological exchange, where values, especially depleted wealth from poor countries then are never compensated at the requisite rate.

Now, in all of these unfair international relationships, including Bretton Woods financiers and what was then GATT, and now as the World Trade Organization or any of the other processes that allow these transfers of wealth from the south to the north, they’ve actually gotten worse. As I say, I haven’t found, with the interesting exception of the World Trade Organization last year being a site of debate over whether there should be a waiver on intellectual property rights or COVID vaccines, I haven’t found that Spirit of Bandung.

Then we saw that attempt, which was led by South Africa’s President Cyril Ramaphosa and joined by Narendra Modi. Modi, of course, represented Big Pharma of the south, which is the generic medicines industry. They’re considered the drug company and the pharmacy of the south, but Brazil, led by Jair Bolsonaro, the reactionary, was firmly with international Big Pharma against the waiver. Russia and China had the Sputnik and the Sinopharm and Sinovac vaccines, so they didn’t come on board with the advocacy for generics and that cost probably millions of lives and led to vaccine apartheid, where, for example, the very unscrupulous leadership of Canada ordered five times the number of vaccines than they had population at the time because they had the best access into the different circuits of Big Pharma and some of the other vaccine systems. That left, for example, Africa with a very low share of the population getting vaccinated.

Now, these are some of the debates about, let’s say, access to international public goods, stopping climate catastrophe, dealing with pandemics by sharing vaccine and treatment information and resources, or trying to address ocean acidification, plastification, or the sixth great species extinction, biodiversity crises, or dealing with global inequality in a systematic way. For example, stopping tax havens and illicit financial blows. This is where you’d want the BRICS to act coherently. In the most important single recent case, trying to get intellectual property waivers on COVID-19 vaccines to stop the pandemic from running out of control, we failed. So I don’t think at this stage we can expect these kinds of global elites who themselves acknowledge that they have a poly-crisis, interlocking and overlapping problems. The World Economic Forum uses that term to basically show their own humility at their incapacity, and to have an alternative approach is so desperately needed. But what we’ve seen, all the evidence we’ve seen so far is that the BRICS fit into this system instead of opposing it.

Talia Baroncelli

You’ve just been watching part one of my discussion with political economist Patrick Bond on the BRICS countries. I promise you that part two is just as interesting. So, if you’d like to support us with a small donation, you can go to our website, theAnalysis.news, and hit the donate button at the top right corner of the screen. If you haven’t done so already, get onto our mailing list via theAnalysis.news’s website. That way, you’re notified every time there’s a new episode. See you with Patrick Bond for part two.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

Patrick Bond is a Distinguished Professor at the University of Johannesburg Department of Sociology, where he directs the Centre for Social Change.

More often then not, the enemy of your enemy is not your friend. Great interview.