This interview was originally published on June 1, 2014. Mr. Lapavitsas says we must deeply reverse financialization and take on private ownership of banking and other critical sectors.

PAUL JAY, SENIOR EDITOR, TRNN: Welcome back to The Real News Network. I’m Paul Jay in Baltimore. And welcome back toReality Asserts Itself.

We’ve been talking about the financialization of the economy, and we have also talked about the financialization of politics, in the sense that a lot of money buys a lot of politicians. And that has a lot to do with what American politics and a lot of other countries’ politics is all about these days.

But what can we do about it? So in this segment, we’re going to talk about what can people demand from the current elites, who seem to control most things, but also what would we do if there was a government in power whose actual agenda was simply the well-being of the majority of its people and not the well-being of the majority of the finance sector.

So now joining us is Costas–.

Joining us now in the studio is Costas Lapavitsas.

Thanks for joining us again, Costas.

And one more time, Costas is a professor of economics at the School of Oriental and African Studies at the University of London. And his most recent book is Profiting without Producing: How Finance Exploits Us All.

So, Costas, start with some short-term demands, although I don’t want to spend too much time on that, in the sense that so far the system and the political elites seem quite resilient to short-term demands. I think it’s time people need to start imagining what they would do if they actually had some power. But in terms of short-term demands, what–if you take the United States, where we are, what might people be demanding?

COSTAS LAPAVITSAS, PROF. ECONOMICS, UNIV. OF LONDON: It’s very difficult to separate, as you say, short-term and medium-term demands, because whatever–.

JAY: Okay. You know what? Then let me phrase the question differently. I agree with you. We don’t have time to get into it. Let me just cut to the chase.

…

Thanks for joining us.

So what is a model that people could realistically imagine could confront finance? What policies, set of policies? I mean, let’s take this example: if people were to elect at a city level, a state level, a federal level governments whose–actually their only agenda was the well-being of the majority of its people, how do you confront this finance sector?

LAPAVITSAS: I mean, the first thing to say here is that it isn’t just confronting the finance sector. It’s about reversing financialization. And financialization is, as we’ve discussed many times now, a deeply rooted thing. It isn’t just the sector of finance that we need to do something about. It’s actually a broad range of economic activities that we need to intervene in in order to reverse financialization.

Or, to put it differently, it isn’t simply a case of regulating finance. It isn’t simply a matter of regulation. What we’re living through isn’t the product of deregulation, simply, and if we only had the introduction of new regulations, everything would be okay, as I’ve indicated many times, actually the deeply rooted transformation going on here, operating across the economy. Therefore–.

JAY: Yeah, just to add to that, it was in the environment of regulations that finance became so powerful it was able to burst all the regulations.

LAPAVITSAS: That’s exactly right. In fact, the process there, I would argue, is a process in which the agents of the economy, as it were, the non-financial enterprises and the financial enterprises and so on, begin to transform themselves. Things happen there [incompr.] discuss these things previously. As they change themselves and begin to do different things, they become more capable of bypassing regulation and of demanding the abolition of regulation. That’s basically what happens. And then, as the interests of the economic agents become more and more powerful, they could well succeed in abolishing regulation. And then you have a financialization on steroids, basically. Then you have an explosion of financialization.

But the process then is far more complex than simply imagining that, oh, there was a change of attitude for some non-specified reason, then as a result of that we ended up with financialization.

JAY: So if regulation’s not key, although I know you think it is–it’s not that it’s worthless, but it’s not transformative.

LAPAVITSAS: Yes. We need regulation. We need regulation with teeth for sure. There’s no question about it. The point there is that this isn’t enough. And if I were to ask–if I were asked to put it in a single word, I would also say that we need to consider ownership, of course, not just regulation. Ownership matters very much, ownership of finance, but also ownership of other sectors of the economy, because ownership allows (A) private owners to bypass regulation, (B) allows public owners of whatever assets they might be to do some things about the economy that regulation doesn’t allow.

In addition to that, I would argue it isn’t just a matter of ownership or of regulation; it’s also a matter of provision, mechanisms of provision, of basic goods and services that households need. This isn’t just a matter of ownership, of the ways to produce and the ways to do finance; it’s also of how we organize social life more generally and allow people access to basic goods and services, which is, as we’ve discussed, a fundamental to financialization.

So if you asked me, then, for a broad picture, I can give you nothing other than a broad picture, because I don’t know the situation in Baltimore or another similar city in the United States.

I would say that to reverse financialization, we need to think first of all of what we’re going to do at the level of the productive enterprise in the first place. We need productive enterprises that actually focus on production rather than on financial profits, that actually take a long-term perspective, that invest to create productive capacity and to create jobs and to provide employment for people, and we need to think of productive capacity that detaches itself from finance, doesn’t have financial motives and financial profit-making in mind, and organizes investment on a systematic basis, as I’ve indicated. That’s the first thing we need to do.

JAY: I’ll give you an example from Baltimore. I mean, it’s very–a lot of people have talked about reviving what used to be a very industrialized city, Baltimore. How do you revive the industry of Baltimore? Many people have suggested it should be a green revival of the industry of Baltimore. But there’s way more profitable ways for private finance to make money. So it’s not in their interest to do it. You would need public financing to do it.

LAPAVITSAS: Quite clearly. And all the mechanisms that I’ve mentioned that we need for the productive sector involve public involvement. I wasn’t–when I say that we need to do things about investment, we need to reorganize production, we need to move it away from the financial profit-making activities in which it’s been engaging, we need public mechanisms through which this can happen, public intervention in investment, public intervention in particular areas of production. We need public mechanisms across the world.

How we have them, it’s a matter for debate. It’s a matter–that’s exactly what society needs to be debating. I don’t have a blueprint. Nobody else does.

JAY: But one thing I think you would have to do is instead of cities and states going to this very same finance sector we’re already talking about. It also brings in the issue of taxation, because instead of borrowing the money from finance, you can also tax them.

LAPAVITSAS: Let’s come now to–that’s exactly right. That’s it. So let’s come to finance now. Where would you get the financing for this transformation of the productive sector that we need? ‘Cause clearly the United States needs a wave of investment, clearly it needs good jobs to be created for the American people, and clearly it needs real incomes to begin to rise, because real incomes have been stagnant. So financialization will not be countermanded, will not be reversed without these real things being put in place through public intervention, through public policies.

Where would the finance come from? Finance can come from a variety of sources. Tax is also very important because tax also comes into the issue of redistribution and greater equality, which the United States definitely needs. But obviously finance, the realm of finance and the financial sector is very, very important.

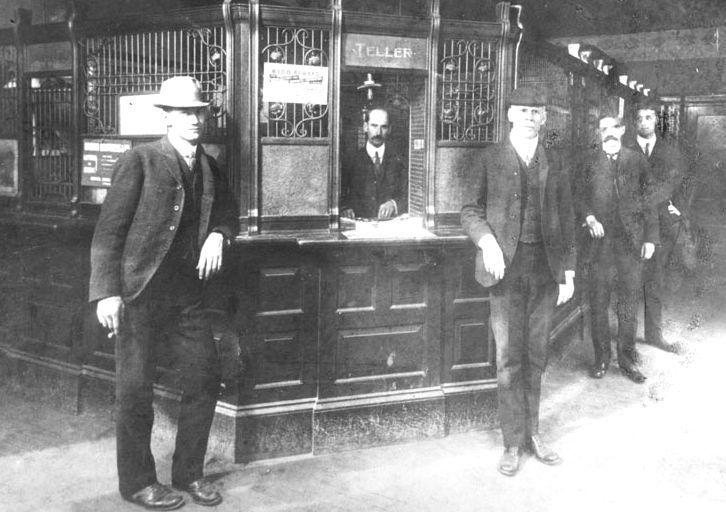

Now, what do we need? There, obviously, we need regulation in finance, but we need public institutions of finance, we need public intervention, we need public mechanisms, and we need publicly owned financial institutions to be put in place that would actually have a public mandate and that would begin to think of themselves and of what they do in the economy not like the private financiers do, which is let’s make a quick buck and let’s get out of it before the sky caves in, but think of themselves as public institutions that are there to provide the financial means that the real economy needs to put itself on a different footing. And yeah, that’s–.

JAY: And it’s not so far-fetched. In 2008, in the bailouts, they already kind of nationalized the banks. The problem is they nationalize it to beef them up to hand it right back to the private owners again.

LAPAVITSAS: That’s exactly right. So nationalization alone, it’s not what we’re talking about–nationalization, actually, we’ve seen time and again–and it can happen within the context of financialization, whereby the state intervenes yet again to rescue the system, nationalizes, but it doesn’t really treat these institutions as agents that actually come to belong to the state and they have to be used in a publicly spirited way. It just sees it as a temporary measure to put them to rights and then return them to the private ownership, which somehow knows best what to do about it, whereas it ruined them in the first place.

So nationalization isn’t really what we’re talking about. We’re talking about public financial institutions with a public mandate and run in a new public spirit, communally based, associational, and with a different understanding of themselves and how they operate and what they ought to do in society, and institutions that are focusing on supporting investment and on providing credit to ordinary people with some aspects of public utility attached to it. That’s the kind of thing we’re talking about. That’s the kind of finance we need for the future, because, I repeat, private finance, in the context of financialization, has failed and failed gloriously. There’s no two ways about it. They only reason why it survived is the state. In other words, it’s public banking. Right? So that’s the second part of this broad program, if you like.

The third part is to do, of course, with households, because we’ve discussed households and how key they’ve been to financialization, and the problem starts with low wages, which we mentioned, but also the way in which public provision of needs and goods and things that they need has been replaced by private provision. Well, the answer is clear. I mean, if you’re going to reverse financialization, you need to do something about redistribution.

JAY: Here it’s been mostly private all along. This is more a European thing to think about public being replaced with private. It’s been mostly private in the United States.

LAPAVITSAS: But in key areas, it’s also been public. There has been public–.

JAY: Public utilities. You could say water, electricity in certain cities.

LAPAVITSAS: But also public–there’s been a public dimension to pensions. There’s been a public dimension to education that has been undermined. So it varies from country to country. But even in housing, the large financial institutions that have been involved in the housing business have been publicly owned, but in recent years, although they remain publicly owned, they’ve begun to operate like private enterprises, begun to imitate–.

JAY: And in recent years, I mean, Fannie and Freddie actually became quasi private, and [crosstalk] was a hybrid [crosstalk] private, yeah.

LAPAVITSAS: That’s what I mean. Yeah. So although the replacement of public with private isn’t the same in this country as it is elsewhere, actually it’s not the same in any country. But as a general trend we do observe it.

So the argument I would put is that we need new mechanisms, first of all to do something about wages. We need to raise real income. And then we need to look at provision and we need to look at how households meet their basic needs. And we need new mechanisms of public provision. We need public mechanisms for housing.

JAY: What’s an example of that? What does that look like?

LAPAVITSAS: We need systems, public systems of building housing, public systems of accessing funds for housing–.

JAY: Like, the whole thing of publicly owned low-income housing has almost disappeared.

LAPAVITSAS: That’s it. We need systems, we need a wave of housebuilding, of decent, good-quality housebuilding across many parts of the developed world to begin to solve the housing problem. If I look at Britain, for instance, about which I know most, if you look at the southeast, London and so on, housing problem there has become impossible. It’s–you can’t get a house, you can’t afford a house to live in in a vast area of the southeast around London because of how financialization has worked around the housing market. I don’t quite know exactly how it works in the U.S., although I follow it, but I’ve got no doubt that public mechanisms of housing provision for the poor and so on should and could become stronger.

JAY: I mean, part of, I think, your thesis from reading the book is if you wanted to–I mean, as a model to create an alternative to the power of finance, but also to start to break down the political power of the finance sector, there doesn’t seem to be any way to combat other than a public sector alternative, ’cause you can’t, as I said earlier, like, even in theory you can talk regulation, but you can’t even pass the most measly regulations.

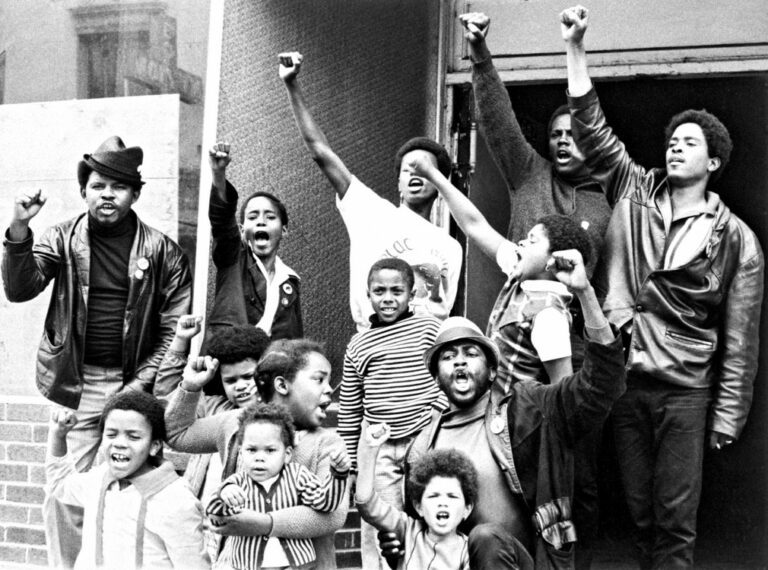

LAPAVITSAS: Yeah. But that’s exactly it. If you intervene in publicly minded and publicly based ways that use ownership as well in the realm of the productive enterprises, in the realm of banks, in the realm of the household, in these [incompr.] you’ve got essentially a program that basically says, I re-strengthen the public sector, I emphasize the social and the collective, and I reduce the influence and the power of the private and individual. In other words, this is a program that is inherently anti-capitalist. And I would argue that you cannot combat financialization, you cannot reverse it, unless you’ve got a clear anti-capitalist direction in mind.

JAY: Because one of the criticisms of this, if you’re talking public ownership, you’re talking government ownership–and you’ve made the point earlier it was the state that made the high-risk adventures possible of the financial institutions. And someone’s going to say, I’m sure one of our viewers is going to say, well, now you’re talking about making the state even more powerful, ’cause you’re going to give them all this–the wrong banks and things like this.

LAPAVITSAS: It’s a very good point. And therefore we need a debate on what exactly the public means. I keep stressing public. I didn’t say the state. And I do it advisedly. It’s not ’cause I don’t–because all this, without actually intervening in the realm of the state, is highly debatable. And you can see it in Europe very clearly and you can see it in the case of Greece and elsewhere. Where a program of radical change such as this is actually in the cards and likely, can you deliver it with the current state, the current mechanism of state, without intervening [incompr.] No.

JAY: ‘Cause I think there is some legitimate basis for, like, the libertarian critique of the state, ’cause people, one, are alienated from the state. It doesn’t serve most people, and on the whole, the state does serve big finance. And so there’s this wariness that if you start building more institutions under the realm of this state, all you’re doing is strengthening the big corporations, really, ’cause they’re going to find some way to use it, one way or the other.

LAPAVITSAS: I’m not a statist, and I didn’t say the state. I keep talking about the public, the public sector. We need public mechanisms. Now, and in fact, I would go even beyond that and say we actually need communal and associational methods of putting the public in place, not necessarily the central state, but locally based communal and associational methods. We need to rethink much of this.

JAY: So it could be done at the level of a city, it could be at the level of–

LAPAVITSAS: That’s right, and through–.

JAY: –the city backing credit unions. It could be state-owned banks, not federally owned.

LAPAVITSAS: That’s it. We need to think, we need to think of these mechanisms afresh. But obviously we also need an aggregate approach. This problem cannot be resolved only at the state level or city level. And there, I repeat, we need to think of public methods, not necessarily nationalization, not necessarily this current state taking over, all this stuff.

JAY: Yeah, ’cause the argument will be: concentration of ownership leads to concentration of power. But as we know from, for example, the Soviet Union, I mean, that can become just as problematic under the banner of public ownership.

LAPAVITSAS: Of course. Who wants–I mean, we know that we don’t want a society in which we’ve got one agent aiming to produce the last button in the economy. And that’s clearly not what we’re about and that’s not what is being discussed here.

JAY: And it’s partly, I think, far more possible to do this now than, for example, in the 1930s, where you could have a whole complexity of ownership of financial institutions–and others, but start with finance–at a city, of all kinds of levels, co-ops, a very complicated system that doesn’t concentrate too much power in one place. But digitization, you know, computerization, it actually makes it possible now to make sense of all that, where, you know, 30, 40 years ago maybe it wouldn’t have been possible.

LAPAVITSAS: That’s exactly right. And I will–and, again, let me remove it in a slightly different context. In the 1930s, people who believed in that kind of socialism and that kind of state intervention actually didn’t want finance. What they wanted–and you can run an economy this way, if you think about it–what they wanted was one agent that will organize production, collect all surplus funds. And this agent would then distribute the surplus funds to other areas of the economy, depending on decisions and needs and so on. You might call this agent a state bank, but that’s not really a banking system. That’s just a bookkeeping exercise. Right? You collect the surpluses and you pass them on. And that’s what they wanted. In other words, they abolished finance, effectively.

Well, what I’m arguing here is that there is room and scope to rethink public intervention [incompr.] with the financial system in place, because it gives you flexibility, and it gives you the ability to meet local need, and it gives you a way to respond to local demand, which is lively and targeted and not clumsy and clunky. And that’s why you might want a financial system in an entirely restructured economy. But this should still be a publicly based financial system.

JAY: And in your book, you say one step towards this might be something like a Tobin tax, where you start to tax financial transactions. You have a paragraph in the book where you say, this isn’t a transformative thing in itself, but it might be a step towards something transformative.

LAPAVITSAS: I, obviously, am not against a tax of this type. Who can be against a tax of this type? It makes sense because it would reduce the spinning over of loanable money, capital, that allows banks to make profits. I’m not against it, although people who wish to reform and restructure the financial system have invested rather too much capital in it and they think that this tax could actually magically change the world and provide large amounts of income that would allow a progressive government to do other things. It’s wildly exaggerated, in my view. But nonetheless, this is an important part of any package that seeks to redress the imbalances of contemporary finance. So, yes, I would be in favor of it and it would be an important element in rethinking the international dimension.

JAY: And in the shortest term, it’s not impossible to imagine the beginnings of this at the level of a city and a state or at a city and a province. I mean, I can imagine even in Baltimore taking the city, working with credit unions, maybe even some small, local, independent banks, of which there are a couple in Maryland that aren’t owned by the biggest banks, and started to stitch together the beginnings of an alternative finance system. And you’d need to do it at the level of the state of Maryland. I’m not sure what a city could do, but even there, maybe.

LAPAVITSAS: I think clarity of objectives is the important thing here, and understanding what is feasible and what is not within the parameters of where you are. If the objectives are let’s think seriously about the productive sector, first of all, and help it, in a sense, de-financialize and begin to focus on what it ought to be focusing–jobs, production, and so on, on a social, on a public basis–if the objective is, let’s do something about the financial system and start reorganizing on a public basis, to move it away from what it’s been, and if the objective is, let’s start providing the household with the thing it needs on a public basis, and let’s start thinking about wages and so on, if that’s the objective, then there are steps that can definitely be taken at the level of the city, of a city, at the level of state, at the level of the federal government, or whatever the overall state. Clearly you cannot resolve everything at the level of the city, but to say that you can do nothing at that level is obviously not true to me.

JAY: And from a practical, political point of view, at least in the United States, that’s–I don’t see how you can do anything other than at the level of a city to start with, because the national politics is so paralyzed that you can’t even imagine it right now.

LAPAVITSAS: I’ve got no expertise and no knowledge of–I can’t speak with any authority on this issue, but what you’re saying makes sense to me from what I observe and from what I read about the U.S. And it also has to do–I mean, that seems to me to fit what I know and understand about American life, basically, and how American society works and what makes it tick at the level of the neighborhood and the level of the individual household. So I would say, yes, there are plenty of things that any kind of progressively minded body of people and political activists and so on at the level of a city wish to do. The argument that you can do nothing at that level is just not right.

JAY: So what we’re going to be doing is we’re going to be doing investigative journalism, town hall debates, and a lot of work over the next few months and years trying to develop what would a realistic alternative look like, both in finance and in other kinds of social policy.

So it’s a good beginning, this discussion. Thanks very much, Costas.

LAPAVITSAS: It’s a pleasure to discuss these things with you, Paul.

JAY: And thank you for joining us on Reality Asserts Itself on The Real News Network.

Never miss another story

Subscribe to theAnalysis.news – Newsletter

“Costas Lapavitsas is a professor of economics at the School of Oriental and African Studies, University of London and was elected as a member of the Hellenic Parliament for the left-wing Syriza party in the January 2015 general election. He subsequently defected to the Popular Unity in August 2015.”