If Biden wins and doesn’t take on the deep structural changes that are needed, he will prepare the waters for the next Trump or worse. Rob Johnson on theAnalysis.news podcast with Paul Jay

Transcript

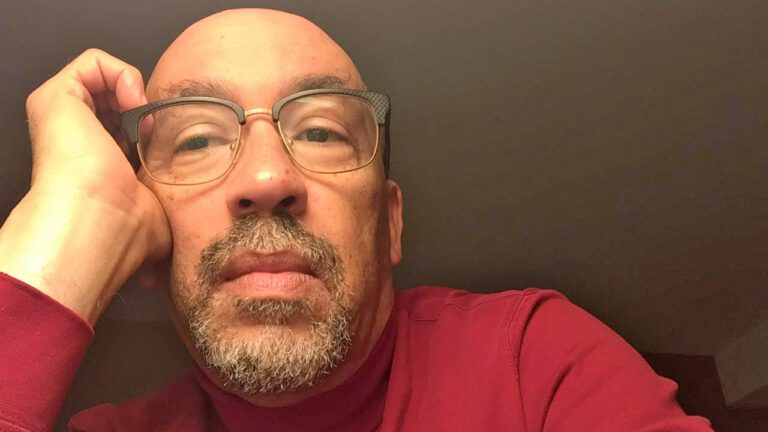

Paul Jay: Hi, I’m Paul Jay, and welcome to theAnalysis.news podcast. As the COVID health crisis deepens and the economic crisis intensifies, it’s becoming very clear how important it is to have more a centrally planned and publicly owned health care system. If you compare the results in different countries around the world, those with government health care insurance and even more, those with publicly owned hospitals, have been able to respond to the crisis in a much more effective way than in the American more anarchistic system made up of mostly private hospitals or non-profits that operate like for-profits.

Central planning and public ownership. This crisis is showing how important it is, but is it only in the healthcare sector that it’s needed? Yet, American mainstream politics is as far from accepting the concept of more public ownership as one could imagine.

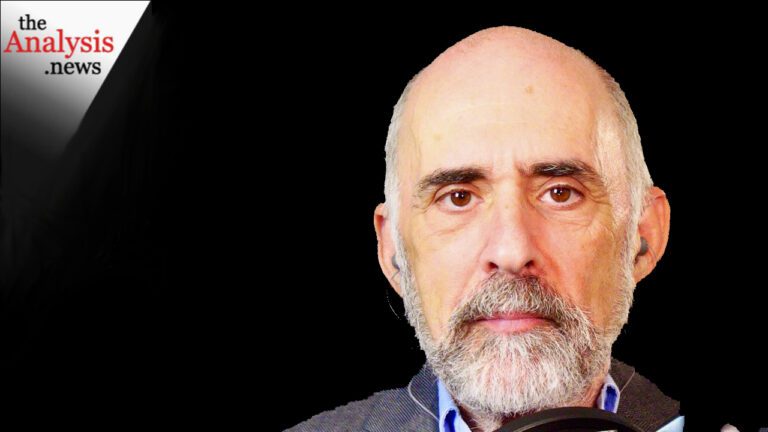

But this crisis has changed a lot of perceptions. Now joining us to talk about all of this is Rob Johnson. He’s the president of the Institute for New Economic Thinking, INET as it’s called, and host of a new podcast produced by INET, Economics and Beyond. Previously, Johnson was a managing director at the Soros fund management, where he managed a global currency bond and equity portfolio specializing in emerging markets, and particularly in Asia.

Johnson served as chief economist of the US Senate banking committee between 1987 and 89. Thanks for joining us, Rob.

Rob Johnson: It’s my pleasure.

Paul Jay: So, if you go back to the 1930s and the Rooseveltian New Deal, he was imposing a fair amount of central planning, within the capitalist framework. He even talked about public ownership. When he said that he was talking specifically about electrical utility companies and stated that if the private sector couldn’t deliver electricity in an affordable way, in such a critical sector of the economy, then it should be turned into a publicly owned utility. He was taking that concept a lot further than any leading American political figure has talked about since. Now we’re in this moment where there is chaos reigning throughout, not just the American healthcare system, but just about everything else, including finance. What is there to learn from Roosevelt about what kind of reforms might be needed now, and perhaps going beyond anything Roosevelt did or proposed?

Rob Johnson: Well, Paul, I think the story of Roosevelt is a fascinating one. A number of things come to mind. First, Roosevelt did not enter office, viewed as a progressive, radical visionary. He kind of looked like an aristocrat or a, how would I say, a part of the ruling class, and he rose to the occasion.

And I guess why I’m bringing this up is because the new deal and the structures and the taking on of power and the four freedoms and all these things. Where this man who had suffered – I’ll come into the health a little bit later – had suffered from polio and there was an empathetic strand within him as a person, and he got to a place where he could see, under his leadership, we weren’t going to get to a healthy place unless he made some profound changes in, what you might call, what you would abide. Not to bring the big Lebowski into it, but he did not abide the control of the utilities. He did not abide the ruling class cabal and the New Deal inspired many people who were not part of the elite.

And as we emerged from the depression, faith in the integrity of governance, notions of the role of governance to kind of mix the economy, sort of a polyphony economy, more than a kind of super hyper free-market economy, gain traction. And I believe that led him, through the 1930s and into the war preparation, where people envisioned that government could, was capable of, and would do the right thing, for the collective, for the broad-based population.

And the reason I bring that to mind, cause Roosevelt’s example, which resonated, really through the time of Lyndon Johnson’s administration, created a sense of hope, a sense of possibility among a broad base of Americans that governance with obviously a vibrant capitalism embedded within it, had the potential to be like a rising tide that raises all boats.

It brought all the people to the place where they could at least believe their children would continue to advance beyond what they had been able to achieve. But that that’s a feeling of accomplishment, being a member of such a system. And I guess through the war preparation and through the end of world war II and the way in which his wife, Eleanor, talked about how people of color had served in the military and the impetus to greater equality and better treatment of African Americans. It had a kind of noble trajectory. And not to say, I mean, there were lots of things that were done, where black people were excluded from some of the benefits and some of the things postwar that this is, but Roosevelt set a tone.

I actually think Dwight Eisenhower embodied a good deal of it from the other party, but I’ve worked in both with Pete Domenici and the Republican party and Bill Proxmire in the Democratic party. And one Senator once said to me that I shouldn’t be confused because there were a-holes and admirals in both parties.

You just had to work with the admirals. Roosevelt set a tone that I think is sorely missing right now. And I think that hearkening back to that time is a hopeful precedent, but we got a lot of work to do.

Paul Jay: One of the things that Roosevelt talked about, is an interesting quote. I don’t have it in front of me, but he essentially said business people, businessmen, and he said, they’re in the business, and the reason they get a return on investment is because they take risk. But businessman not willing to take risks shouldn’t be in business. I think I’m pretty close to his quote. We’ve come to a point where the finance sector is the most profitable sector of the economy and practically takes no risk because when they get into trouble, they get bailed out. And now we’re seeing it again. The crisis itself isn’t this time caused by a financial crisis.

The pandemic has sort of closed down production, but it’s still the finance sector and also the corporate sector, is getting enormous amounts of the stimulus money and a lot of it is being used, especially in the corporate sector, just to pay down debt that was accumulated through stock buybacks and is not actually going in terms of real stimulus to people, which is another thing Roosevelt specifically talked about. He said, just loaning money to companies doesn’t get you out of the depression if you don’t do something about consumer demand and purchasing power.

Going to this point you say about governance, the problem is, is governance, now, to my mind, is the political governance is so controlled by a sector, by finance, which to such a large extent is so short-term sighted, so parasitical, I don’t know whether you can get Rooseveltian kind of thinking in the governance, without some kind of radical change and where, where does that come from? Cause I don’t see it coming from within the elites, the way Roosevelt did.

Rob Johnson: No, what I’ll call the, the motive mind of being clever and extracting for yourself or for your firm, from the dynamics of political economy and of how to manipulate governance is a very, very different mindset than stewardship, where you feel privileged to represent people and bring to bear your mental capacities in your experience in the private sector, and to overcome a crisis.

I think your characterization of finance and perhaps now Silicon Valley technology and its relation to government is quite daunting. And I would emphasize to our listeners that Donald Trump ran around the country and his bumper sticker, if you will, was the system is rigged and he gathered a lot of energy.

He beat 15 Republicans before meeting Hillary Clinton, and obviously the proper diagnosis to get people to react didn’t necessarily transform into the remedy. That such a diagnosis, which suggests to restore, how we say, to diminish the despair and restore the faith in governance that, that could be achieved.

And, I’m very worried. I often use the phrase the commodification of social design, whereby. Political representatives, particularly now in the United States, are so dependent on money and donations, and the wealth is so concentrated among large institutions and individuals that the survival of politicians makes them supplicants to financial power in all the designs disproportionately reflect the needs of the already wealthy. And so things like money for public schools and whatever is always subjected to this notion of quote, we can’t afford it. Like there’s some scarcity. Then there’s some discipline that far sighted financiers can perceive. At the same time in 2007 and eight, when they needed $800 billion, they snapped their fingers and got it in a few days through the TARP bill, when Lehman Brothers went under. The kind of pressure of having to lead for a broad based society in a system where the government representatives don’t represent people, they represent their survival campaign contributions. Or even, as some of the research that INET has shown, how their portfolios as private individuals get enhanced by their inside knowledge and their so-called blind trusts outperform Warren Buffet and George Soros s hedge fund.

So you see all kinds of dimensions of what we might call legalized corruption. You see government exacerbating rather than ameliorating inequality. In the case of a shock, you see growing fear and despondency. I recall there’s a gentleman in New York, he was a former musician. Very insightful, named Stuart Zeckman, and he did a podcast years ago where he said, there’s a false consciousness in characterizing the difference between government on the one hand and the private sector on the other.

Like they’re at war and you got to rely on one or rely on the other. His point, which I’m paraphrasing, was that the public in the Gallup polls didn’t trust government because they thought it was owned and dominated by powerful, wealthy interests and large corporations. You know, Tom Hartman, the progressive radio host and writer, does a beautiful job of describing the role of personhood of corporations in America’s history, going back to the railroads. I think his book is called Unequal Protection, and how all the railroad lobbyists played all kinds of games and got things put into the 14th amendment so that essentially they don’t have any of the culpability of a citizen, but they have all the rights of a citizen, is a corporate structure. The executives are insulated from personal consequences, and this has only gone on and on through the lobbying and legislation leading to the nondisclosure super PACs and what have you. But I think coming back to the substance of the point, it’s going to take a profound awakening.

That our system of social design is what I would call the mother of all moral hazards. You mentioned these companies with their stock buybacks, running debt-equity ratios up to the moon, extracting money for themselves in the C-suite and their key investors, and then they’re running on razor thin safety margins.

And they’re the beneficiaries of the bailout more than people who are suffering or people who are continuing to go to work despite the health risks because they are in an essential sector. What my friend Ed Pavlic calls the labor in the shadows. I think we have a false heroism now about what really important work means, and it’s not just based on return on investment or spectacular money that comes from scale.

And the other dimension that is really hard to take is these complaints. You’ve heard it during the Sanderson and Warren campaign about socialis To my eyes, it looks like we’re socializing the downside for the powerful and privatizing the upside. Then everybody else is left to fend for themselves.

These kinds of things cannot go on. There is no legitimacy in such a structure, and Donald Trump is a symptom of that. So I think it’s going to require tremendous awakening and collective action, and hopefully some people like Franklin Roosevelt, who transformed themselves and rose to the occasion.

Paul Jay: The defense of the capitalist system itself, which was Roosevelt’s mission. He was far from being a socialist. He talked about these reforms were necessary to defend the private property system, but that kind of consciousness of looking after the class and the system in a systemic way, that seems that those voices in the elites now who still talk like that, I would say Soros is one of them, they’re practically marginalized. I remember seeing Soros speak at an INET conference in Bretton Woods. I forget the year. It’s what was the year

Rob Johnson: 2011

Paul Jay: Yeah. And Soros looks out into this audience of like a thousand of many of the leading economists of the world, and he looks, and he’s silent for a long time, and then he says, if I remember correctly, his first words were, I’m bewildered. And he goes on to say how the crisis of 2007 / 2008, that everything that went to create that crisis next to nothing had been done to prevent it from happening again. And he’s just bewildered, that those, both in government and in the financial sector, the leaders, we’re just so shortsighted. And so much about, you know, that day’s return to the next day’s return. And the society, the world, we’re facing systemic threats, pandemic crisis for sure, but the climate crisis and the one that never gets talked about is still a threat of nuclear war. And the underpinnings of the way the economy is organized, the inequality is, this is extreme crisis.

The voices within the elites that would actually look at this in terms of what is the systemic health – let me get it out there on the table – I’m no fan of capitalism, period. And anyone that watches me, knows that I think we need to get to serious amounts of public ownership and transition more and more to democratic forms of public ownership.

But that being said, we need reforms quickly. We’re not going to get to what I’d like to see quickly, but where are the rational voices within the elites?

Rob Johnson: Well, I think you’re right. I used to tell a story. I lived in Connecticut, you know, and this was during my hedge fund years. And Newt Gingrich came to power and a bunch of my neighbors were very enthusiastic.

And I told the story of how when I was a kid, Robert McNamara lived in my neighborhood in Detroit, and then somebody once asked him, why did he think as the chief executive of Ford motor company, he deserved to be paid 14 times what the average worker was paid. And his response was, anything more would be obscene.

Well, when I’m sitting around the pool with the Newt Gingrich fan club in Connecticut, we’re looking at CEOs being paid 346 times what the average worker is paid and when I’m listening to my neighbors, and these are some people I like, but I’m talking really now not about pernicious wicked person, but they’re kind of in the flow of the current thinking in a sort of like, well, if you don’t have a private plane and everything else, you’re a fool.

You could get all those benefits. Why don’t you go for it? Like you should be ashamed of yourself by being more modest about your own financial take from your participation in whatever endeavor. So we had a very big change in psychology, from say 1964 to, in that case, probably 1996 and I don’t see, I don’t see the call to action to stewardship, let’s say that started with 2008 really there. I mean George Soros is a person, who you brought up in a constructive light, who has been thoroughly demonized by lots of people, Netanyahu and Donald Trump and others. But George grew up in terrifying instability in Hungary at the time of the Nazi invasion of his country, and his family eventually evacuated, I think through Morocco and up to London. And then George came to the United States and, he was a student of Carl Poppers and very deep philosophically, but a lot of people I knew thought he was more like a Marxist sociologist. He made a joke to me when he hired me and he said, I’m not a security analyst. I’m an insecurity analyst, and that’s what I want you to be too. I didn’t hire you to be a security analyst. These play on words. But the point was he had a tremendous feeling for the intuitive awareness of social instability and an acute sense of how hideous it could be and I think that set him apart and he didn’t see why other people could cling to the status quo or to their own private benefits in these contexts when the stakes were so high. Today is the 8th of May, and I read an interview with him that’ll be published over the weekend today that reflects that same consciousness and intensity. I don’t know if it’s a question of most of our leaders now are younger than that generation that endured the terrible turmoil of World War II. George is 89, but I don’t think in the light of this pandemic, in the extremes of inequality, which can be found in the data that now exceed what it was, in the 1930s and the failure of health systems, in the making it legal that used to be called tax evasion.

Now you keep your money offshore and then give sermons about how you can’t afford it. We’re, we’re at a place now where – and you refer to climate – the social unsustainability, the environmental unsustainability, are profound. It’s almost like circumstances beckoning for a new enlightened leadership to rise.

And perhaps like the case of George Soros, it will be young people. Who bear the weight of the fear and the anxiety of the consequences of what has now been unleashed and it will take some time.

Paul Jay: We don’t have a lot of time.

Rob Johnson: Like you said, with the climate issues on the horizon, that’s for sure.

Paul Jay: See, my thinking is, that the reason that the situation in terms of the short-sightedness, the lack of systemic stewardship, as you talk about, has so deteriorated, that it’s a reflection of what’s happened in terms of the growth of the power of finance and globalization, which are both, I think, products of what happened with the digital revolution. Computerization turned globalization into such a qualitatively new level that the extent to which corporations could play the Chinese workers off against American workers and such and on Wall Street… I met a guy who was a broker in the sixties. And he, he said, just imagine doing a derivatives play or a subprime mortgage play, with a pencil and paper. Computerization, so greatly enhanced the global capital flows and the ability to create these unimaginably complicated financial products. That all of this led to incredible wealth pouring up, not just to the 1% and not just to the quarter of 1%, but particularly to those in the finance sector.

And with that came tremendous political power. If you look at all the funding of the major of the presidential candidates and most of the down-ballot candidates, a hedge fund guy after hedge fund guy is in the top 10 or individuals connected with the big institutional investors. And, and so much of that capital in the hands of finance now is speculative.

The derivatives market is something, what is it, seven times global GDP. And the individuals that are winning in that sector are just living in a complete bubble. They’ve never had, unimaginably, never had it so good. They are just blind to the situation, but the problem is, is the politicians are so beholden to them.

I guess I’ll ask it again. Are there sections of the elites with enough power to do something about this, to, to shake this? Of course, the real change is going to come from a mass movement coming from ordinary people, from workers, but that’s pretty weak right now. And there’s not a lot of time to deal with all this.

Rob Johnson: Well, I don’t know. I mean, I see, a handful of people.

Another one of my Connecticut neighbors, but the hedge fund manners, or Ray Dalio is writing his, though he can see that we are not on a sustainable trajectory. He was what I’ll call a kind of a John McCain style Republican and grew up in a middle-class family. His father was a musician and he, said very explicitly, I couldn’t evolve, like I did in my life, if I was a young one now. He sees that the rungs in the ladder of opportunity are not what they could be, or what once were.

I see kind of a gated community mentality at the center of it, which is that you can insulate yourself, whether you’re creating a private airstrip and buying land in New Zealand for your getaway or just gated community. And I have to say in the, in the contradiction, my two children, my two younger children go to private schools, but wealthy people can insulate their children from the deterioration of the public education system if they can afford a private school, and that’s a coping. That’s not the desired outcome. I love the school and my daughters go, it’s called Spence. I love the work that the faculty does, but every child should have that quality of education and the society should provide for that. And eliminate some of the offshore havens and monkey business that leads to the preaching that we can’t afford it. But I think, Paul, you’re asking the right questions and the question is, how far down do we have to go before people respond, people of sophistication, people of power, understand that accumulating another $3 billion when you already have more than 20 or whatever is absurd. It just doesn’t matter.

And I hope some of those people use their freedom and their sophistication to recognize and contribute to what does matter. But it’s hard to imagine. Necessity is the mother of invention, as they say, and we’re getting close to that necessity. You look at, you look at a symptom in the United States, the prison industrial system.

Well, they’re incarcerating more and more people and law enforcement is kind of unconsciously more and more violent, particularly directed at people of color. And now the prison lobbyists are – I’m very familiar with Detroit – the prison lobbyists are essentially trying to fill the beds by making the conditions in which minors can be sent to jail more extreme. And you’re seeing households losing their fathers, and you’re seeing these prisons lobbying and state governments, and they’re very powerful. And it’s so expensive relative to reinvigorating people or having fewer people in jail. Even the Koch brothers are sponsoring prison reform right now because of how ridiculous the expense it is. And they’re right. This is so not a fine tuned efficient system.

Paul Jay: We’re likely to be seeing, I think, a Biden administration. I know a lot of people think Trump could win this election. I personally doubt it. But if we do get a Biden administration and you got a call, how should they deal with this economic situation?

Rob Johnson: Well, it’s not news in the sense of what you and I have been talking about here. The next administration needs to make remarkable changes in the structure of healthcare provision in the United States. It needs to massively increase opportunities for the lower third of the population. It needs to put a greater burden on the wealthy and it needs to mount a very formidable campaign, which many have called a Green New Deal to address climate and profound energy transformation. And you might say that’s too daunting, but a massive energy transformation might hire a lot of people. It would be the equivalent of a Keynesian stimulus. We can pay for it either through central bank financing, which is being illustrated now in the pandemic, emergency programs, or having those who own the economy and earn the greatest share of the income contributing more to the process.

The question I have more for Biden or whoever is that president that might replace Donald Trump. You’re one person. You’re sitting in the White House. The Congress, both houses, is still in this feeding frenzy of fundraising being controlled by lobbyists being controlled by the fundraisers of you, as you said, hedge fund managers, tech billionaires, and whoever else that has deep pockets, and we got to free social design from dependence on that.

So where would I go with that? Almost every media corporation in America gets a charter from the government. There need to be set aside some of their bandwidth, rather than making these elections in the primaries and the debates, some kind of feeding frenzy for them to earn advertising money, they’ve got to donate some space so people can become visible in the political process without needing to raise so much money.

Second thing is you need to put massive, massive caps, meaning reduction, on the unbridled and secret financing that the super-PACs represent. I find it hard to imagine that in one swoop, anybody in the White House can do that, however well-intentioned. I don’t think our courts are particularly unbiased in these questions of wealth distribution right now.

I think they are quite heavily biased in the wrong direction. Not person to person, but there’s been all very large wave of appointments that are very sympathetic to what you call the imperatives of major donors. The question I think is, will the failure, analogous to the 1930s failure that you described that Franklin Roosevelt rose to, will it be so profound that no one with a straight face can stand up and defend current behavior, current systems, current fault lines and inadequacies? What happened? I don’t know. But I think whoever is the next president will not inspire hope or faith or belief in American governance opportunity for their children and alleviate despair unless they take on these big structural challenges.

And if they don’t, there will be preparing the water for the next Donald Trump or worse.

Paul Jay: What is the danger of fascism or a type of authoritarianism, more overt in the United States? Even to the point of maybe there won’t be an election, whether the excuses, the pandemic or, or war. How dangerous is this moment?

Rob Johnson: I think it’s a very dangerous time because of despondency, because of the way in which the signal to noise ratio of what people are subjected to has deteriorated so much that they can’t seem to find goodness or faith or something to believe in. And that authoritarian control that which you might call the offering of social stability imposed from the top, which tends to reinforce existing power historically maybe something that people accommodate just because it reduces uncertainty. So I think that, I think that’s a very formidable danger at this juncture, but I think that once again, there’s an intermediate step in a prolonged suffering. It’s not a resolution. But one person once said to me, he was from Finland, that the United States had this miraculous experience with its founding documents, declaration of independence, constitution bill rights, where it was like the software of American society. And when people bought into that, they put their faith in those principles. When something started to deviate from those principles, they could protest.

It was like a system of recognition and then constructive, legitimate feedback, to change the course. Then he said to me, with the way things are going in the United States now, if you appeal to those documents and those principles, people might mock you as a romantic fool. And once that belief in that trust, that common, which you might call North star like energy is dissipated, then you’re basically out at sea, without navigational, mature capacity. You’re quite aimless and in the fog. I’m dreading right now that the breadth of despondency makes us quite vulnerable to that authoritarian, at least temporary resolution. But I don’t know and I’m actually not inclined to blame a personality. I think it’s, it’s almost bigger than any, any individual. It’s kind of a dynamic. It’s exacerbated by something. Bolsonaro, Trump, Marie LePen, there are numerous people all over. Orban. I’m in a place where, it seems like the fear of a failed design in its consequences, and the incapacity for repair is larger than any one person to blame. It’s more systemic.

Paul Jay: What’s your assessment of Biden?

Rob Johnson: I think he’s always been a pragmatist, working within a system, that awarded people for representing power disproportionately. And I think that he has often on the wrong side of things related to wars, taxes, regulation, austerity programs, vis-a-vis benefits like social security and Medicare.

People who know him better than I do say that he does kind of come from a mindset of the middle class. He hasn’t survived by being their advocate. But he might have the capacity for empathy, for the circumstances and the, in extremeness of these circumstances. I’m concerned about his age and the relationship of age – this isn’t about him in particular – to the vitality that’s necessary to meet this challenge.

And I’m concerned that this kind of tactic that I see from centrist Democrats, which is to kind of belittle and poopoo, diminish, disregard ideas and initiatives from other people like they’re crazy, when they’re standing on the bridge of a sink and ship themselves. And I think that the election of Donald Trump should have been a much stronger wake up call for the Democratic party, which, what I would say the death knell of the enthusiasm of the American working class for the party of Franklin Roosevelt through Lyndon Johnson was rung loud and clear with the election of Donald Trump.

And I don’t know that I see Joe Biden as a person who will stem or reverse that tide, but I hope I’m wrong.

Paul Jay: It’s fairly traditional in the United States and some other countries, particularly most States, that in times of crisis, war is often the policy choice. How dangerous the situation is, now, obviously the Trump administration has Iran in its sights, but the rhetoric with China, if believable, you have people in the Pentagon talking realistically, at least they pretend to sound realistically about a coming war with China. When they raised this massive new military budget, the secretary of defense or acting secretary of defense Esper said, when asked why you needed so much money, and he answered with three words, China, China, China. How dangerous is all that?

Rob Johnson: Well, I think there are different types of danger, which you alluded to earlier in this conversation. One, is the need to cooperate on climate change and the need for the United States and China to work together, vis-a-vis this pandemic and vis-a-vis reducing the carbon emissions on earth and in moving beyond. And I would put India into that climate agenda as is centrally important as well. But Bismarck once said, if you can’t solve your problems at home, then there’s a leader you declare war on and unify people against an outside enemy. And I sense that in this disintegrating sense of consensus, given the appetites of the American military-industrial complex, which are quite formidable.

Just as an aside, I used to work as a research assistant for a man named William Kaufman. He had worked with McNamara as a defense planner who was on the faculty at MIT. And he told me that he created a budget every year at the Brookings institution to show what the threat structure was, what the force structure needed to meet the threat structure was, and what the force structure was that existed.

So the Delta between the needed for structure and the one you had should have been your defense budget. And because all along rolling in pork and everything else, it never looked anything like that. Now, Kauffman was a very subtle man. He did not get out and beat the drum, but his indictment of the procurement process in the military-industrial complex was ferocious.

And when I worked with the Senate budget committee under Pete Domenici, I kept those teachings very close and I saw defense, appropriations and marketing of dangers in North Korea or China or Russia or whatever, every year, right on calendar when they wanted their budgets approved. But as Kauffman emphasized over and over, they were not, targeted to meeting the threats. The threats were just used as marketing. Sort of like Adam Curtis’s documentary, the power of nightmares on U S Soviet relations that became US in Iraq. Daniel Ellsberg, who I know you’ve been working with, has written in his most recent book, the doomsday machine, the other things other than climate, that is equally ominous and dangerous. And my sense is that an out of control military-industrial complex may, on the one hand, kind of create all kinds of involvements and exercises that aren’t really geared towards protecting the American people. But on the other side, what I think Ellsberg reveals is the scope and scale of the danger, if we get off course and use those weapons, is far, far more ominous than what’s been presented to the public. And I suspect he’s quite right. So at one level, war is dangerous, wherever it is perpetrated. Another level it diverts our attention from the collaboration needed for the global effort to stop the human race from being extinguished by climate.

And thirdly, it’s very, very clear that the potential annihilation of mankind by a nuclear war raises the stakes enormously.

Paul Jay: So I guess I’ll ask the question again. You know, a lot of people at very senior levels, both in the finance sector and government and so on, how are they so blind to all this in their own, just narrow personal interests, their own kids, their own families? How can they just think they’re going to be in a bubble and be okay?

Rob Johnson: I don’t know. Sometimes it denial is comforting. I don’t know how to, I don’t know. I mean, when you don’t know how to envision, how to alleviate the pain, when you don’t know how to envision what constructive actions to take or how to mobilize people or systems to take that action, sometimes the only thing you can do is comfort yourself in a fantasy world. And that’s what I call denial.

Paul Jay: And if you’ve got tons of money, you can build yourself a nice fantasy world.

Rob Johnson: It’ll be nice until it’s not.

Paul Jay: Thanks for joining us, Rob.

Rob Johnson: My pleasure. Thank you.

Paul Jay: And thank you for joining us on the analysis.news podcast.