On Reality Asserts Itself, Ms. Foroohar says financialization delivers stagnant wages, inequality, and economic crisis; the Financial Times columnist and author of “Makers and Takers” says the financial sector represents only 7 percent of the U.S. economy but takes around 25 percent of all corporate profit while creating only 4 percent of all jobs – with host Paul Jay. This is an episode of Reality Asserts Itself, produced May 9, 2018.

STORY TRANSCRIPT

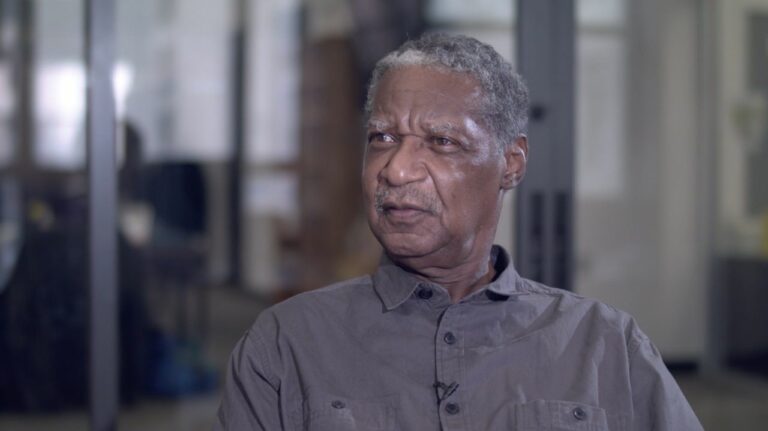

PAUL JAY: Welcome to The Real News Network. I’m Paul Jay. This is Reality Asserts Itself, and we’re in New York.

In her 2016 book “Makers and Takers: The Rise of Finance and the Fall of American Business,” Rana Foroohar describes how financialization is bleeding the global economy to make a handful of elite investors very, very rich while holding back innovation and productive investment in the real economy. She writes that the financial sector represents only 7 percent of the U.S. economy, but takes around 25 percent of all corporate profit while creating only 4 percent of all jobs. According to Ms. Foroohar, even companies associated, as associated with research development and creativity as Apple borrow to invest more in stock buybacks and acting like a financial institution than they do developing qualitative leaps in their products. But more about that later.

Her book is a scathing critique of the lords of Wall Street, yet she remains hopeful that capitalism can be reformed and we shouldn’t give up on it yet. Rana is an associate editor and global business columnist for The Financial Times. She’s also CNN’s global economic analyst. Prior to her work at CNN and The Financial Times, Rana spent six years as an assistant managing editor and economic columnist for Time. And before that she spent 13 years at Newsweek as an economic and foreign affairs editor and a foreign correspondent covering Europe and the Middle East. Now joining us in the studio in New York is Rana Foroohar. I think I got it right that last time, did I? Thanks for joining us.

RANA FOROOHAR: Thanks for having me.

PAUL JAY: So we’re going to get into the substance of the book. But those of you that watch Reality Asserts Itself, you know we usually start with a personal section. And while we don’t have quite enough time to do the whole, Rana’s whole biography, we are going to start with a personal question. So you’re writing in The Financial Times, you know all kinds of people on Wall Street, you know how all this works. Why aren’t you cashing in? Why are you exposing it?

RANA FOROOHAR: Well, that was what the book was supposed to be, Paul. Yeah, it’s not, not quite as good as the Wall Street bonus. But you know, I actually did do a brief stint in finance. I worked for about a year in London, this is quite telling, in 1999 for a high tech incubator that was funded by Citigroup. And I left in part because I been writing a lot about finance and about technology. This was the last dotcom bubble, as you remember, in the late ’90s. And I had gotten this call, and this big company was looking for, to hire journalists to do B to C media deals, which right there should have been a sign of a market top, frankly. But I took it because I thought it’d be really interesting to see how the sausage was made. And it was, and it was very telling.

But I love journalism, I loved telling stories. I think it’s much more interesting, frankly, than a lot of what happens in the financial sector. You get rich but you have to do not only some shady things sometimes but a lot of boring things.

PAUL JAY: But, but the kind of wealth that’s being generated generated in the top, not even just the top tier, from middle to top tier of finance, is not known in human history.

RANA FOROOHAR: Right.

PAUL JAY: You could be part of that.

RANA FOROOHAR: I guess I could. It’s funny, I’ve really never felt the pull. I kind of think of myself as a little bit of a scholar looking at this group of people as a tribe. I mean, they are, they can be studied almost like an anthropologist would go into a new country and study.

I mean, they have their own habits, their own rituals, their own belief system. And I just find it fascinating as an outsider to approach that. And actually, I think that being an outsider not just, you know, from Wall Street but from the financial press was actually helpful to me in writing this book. There’s an anecdote that I tell in the intro. It was my sort of come to Jesus moment, I know I have to write this book. I was sitting in a meeting, an off the record meeting that had been called by a former Obama administration official who had been very involved in the bailouts, and he was, it was around 2012, 2013. He was kind of trying to wrap a bow around everything and say we’re all done here, the financial system is safer, nothing to see.

And I was there, and there was maybe one other general interest news writer, reporter there. And most of the people around the table were financial beat reporters. Now, those folks have to go back to these wells again and again and again. And they can also get very siloed in terms of how they’re thinking about this story. But this official, former official, was saying, you know, we got done everything we need to do. Dodd-Frank is going to make everybody safer. And at the time, and this was four or five years after the financial crisis, I was looking at Dodd-Frank and saying, you know, half the rules have yet to be written. None of them are implemented. You know, we’re four, five years on from a crisis. What’s going on? And I asked him if he thought that the industry had had undue lobbying pressure. Because of course one of the reasons why regulation really didn’t get done, in my view, properly in the last decade despite the fact that we had the worst financial crisis in 75 years is that there was so much lobbying power. And the financial sector spent so much money and time putting holes into, you know, making, making the regulation Swiss cheese.

So I said to him, do you think that the industry had undue pressure on this regulation? And he said absolutely not. And then I gave them a statistic showing there was an academic at the University of Michigan that had tallied up all the public records and found that 93 percent of all the meetings on the rule-making had been taken with the industry itself, and most of them with the top three banks, many of them with the executives whose names you know. And I’ll never forget, this was so telling, I put that stat out there and the official looked at me with a real sense of confusion and said, well, who else should we have been talking to? And for me I was, I looked around the room and I thought, surely everyone’s going to be scribbling and this is going to be big news. And nobody was really surprised. I thought, this is how much cognitive capture there is. This is how much power the industry has, that we’re not even questioning, not only the regulator himself, but the journalists aren’t questioning that this is a problem.

PAUL JAY: I interviewed Bart Chilton from the Commodity Futures Trading Commission when they were working on this position limits ruling, I guess, or legislation. And he told me it was 100-11, how they got lobbied from finance. And there were, and it’s not that there weren’t people out there advocating for these kinds of reforms. They were out there to be met with. And it’s not like they didn’t know stuff. They did. They just didn’t get the meetings.

RANA FOROOHAR: Absolutely. Well, you know, Bart’s a great source. I’ve also had conversations with Anat Admati, who you may know, who wrote The Bankers’ New Clothes. She’s an academic at Stanford. She said, nobody called me. I mean, this is one of the world experts on financial regulatory issues. These people were purposely not let into the room.

PAUL JAY: And for good reason. When one looks at the kind of money being made by everybody concerned. And you talk in your book about the revolving door, people making regulation laws one day are back into the financial institutions the next.

RANA FOROOHAR: Yeah, absolutely.

PAUL JAY: And let me read it, I’m going to read a quote from your book.

RANA FOROOHAR: Okay.

PAUL JAY: Our system of market capitalism is sick. And the big picture symptoms, slower than average growth, higher income inequality, stagnant wages, greater market fragility, the inability of many people to afford middle class basics like a home, retirement, and education, are being felt throughout our entire economy and indeed, our society. Or economic illness has a name: financialization. And that’s the theme of your book.

So let’s, because we don’t have too much time. Let’s start with the very beginnings of how financialization takes place, why banks start to play such a role in society. And then I think we’ll probably focus on a couple of things you focus as models. The formation of Citigroup, and then we’ll do Apple.

RANA FOROOHAR: Yeah.

PAUL JAY: So let’s talk about how financialization develops in the United States, but let’s first talk about what is financialization.

RANA FOROOHAR: Yeah. So, I define financialization, as do many academics, as the process by which the financial sector has come to be the tail that wags the dog, if you will. If you go back to Adam Smith, the father of modern capitalism, he would have looked at the financial sector as a catalyst for other sectors. So the financial sector is an allocator of capital. It helps businesses grow, it allocates money to people who are job creators in retail, in manufacturing, in construction, et cetera. It’s never the end game. It’s the facilitator.

But I argue in my book that basically since the early 1970s we started to go through a real sea change in our economy, in our politics, and our society, where finance itself became the game. And you can see this. I mean, if you think about the way in which we talk about our economy. We started out as an agrarian society then we became a manufacturing economy and then a service economy. And the idea was that at the very top of that triangle would sit the financial sector, and politicians came to speak of it as we should all be aspiring to be right there at the tippy top of that, of that triangle. But really, if you think about Adam Smith and the way he envisioned capitalism working, you would flip that. You would have finance at the very bottom facilitating other kinds of businesses that actually create real jobs and real growth on Main Street.

PAUL JAY: Here is another excerpt from “Makers and Takers:”

“Rather than funding the new ideas and projects that create jobs and raise wages, finance has shifted its attention to securitizing existing assets (like homes, stocks, bonds, and such), turning them into tradable products that can be spliced and diced and sold as many times as possible—that is, until things blow up, as they did in 2008 … Academic research shows that only a fraction of all the money washing around the financial markets these days actually makes it to Main Street businesses. As recently as the 1970s, the majority of capital coming from financial institutions would have been used to fund business investments, whereas today’s estimates indicate that figure at around 15 percent. The rest simply stays inside the financial system, enriching financiers, corporate titans, and the wealthiest fraction of the population, which hold the vast majority of financial assets in the United States and, indeed, the world.”

Please join us for part two of our interview series with Rana Foroohar on Reality Asserts Itself on the Real News Network.

STORY TRANSCRIPT

PAUL JAY: Welcome to The Real News Network. I’m Paul Jay. This is Reality Asserts Itself, and we’re in New York.

In her 2016 book “Makers and Takers: The Rise of Finance and the Fall of American Business,” Rana Foroohar describes how financialization is bleeding the global economy to make a handful of elite investors very, very rich while holding back innovation and productive investment in the real economy. She writes that the financial sector represents only 7 percent of the U.S. economy, but takes around 25 percent of all corporate profit while creating only 4 percent of all jobs. According to Ms. Foroohar, even companies associated, as associated with research development and creativity as Apple borrow to invest more in stock buybacks and acting like a financial institution than they do developing qualitative leaps in their products. But more about that later.

Her book is a scathing critique of the lords of Wall Street, yet she remains hopeful that capitalism can be reformed and we shouldn’t give up on it yet. Rana is an associate editor and global business columnist for The Financial Times. She’s also CNN’s global economic analyst. Prior to her work at CNN and The Financial Times, Rana spent six years as an assistant managing editor and economic columnist for Time. And before that she spent 13 years at Newsweek as an economic and foreign affairs editor and a foreign correspondent covering Europe and the Middle East. Now joining us in the studio in New York is Rana Foroohar. I think I got it right that last time, did I? Thanks for joining us.

RANA FOROOHAR: Thanks for having me.

PAUL JAY: So we’re going to get into the substance of the book. But those of you that watch Reality Asserts Itself, you know we usually start with a personal section. And while we don’t have quite enough time to do the whole, Rana’s whole biography, we are going to start with a personal question. So you’re writing in The Financial Times, you know all kinds of people on Wall Street, you know how all this works. Why aren’t you cashing in? Why are you exposing it?

RANA FOROOHAR: Well, that was what the book was supposed to be, Paul. Yeah, it’s not, not quite as good as the Wall Street bonus. But you know, I actually did do a brief stint in finance. I worked for about a year in London, this is quite telling, in 1999 for a high tech incubator that was funded by Citigroup. And I left in part because I been writing a lot about finance and about technology. This was the last dotcom bubble, as you remember, in the late ’90s. And I had gotten this call, and this big company was looking for, to hire journalists to do B to C media deals, which right there should have been a sign of a market top, frankly. But I took it because I thought it’d be really interesting to see how the sausage was made. And it was, and it was very telling.

But I love journalism, I loved telling stories. I think it’s much more interesting, frankly, than a lot of what happens in the financial sector. You get rich but you have to do not only some shady things sometimes but a lot of boring things.

PAUL JAY: But, but the kind of wealth that’s being generated generated in the top, not even just the top tier, from middle to top tier of finance, is not known in human history.

RANA FOROOHAR: Right.

PAUL JAY: You could be part of that.

RANA FOROOHAR: I guess I could. It’s funny, I’ve really never felt the pull. I kind of think of myself as a little bit of a scholar looking at this group of people as a tribe. I mean, they are, they can be studied almost like an anthropologist would go into a new country and study.

I mean, they have their own habits, their own rituals, their own belief system. And I just find it fascinating as an outsider to approach that. And actually, I think that being an outsider not just, you know, from Wall Street but from the financial press was actually helpful to me in writing this book. There’s an anecdote that I tell in the intro. It was my sort of come to Jesus moment, I know I have to write this book. I was sitting in a meeting, an off the record meeting that had been called by a former Obama administration official who had been very involved in the bailouts, and he was, it was around 2012, 2013. He was kind of trying to wrap a bow around everything and say we’re all done here, the financial system is safer, nothing to see.

And I was there, and there was maybe one other general interest news writer, reporter there. And most of the people around the table were financial beat reporters. Now, those folks have to go back to these wells again and again and again. And they can also get very siloed in terms of how they’re thinking about this story. But this official, former official, was saying, you know, we got done everything we need to do. Dodd-Frank is going to make everybody safer. And at the time, and this was four or five years after the financial crisis, I was looking at Dodd-Frank and saying, you know, half the rules have yet to be written. None of them are implemented. You know, we’re four, five years on from a crisis. What’s going on? And I asked him if he thought that the industry had had undue lobbying pressure. Because of course one of the reasons why regulation really didn’t get done, in my view, properly in the last decade despite the fact that we had the worst financial crisis in 75 years is that there was so much lobbying power. And the financial sector spent so much money and time putting holes into, you know, making, making the regulation Swiss cheese.

So I said to him, do you think that the industry had undue pressure on this regulation? And he said absolutely not. And then I gave them a statistic showing there was an academic at the University of Michigan that had tallied up all the public records and found that 93 percent of all the meetings on the rule-making had been taken with the industry itself, and most of them with the top three banks, many of them with the executives whose names you know. And I’ll never forget, this was so telling, I put that stat out there and the official looked at me with a real sense of confusion and said, well, who else should we have been talking to? And for me I was, I looked around the room and I thought, surely everyone’s going to be scribbling and this is going to be big news. And nobody was really surprised. I thought, this is how much cognitive capture there is. This is how much power the industry has, that we’re not even questioning, not only the regulator himself, but the journalists aren’t questioning that this is a problem.

PAUL JAY: I interviewed Bart Chilton from the Commodity Futures Trading Commission when they were working on this position limits ruling, I guess, or legislation. And he told me it was 100-11, how they got lobbied from finance. And there were, and it’s not that there weren’t people out there advocating for these kinds of reforms. They were out there to be met with. And it’s not like they didn’t know stuff. They did. They just didn’t get the meetings.

RANA FOROOHAR: Absolutely. Well, you know, Bart’s a great source. I’ve also had conversations with Anat Admati, who you may know, who wrote The Bankers’ New Clothes. She’s an academic at Stanford. She said, nobody called me. I mean, this is one of the world experts on financial regulatory issues. These people were purposely not let into the room.

PAUL JAY: And for good reason. When one looks at the kind of money being made by everybody concerned. And you talk in your book about the revolving door, people making regulation laws one day are back into the financial institutions the next.

RANA FOROOHAR: Yeah, absolutely.

PAUL JAY: And let me read it, I’m going to read a quote from your book.

RANA FOROOHAR: Okay.

PAUL JAY: Our system of market capitalism is sick. And the big picture symptoms, slower than average growth, higher income inequality, stagnant wages, greater market fragility, the inability of many people to afford middle class basics like a home, retirement, and education, are being felt throughout our entire economy and indeed, our society. Or economic illness has a name: financialization. And that’s the theme of your book.

So let’s, because we don’t have too much time. Let’s start with the very beginnings of how financialization takes place, why banks start to play such a role in society. And then I think we’ll probably focus on a couple of things you focus as models. The formation of Citigroup, and then we’ll do Apple.

RANA FOROOHAR: Yeah.

PAUL JAY: So let’s talk about how financialization develops in the United States, but let’s first talk about what is financialization.

RANA FOROOHAR: Yeah. So, I define financialization, as do many academics, as the process by which the financial sector has come to be the tail that wags the dog, if you will. If you go back to Adam Smith, the father of modern capitalism, he would have looked at the financial sector as a catalyst for other sectors. So the financial sector is an allocator of capital. It helps businesses grow, it allocates money to people who are job creators in retail, in manufacturing, in construction, et cetera. It’s never the end game. It’s the facilitator.

But I argue in my book that basically since the early 1970s we started to go through a real sea change in our economy, in our politics, and our society, where finance itself became the game. And you can see this. I mean, if you think about the way in which we talk about our economy. We started out as an agrarian society then we became a manufacturing economy and then a service economy. And the idea was that at the very top of that triangle would sit the financial sector, and politicians came to speak of it as we should all be aspiring to be right there at the tippy top of that, of that triangle. But really, if you think about Adam Smith and the way he envisioned capitalism working, you would flip that. You would have finance at the very bottom facilitating other kinds of businesses that actually create real jobs and real growth on Main Street.

PAUL JAY: Here is another excerpt from “Makers and Takers:”

“Rather than funding the new ideas and projects that create jobs and raise wages, finance has shifted its attention to securitizing existing assets (like homes, stocks, bonds, and such), turning them into tradable products that can be spliced and diced and sold as many times as possible—that is, until things blow up, as they did in 2008 … Academic research shows that only a fraction of all the money washing around the financial markets these days actually makes it to Main Street businesses. As recently as the 1970s, the majority of capital coming from financial institutions would have been used to fund business investments, whereas today’s estimates indicate that figure at around 15 percent. The rest simply stays inside the financial system, enriching financiers, corporate titans, and the wealthiest fraction of the population, which hold the vast majority of financial assets in the United States and, indeed, the world.”

Please join us for part two of our interview series with Rana Foroohar on Reality Asserts Itself on the Real News Network.