This is an episode of Reality Asserts Itself, produced on June 12, 2014. Mr. Johnson says, “I used to tell my dad, if I’m fortunate enough to see St. Peter and get through the gate, I’m not going to get in because I helped knock off the British pound”.

PAUL JAY, SENIOR EDITOR, TRNN: Welcome to The Real News Network. I’m Paul Jay in Baltimore. And welcome back to Reality Asserts Itself with our series of interviews with Rob Johnson, who joins us again in the studio.

Thanks for joining us again, Rob.

ROB JOHNSON, EXEC. DIRECTOR, INSTITUTE FOR NEW ECONOMIC THINKING: My pleasure.

JAY: So, one more time, Rob is president of the Institute for New Economic Thinking. He’s also a senior fellow and director of the Global Finance Project for the Franklin and Eleanor Roosevelt Institute in New York. Previously, Robert was a managing director at Soros Fund Management, where he managed a global currency bond and equity portfolio. And he was, as I’ve said, one of the men who broke the Bank of England.

Thanks again.

So we’re going to pick up Rob’s narrative. He left working on Capitol Hill with the budget and such committees and went into the private sector. You worked at a private bank. And then you go and you work–what year do you join Soros?

JOHNSON: Nineteen ninety-two.

JAY: Nineteen ninety-two. As you leave working for government–and we talked about the period of finance becoming so overwhelmingly powerful. You see the sausage of legislation, finance legislation being written, which makes you dubious about the whole process. And you can start–you must know–I mean, you can see the social consequences of these policies. This is the–you know, this never was an equal society, but the roots of tremendous inequality are in that period of the ’80s. This is where the equality gap starts to take off. How does that affect you personally? Go back to your roots in Detroit. And to be frank with you, you don’t make a choice. Your next choice isn’t, oh, I’m going to become–what’s this?–a reformist evangelical fighter to try to make this system more equal; you go into banking to make money.

JOHNSON: No, I went to work for a hedge fund as a financial speculator. And I would say, at the time, I wasn’t thinking like I was a socially responsible visionary. I still viewed myself, even in 1992, as a young person getting an education, meaning I could be in a place where I had plane tickets all over the world, access to consultants, Reuters machines, eventually Bloomberg machines, and I could start, what you might say, to comprehend what was happening on the planet with all of these things at my disposal.

When I went to work in Soros’s firm, I thought the 12 or 13 partners there were amongst the most brilliant people I’d ever met. So there was a pure level of curiosity that motivated me. One of my colleagues, Stanley Druckenmiller, who I used to call the Michael Jordan of traders (and I think that was true in that time), he once said to me that the dirty little secret is that if we had been paid $50,000 rather than much more money, that we still would have done it, ’cause we loved what we were learning and what we were doing each day. And I don’t think he was far off base there.

JAY: But the money increasingly got to be stratospheric.

JOHNSON: Yes.

JAY: And that’s got to be it’s own–.

JOHNSON: Now, to be fair, though, in 1991, 1992, you’re right. Things are in motion. But the really hyperbolic increase in finance took place after the development of derivatives, which, ironically, happened under a Democrat: the Bill Clinton of Rubin and Summers’ Treasury is when this really took off. And then I would say the deregulation fostered by Alan Greenspan, who was a Republican, and the Democratic Treasury went wild under George W. Bush, where essentially the rules weren’t even enforced and you’d had the Enron scandal and no repair of all the off balance sheet dimensions, in part thanks to Joe Lieberman of Connecticut, who worked very hard to maintain the capacity of all these off-balance-sheet techniques, the special inversement vehicles and other things, many of the things that were used in the crisis of 2008. But the financiers could see by the late ’90s much more of this what you might call unbridled free-market sensibility than I could see in 1992.

JAY: You are an expert in ’92 with exchange rates,–

JOHNSON: Exchange rates, currencies. Yeah.

JAY: –currency speculation.

JOHNSON: When I worked with Bankers Trust Company, I worked on an inter-European fund and a very small fund I was building on intra-Asian currency and money market–Indonesia, Thailand, Malaysia, Singapore, Hong Kong, places like that.

JAY: So for people that don’t understand currency speculation–and I don’t have any great expertise in currency speculation, but my understanding is you were either–you’re betting on your predictions a currency will either gain strength or lose strength, and you’re going to bet one way or the other.

JOHNSON: Yeah, you’ll bet that the German Deutsche Mark is going to strengthen against the French franc or weaken against the French franc. It’s betting on the relative strength of one against another country.

JAY: And is this actually, then, buying the currency? Or you’re buying–you’re playing hedge funds, you’re buying positions?

JOHNSON: You’re buying Deutsche Marks and financing it by borrowing French francs in the example I used.

JAY: So, you know, within a certain amount of amounts, this is kind of normal within the way capitalist economics works. Big companies do this all the time, and they figure–they try to stabilize their earnings.

JOHNSON: Well, they have a commercial interest, which might be called hedging, meaning they’re insuring against being harmed by an adverse fluctuation in the currencies. Speculation is more of an outright decision to try to make money on the direction things are going.

JAY: Right. So tell us the story, then, of what happened with the Bank of England.

JOHNSON: Okay.

JAY: And both what happened and also, sort of personally, your own thinking through it.

JOHNSON: Sure. When you see the advent of German unification, which is going to require tremendous scale, infrastructure, investment, and development in Germany, you sense that Germany as a national economy is going to take off, it’s going to have a very vibrant and robust period. The Germans also have a tradition which is to fight inflation. So you know the central bank isn’t going to let that vitality lead to very, very rapid rises in inflation. They’ll resist it by raising interest rates.

Germany was embedded in what was called the Exchange Rate Mechanism, the ERM, of Europe. And within, say, two and a quarter percent plus or minus, they were lashed to the French franc, the British pound, and Italian lira, and some other things.

What you could sense is that Germany’s what you might call particulars associated with unification were going to create a stress or a division, in this case between the British pound and the German Deutsche Mark, that there would be upper pressure on the Deutsche Mark, downward pressure on the pound.

If the Brits wanted to stay in that system, they would have to raise their interest rates to give investors more incentive and therefore [attractives?] to the pound. But higher interest rates in a society that had floating-rate mortgages, widespread floating-rate mortgages, was very credit- and interest-sensitive, would be very painful.

So as this culminated, we saw a stress between Britain and Germany structurally reaching a point of potential rupture.

And we also knew there were acrimonious relations between the Brits (their leaders) and the Germans. The Germans felt that their Deutsche Mark was the anchor currency of Europe. The British sterling had been the reserve currency in the world. And John Major, their prime minister, aspired to what you might say the nostalgia of the British people that the British pound should be in that role. We experienced a lot of acrimony or reports coming out of meetings meetings between Norman Lamont (the chancellor of the exchequer) and the governor of the Bundesbank. And we drew inference from that; very simply, if Britain gets under stress, Germany’s not going to come to their assistance.

And with that stress in mind, George Soros, who’s a tremendously insightful psychologist, political economist, scenario-builder; Stanley Druckenmiller, who I mentioned was the Michael Jordan of traders; and myself; and another man named Scott Bessent, who understood how balance sheets of British companies could be made very vulnerable by these interest rate rises; in conversation we developed the conviction that we should go after this.

JAY: So three of you are sitting around a table analyzing this together.

JOHNSON: Yeah, the three of were at a table, and Scott, I believe, was in London. And those conversations led to the conviction that we could go after this, what looked like a one-sided bet. The British pound wasn’t going to leap up and get strong, and it was bounded in a system. So we felt like we might lose 1 percent or so if we were wrong, and we might make 20 percent. So if you have a 20-to-1 shot and–.

JAY: And how much money have you got to play with here?

JOHNSON: Well, we were authorized to do as much as, I believe, $15 billion by Mr. Soros, who set what you might call the magnitudes of leverage we could use through those conversations.

JAY: And you said that you didn’t just take advantage of a moment; you guys helped create the moment.

JOHNSON: Well, to the extent that the British had roughly 22 billion of reserves [USD?], when we make a play of that magnitude, the probability that their reserves would be exhausted increases and the rest of the market [crosstalk]

JAY: To defend the pound, they have to use their reserves to buy pounds.

JOHNSON: They have to use the reserves. That’s right.

JAY: And there’s a certain point that they run out of money to buy pounds with.

JOHNSON: That’s right. They have to defend the pounds at the boundary. And if they run out of money, then the boundary is a problem to defend, ’cause they don’t have the reserves, or want to borrow to continue defending the boundary. And the market can infer that the pressure is strong and persistent over a number of days, so the probabilities change in favor of devaluation.

But there were also divisions within the British Tory Party at that time, between those who are pro-Europe and those who were part of what you might call the transatlantic alliance, the special relationship with United States, many of whom had not wanted to enter the ERM. So you could see the faultlines within the Tory Party playing a role, meaning increasing the probability that when put under stress, they would abandon the system.

JAY: So you use $15 billion?

JOHNSON: It didn’t get quite there. The devaluation happened before we got to that point.

JAY: You got to about 12, is that what it was?

JOHNSON: Yeah, ten, 12, something to that degree.

JAY: Yeah. But what do you do with the 12, exactly? What is it you do?

JOHNSON: Well, you sit there and watch–.

JAY: No, no, no. I mean, what–to put the pound under stress, you do what with the 12?

JOHNSON: Oh. You are borrowing British pounds and converting them into Deutsche Marks and investing them in Deutsche Mark short-term instruments. So you’re going long the Deutsche Mark, short the pound, repeatedly. And in this case, at the boundary, the British, as we’re borrowing the pounds, they’re having to provide them; as we’re buying the Deutsche Marks, they have to take the other side.

JAY: Yeah. So you force them into the other side.

JOHNSON: We forced them to liquidate their Deutsche Mark foreign-exchange reserves and buy the pounds. And as they run out of reserves, the market observes it. That increases the likelihood of a devaluation.

JAY: So what happened? How big a devaluation?

JOHNSON: Well, there were–probably in the neighborhood of 15 to 20 percent. Not all at one time. The lower boundary, I believe, was to two seventy-seven and a half, and things get down as low as two-twenty over a number of weeks.

JAY: So the Soros Fund makes, what, about $1 billion on this play?

JOHNSON: More than–a billion in a day or two.

JAY: In a day or two.

JOHNSON: And then eventually more than that.

JAY: Do you know what the total amount was in the end?

JOHNSON: Oh, take–call it–let’s just say I don’t want to be too precise here, but $10 million and 20 percent, that’s about $2 billion.

JAY: Right. So what were the consequences of that devaluation?

JOHNSON: Well, I think for the British economy,–

JAY: Yeah, for the British.

JOHNSON: –it allowed them to lower interest rates, restore competitiveness of their export sector. When it first happened, the British officials were embarrassed and the press college called it Black Wednesday. As the economy started to rebound from the slump, they called it White Wednesday, ’cause they considered it relief from–.

JAY: Black Wednesday is, what, September 16, 1992?

JOHNSON: Right. And people started to refer to it as White Wednesday, the day they were unshackled from this ERM system and their economy could regain prosperity.

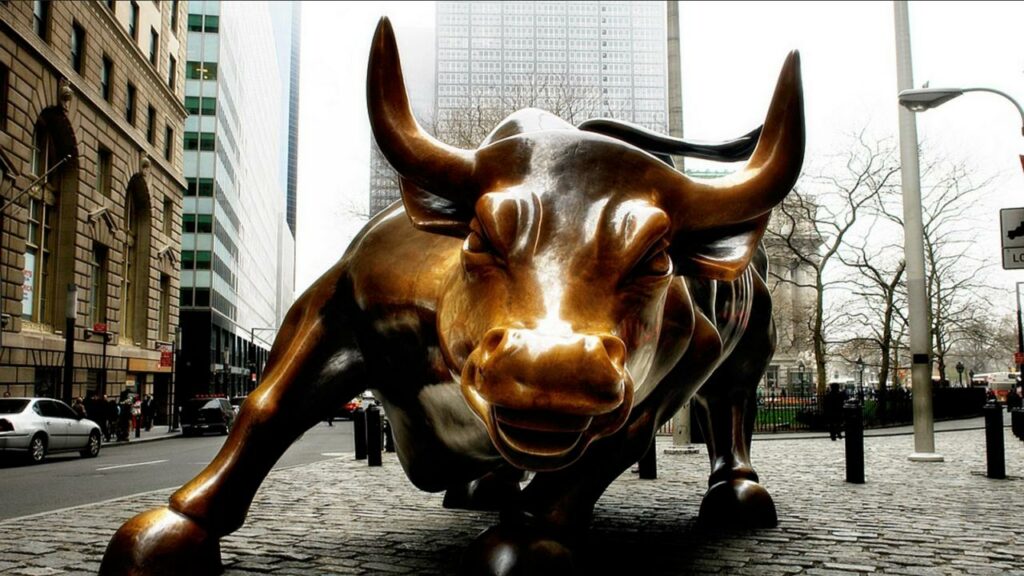

With regard to what you might call the political economy of the experience, I think it was quite daunting that a very small boutique firm in New York could take on a G5 government and appear to win. It was a bellwether moment in understanding the growing power of private capital markets in relation to government policy.

JAY: What were the consequences of the devaluation on ordinary people’s incomes and the cost [crosstalk]

JOHNSON: I would guess that–I mean, there are probably several. First of all, if you had a floating-rate mortgage, the interest rates came way down. Then you would probably gain some purchasing power. To the extent that you are buying, say, imported foodstuffs or imported, you know, consumer durable equipment, there was probably approximately a 20 percent increase in the price as a result of a weaker pound relative to, say, imported goods from Siemens or someplace in Germany.

I think economic activity started to rebound as the German economy was valued higher and the British regained competitiveness. So their export sector started and import competing sector started to thrive. It may have increased some employment.

So there’s mixed impact. There are some that are adverse and some that are beneficial, depending on where you are within the economy.

JAY: You’re still in this mode of learning. The amount of money that’s getting made must be–I don’t know what the word is. I’ve never experienced it.

JOHNSON: It was surprising. It was, how you say, unprecedented in my family tree.

JAY: Yeah. I mean, people have described it as a kind of aphrodisiac. Do you get into this mood? I mean, it must be surreal: one, to make that play and win; two, the amount of money.

JOHNSON: I remember–you know, my father is a physician, and I remember talking with him, and it was a bit unsettling to him. And I said to him that I think that it was important for us both to discuss this, recognizing the correspondence between the money I’d made and the social value I’d created was not something I believed in. I didn’t see those things as I was making–. You know, for our investors and so forth, they had benefited from our collective skill of this team, but I didn’t personally think I had done anything–you know, the joke I used to tell my dad is, if I’m fortunate enough to see St. Peter and get through the gate, I’m not going to get in because I helped knock off the British pound.

I’m–you know, that created a lot of personal freedom for me to do things in my life, whether it’s philanthropically or with my own time and energy, that I hope to, how you say, convince St. Peter at that time.

JAY: But it is on your mind at the time, this contradiction between–.

JOHNSON: Well, it’s a big change in my life. I didn’t–.

JAY: No, but I mean this issue of, you know, this idea of making so much money without having produced anything and what the social consequences of this are.

JOHNSON: And the personal consequences.

JAY: That’s what I’m getting at.

JOHNSON: Knowing there was–. One of my partners at Soros said to me, you now have antlers. I said, what do you mean? He said, you are a trophy animal. Whether it’s real estate developers or tax collectors or whatever, people are going to zoom in on you now, and you have to–he basically said, you have to grow up.

JAY: Some people have, in their critique of George Soros–but I guess it would apply to you too, that when you’re talking now about financial reform and having a system that’s not so irrational and not so predatory and not so, you know, destructive, that you guys took advantage of exactly that.

JOHNSON: Mhm. What I would say in that respect–and I believe that George has lived by this–is that he’s often said he was like a theater critic, and he looks for the fault lines, and as a financial investor, he takes advantage of them. But when he thinks they’re harmful to society, he also makes public statement to awaken the officials to those faultlines and how they could be repaired. So he does not refrain from exploiting the faultlines, ’cause he says others will get there if I don’t, but he does invest in dialog about the repair. He’s not lobbying to perpetuate the malfunctions.

JAY: Okay. We’re going to pick up this story in the next segment of our interview. So please join us for our series of interviews with Rob Johnson on Reality Asserts Itself on The Real News Network.

Never miss another story

Subscribe to theAnalysis.news – Newsletter

“Robert A. Johnson is the Executive Director of the Institute for New Economic Thinking and regularly contributes to NewDeal 2.0 with his “FinanceSeer Column.” He also formerly traded currency on Wall Street under George Soros.”