Why is the Fed buying corporate junk bonds and debt but won’t buy out student debt? Michael Hudson on theAnalysis.news with Paul Jay.

Paul Jay

Hi, I’m Paul Jay. Welcome to theAnalysis.news. Thank you to everybody who has clicked the donate button. And if you haven’t, maybe you might do it this time. If you’re watching on YouTube or our website, click the share button and subscribe and we’ll be back in a second with Michael Hudson.

U.S. household debt climbed to a record high of fourteen point six trillion dollars at the end of 2020 as mortgage debt surpassed 10 trillion for the first time. Now, the GDP of the United States is only around 21 trillion. Americans owe over 1.71 trillion dollars in student loan debt spread out among 44.7 million borrowers. That’s about 739 billion more than the total U.S. credit card debt. While defaults and payments have been halted due to the pandemic, I’m talking now again about student debt, there’s no plan yet for forgiving such debt in spite of promises from Biden and many others in the Democratic Party. Biden said during a CNN town hall that he would not forgive 50 thousand dollars through executive action, as urged by Senator Schumer and Warren, Biden said, I’m prepared to write off the ten thousand dollars debt, but not the fifty thousand because I don’t think I have the authority to do it. Well, a group of 17 state attorneys general called on Biden to forgive fifty thousand dollars in student debt loans per borrower through executive action, asserting he does have the authority to do so under the Higher Education Act.

On the other hand, beginning in mid-March 2020, the Federal Reserve initiated an aggressive policy of quantitative easing, which included the purchase of corporate bonds. Billions of dollars of corporate debt has been purchased by the Fed, mostly from major companies including Apple, AT&T, General Electric, Ford, Comcast, Microsoft and around 90 others, companies that probably didn’t even need their debt purchased. So the role of the state in forgiving debt is quite OK as long as it’s a major corporation and not a student. OK, I’ll admit the Fed policy is a little more complicated than I outlined, but the principle is clear. It’s not considered a systemic risk for corporations and banks to rely on the government to bail them out of debt. But it is a danger to the system for government to forgive family and student debt. Of course, it goes further than that. The system requires high levels of debt among the population for corporations and banks to continue to rake in massive profits and engorge the fortunes of the billionaire class.

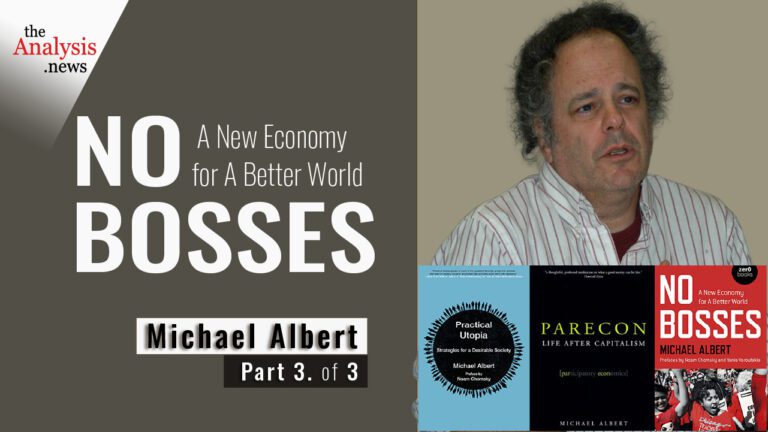

Now joining us to talk about debt is Michael Hudson. Michael’s an economist, a professor of economics at the University of Missouri, Kansas City, and a researcher at the Levy Economics Institute at Bard College. He’s also a former Wall Street analyst, political consultant, commentator and journalist. Thanks for joining us again, Michael.

Michael Hudson

Good to be here. Regarding your lead in, Sheila Bair, the head of the Federal Deposit Insurance Corporation, wrote an op-ed in The Wall Street Journal recently saying the problem with the Federal Reserve is its buying junk bonds. It’s buying the bonds, as she put it, of some big corporations that can’t pay their debts. And she’s criticizing them. She pointed out that the entire financial system rests on debt because debt is the collateral for the banks. The banks’ assets are the debts of the people. So the Fed policy is aimed, ever since 2008, by somehow keeping the economy’s ability to pay its largest massive debts, real estate debts, intact by lowering interest rates to support the mortgage market. And if you support mortgage lending, then even if individual homeowners can’t pay their debts, they can at least sell them to somebody or a company that can afford to pay. So, the whole financial system is a pyramid resting on these debts.

Paul Jay

Let me just emphasize something you just said, because you kind of corrected me on something correctly, that the fact that these major corporations like Apple got their bonds and debt bought was a piece of it. But you’re right, the other piece, which actually developed maybe a little further after they started this program, is they’re now really buying tons of debt where the companies are practically insolvent and never could pay off this debt. As you call them, zombie corporations. Sorry, go ahead.

Michael Hudson

Well, imagine the Fed could have simply bought all the student debt from the government and then wiped it out. The Fed could have wiped it out. The fact is, if the government were to write down all the student debt, it wouldn’t cost the government a penny right now. And that wouldn’t cost the banks a penny because the debt is owed to the government and the government would simply be canceling a future source of revenue. And by canceling the student debt revenue, they’d say debt is a public need. Debt is what people need to get by. It’s a basic need, and so it deserves to be public as it is in England, China and most other developed countries. Only in the United States do you have education taking off at a rate that almost is approaching the inequity of health care and medical care here. That’s what makes America so different from every other industrial country and from China. And because of this heavy debt and health care and all the other expenses that other economies don’t have, that’s exactly why the United States isn’t able to pull out of the recession that we’ve been in for the last 13 years, since 2008.

Paul Jay

Would you say expenses they don’t have, individuals don’t have? They’re dealt with collectively, the health care and education. Yeah, I don’t think there’s an advanced capitalist country, industrialized country, in the world that doesn’t have more or less free higher education. Although I have to say that tuition rates in Canada have been going up with some seriousness. Not nearly at American levels. And student debt exists in Canada too, but again, not as bad as in the U.S..

Michael Hudson

That’s right. Canada is always about three years behind the United States. That’s the perception of Canada. When I worked with the State Department in Canada in 1979, we did test questionnaires on Canadians. What do you think of the future? And almost all Canadians thought their future was going to be what the United States had, but three years behind. And that’s become the basic administrative policy of prime ministers ever since.

Paul Jay

So let’s dig into what you just talked about, because the rationale for all this buying of both corporate bonds from the Apples of this world and now junk bonds, essentially, from companies that really can’t afford to pay their debts, is that this is systemically necessary because of the pandemic, because of the deeper recession. It acts as a stimulus. It stops a greater unraveling of the economy and so on. But all of that rationale would exist for student debt exactly the same way and even more because it would give so much stimulus on the consumer side. As I say, some of these companies that they’re buying their debt from are actually cash rich, like an Apple. They have debt for convenience. But the stimulus, far more stimulus would have come from relieving systemic debt. But the reason I think they don’t do it, and this is what I’m asking you, is because they don’t want people to have any notion that debt gets relieved by the government. They want people to consider that debt must always be paid.

Michael Hudson

I think there’s a simpler explanation. One person’s debt is somebody else’s asset. The government can cancel debts because its the creditor, ultimately, for student loans. So it can cancel debt and nobody’s going to complain because nobody loses any money and the government can make up what it doesn’t get in student debt interest and principal by taxing or by simply printing the money. But if you cancel corporate debt, then you’re going to hurt bond holders. If you cancel business debt you’re going to hurt someone. If you cancel mortgage debt or landlord debt right now, other than a huge increase in backlog of mortgage debt, because many not only homeowners have lost their job, but also the landlords are renting out to renters who are not paying. And if they don’t pay, then the banks will lose.

The Federal Reserve’s job is to make sure that the economy is run for the banking system and for the bond holders, rather than having the banking system and bond markets run for the economy. So we’re living in an upside down economy where everything is being run in order to sustain the bond holders and the banks. And the problem with this is that the mortgage debts, the student loan debts, the personal debts, the car loan debts, they’re growing at an exponentially high rate, while the economy is not growing at a high rate. All of the economy’s growth since 2008 has been only for the top five percent of the population. For 95 percent of the population since 2008, the GDP has actually shrunk. And so you’re having a very sharp polarization right now. So I think if you’re talking about the debt issue, the question is, do you want to sustain this polarization between creditors at the top and the indebted 95 percent or do you want to restore the kind of equality that people think usually is the hallmark of democracy, at least of economic democracy? And the choice by the government is we’re going to sustain the polarization. No matter what, the creditors won’t lose a penny. The debtors will lose.

Paul Jay

OK, so why do you think Biden, and not just Biden, but that section of finance that they represent, why don’t they want to forgive student debt?

Michael Hudson

I think partly it’s what you said. It’s the whole idea that if you admit that you should write down debts when the effect is to help the economy grow and you write down debts that impair economic growth, then people would put economic growth over the welfare of creditors. And that’s revolution. That’s not what our economy is all about. We put creditors first, not the economy. And the very thought of putting the welfare of the people first over the creditors in general, well that’s totalitarianism. That’s a dictatorship. We can’t possibly have that. So it’s the greed of the creditors and the fact that the creditors are able to control politics and who gets nominated, et cetera, enables them to prevent anything that might shock the assumption that the sanctity of property is really the sanctity of creditors to evict property owners if they can’t pay. It’s really the sanctity of debt. And if you talk about the sanctity of debt, it’s the sanctity of the exponential growth of debt, even when it’s beyond the ability to pay, even when it pushes the economy into a chronic depression. And in fact, what we’re suffering now is debt deflation. And the debt deflation at the bottom, students are experiencing, the unemployed are experiencing, cities and states are experiencing it. The transportation systems are running at deficits. All of these deficits are the savings and the gains and the wealth of the one percent or five percent or whatever you want to call the banking and creditor class.

Paul Jay

I saw a stat from Brookings Institute. Now, this is a few years old, maybe five, six years old, but the amount of assets in private hands after liabilities in the United States was, at that point, something like 98 trillion dollars. It’s not like there isn’t enough wealth, there’s no reason why people have to be in such debt. It’s just as you say, it’s the polarization. Talk a little bit about this issue of debt relief, because you’ve done a lot of work on the history of debt and debt relief.

Michael Hudson

Well, the interesting thing is that people assume that the economy is going to crash if people don’t pay the debts. But as we’ve discussed before, I’ve had an archeological anthropology group at Harvard since 1984 where we’ve gone into the economic history of Mesopotamia. And for three thousand years, Sumer, Babylonia, all Near Eastern kingdoms and their rulers, normally, when they would take the throne, they would cancel the personal debts. Not the business debts, not the debts of merchants and traders, but the personal debts. And they did it because otherwise you would have the debtors falling into bondage to the creditors. And that meant if you were a small holder supporting yourself on the land, well, you’d be behind in your taxes or you’d need to borrow for some reason and you would have to work off the debt by working for the creditor. Well, then you couldn’t work on the corvée labor to build the walls and dig the irrigation ditches and the public infrastructure. And if you owed the crop surplus to the creditor, then you couldn’t pay the taxes. So every new ruler who took the throne in the near east for thousands of years would simply have a clean slate. He’d say, OK, we’re wiping out the backlog of debts. And Hammurabi’s Law is one of his clean slate proclamations which said, well, if there’s sickness or if there’s a crop failure or if there is some interruption in economic activity that people can’t afford to pay, then the debts don’t have to be paid.

Well, the result was resilience. The result was not an economic collapse. And this seems so radical that for almost a century, assyriologists and economic historians said they couldn’t possibly have canceled the debts because if they did, the economy would collapse. Well, the fact is the economy didn’t collapse because they canceled the debts. Once you wipe out the debts to the creditor class, you prevent an independent financial oligarchy from developing. You enable the small holders to pay their crops to the palace as they did before. And they’re working on their own land, they’re able to do their corvée duties, the work duties that they did in the off-season from the plantings. And so these clean slates would not only cancel the debts, they would give back the property that had been forfeited to the creditors and they would free the debtor from bondage, that is owing the labor to the creditor. And in fact, this is word for word borrowed by the Jubilee law of Judaism, Leviticus 25. So it even was actually built in to religion, but by the time Jesus appeared and said he’d come to restore the clean slate in his first sermon, you had the Roman oligarchy taking over. And Rome rewrote the whole law and completely changed the course of civilization, certainly of Western civilization, and said all the debts have to be paid. There are not going to be any debt cancelations. We’re not in a democracy. Well, for five centuries, from about the sixth century B.C. in Greece, down to the end of the republic with Augustus in Rome, you had revolts at urging debt cancelation and a land redistribution. There were constant revolts. In Rome, the secessions of the plebs, there was civil war. There was civil war in Greece. Democracy in Greece began with leaders called the tyrants who were reformers who kicked out the oligarchy and canceled the debts and redistributed the land. Well, that stopped being done and the result was a dark age.

So you have Western civilization, ever since Rome having a stop go, stop go. You’ll have the dust build up. It’ll lead to a crash, to austerity, and the whole world now is being subjected to what the International Monetary Fund subjected third world countries to. If you want to see where the US economy is going. Look at what happened to Greece when the International Monetary Fund and Obama personally and Tim Geithner, his treasury secretary, told Europe, you can’t forgive Greeks’ debts because the American banks have written default contracts on these and we’d lose money. So to save my constituency, the banks from losing money, you have to create a permanent depression in Greece. Well, that principle of Obama is exactly the principle that Biden is following today. Biden and the Democratic Party and the Republicans say it is worth plunging America into depression. It’s worth impoverishing it just so the upper one percent of creditors and the banks will not lose. And it’s why the economy is polarizing, not converging.

Paul Jay

My memory is it wasn’t that long ago there was a bill that would allow students to declare bankruptcy and avoid student debt and then they wouldn’t do it. They exempted student debt from that.

Michael Hudson

I know, it was Biden who was the head of the committee that rewrote the bankruptcy law to prevent student debt from being written off. It was Biden who locked in student debt. You’d think that maybe he would say here’s a chance to undo the great error that I did, grinding down student debt. Basically, if he would have vocalized what he said, he would have said, I want to make students so poor that they have to pay student debts so high that they can’t afford to buy a home. They can’t afford to get a mortgage because they already owe the student debt. They can’t afford to start a family. They can’t afford to get married. That’s my policy. And that was the Democratic policy, and it was a bipartisan policy, of course. But Biden played the lead role in this awful bankruptcy law. And bankruptcy was supposed to be the one way of Western civilization’s alternative to a clean slate. They’re not going to wipe out all the debts as they did in the ancient near East, but they wipe that on a case by case basis, but thanks to Biden, he said, well, you can’t wipe out that student debt. We’re not going to let you do that. We’re going to tighten the rules so that it’s very hard for individuals to declare bankruptcy. Only our constituency, the banks and the corporations are allowed to wipe down their debts, as you point out, which is why Obama was willing to bail out General Motors and the car companies, but not the debtors who were subject to the junk mortgages and all the bank fraud that you had Bill Black explain on your program.

Paul Jay

Well, I was just about to say, Bill Black’s point is that it’s the bankers, not the banks. The bankers loot their own banks as well as looting their customers and society. And when it comes to bankruptcy, the way the law works, the management of these companies, who have been paid bonuses and millions of dollars in salary, if the company goes down the toilet, they don’t lose any of their personal wealth. It’s all been separated through the bankruptcy laws and incorporation laws. So those individuals walk away, they may lose some stock or whatever, but they usually walk away rich. Whereas when it comes to student debt and individual family debt, there’s no such mechanism. And you can go bankrupt, but you lose everything you’ve got. You don’t just walk away scot free from your company.

Michael Hudson

And the amazing thing is that nobody is suggesting any alternative. Nobody is pointing that the debt really is a problem. Certainly if you take an economics course, it doesn’t appear in the economics courses and it doesn’t appear in the political discussion. You don’t have anyone, sort of a counterpart to Bernie Sanders talking about socialized medicine. You don’t have anyone talking about socialization of debt or writing down the debt or the fact that it’s debt that is grinding our economic growth to a halt. And also because people have to spend so much money on debt, not only are they not able to buy the goods and services they produce, but they’re not able to get jobs exporting because their cost of living is so high because they have to pay so much debt.

Paul Jay

Why in the United States, as compared to the other industrialized countries, has the cost of higher education so been put on the shoulders of students. There’s Nordic countries in Europe. I can’t remember exactly, I think Norway is one, but there’s a few others. Not only do they provide free education at the highest levels, they’ll even give it to anyone from around the world who goes there. They’ll give them free education. I believe in Germany, foreign students even get a stipend to go to school. Why did it develop so differently in the US?

Michael Hudson

Well, think of education as being like buying a house. If you buy a house, the price is however much a bank is going to lend you to buy a house. And the banks have loosened their mortgage terms and they’ve lent more and more debt to value ratio. Same thing in education. Once you privatize the educational system and once you provide a market for banks to finance it, banks are going to compete to lend more and more money to students and students will all take it on. And the student that initially created a huge market to the banks would essentially appear on every campus and they would lend more and more for the education. And so obviously, universities thought this was wonderful. If the bank will lend our students more, we’ll make more and more money. And so the schools turned into profit centers. New York University is a profit center, Columbia University, a profit center here in New York. And you can just look at the huge rise of endowments at Harvard, Yale, all over the country. Now schools are run as if they’re for profit. Quite apart from the actual for profit colleges, which don’t really provide education. They are only markets for banks to make debt or for the government to make loans to students that go directly to the universities regardless of what they do.

So it’s the privatization of education. In America, we do not believe that education is a human right or a social right. Everybody is free to get whatever education they can pay for. They’re free to get whatever medical care they can pay for. Other countries say, wait a minute, you don’t have to pay for human rights. But America has turned everything into a commodity. Education is a commodity to be bought and sold. Health care is a commodity sold and not only privatized, but it’s been financialized. And this is presented as capitalism, but it’s finance capitalism. It’s not industrial capitalism, which is why Norway and England and Germany are capitalist countries, but they haven’t financialized human needs and basic rights to the extent that the United States has.

Paul Jay

Well, I think that’s the key word, to the extent, because they’re certainly on the way there.

Michael Hudson

Yes, that’s the trend in the West and it’s pulling the whole western world into a full debt pyramid.

Paul Jay

So can you have the kind of debt relief you’re talking about wipe out student debt to start with? That seems to have more support than other kinds of debt. But can you have this kind of modern capitalism without this kind of debt? Isn’t it kind of inherent in financialization that they actually need large sections of the population in debt? And not only in the US, I mean, household debt is pretty high in most most industrialized countries.

Michael Hudson

Well, it’s inherent in financialization, but not in capitalism. The German economic miracle of 1947 might well be based on a debt cancelation. All domestic debts were canceled except for the debts that employers owed their employees for the monthly payment. And except for a minimum of bank accounts. And in Germany they wrote down the debts and the result is this made Germany a debt free economy and was able to take off and become Europe’s dominant industrial powers as it is today.

So, of course, you could have under capitalism a debt write down just as you had in ancient Babylonia, a debt write down and you had a thriving economy. And if you don’t write down the debts, you’re not going to have an economy of any form. You’re going to have austerity. And you’re going to have, in Rome’s case, a dark age.

Paul Jay

You had a lot of financialization in the 1920s. You had the big crash in the 30s, depression. But right after World War Two, financialization takes place throughout the capitalist world and it takes off like a rocket in the 1980s. But that horse has left the barn, hasn’t it? I don’t think you go back to capitalism that’s not financialized. In a sense I think it’s inevitable with modern capitalism.

Michael Hudson

That certainly is the trend now. But if you do not de-financialize the economy, then you’re going to have economic growth concentrated in countries that are not financialized, such as China, where finance is a public utility. The real key to make capitalism effective would be to keep money and bank and the credit and debt system as a public utility. China can afford to write down the debts and it doesn’t have a constituency to lose because the debts ultimately are owed to the People’s Bank of China, the central bank or the Bank of China. Capitalism can only succeed, certainly industrial capitalism, can only succeed if you don’t have finance crowding out industries. If you don’t have finance just absorbing the whole economy and making it really into an economy like ancient Rome.

Paul Jay

And of course, the irony of banking as a public utility and the finance sector’s opposition to that is they can’t exist without government subsidy and bailouts and all the rest. And actually, it kind of is a public utility, except for the people that owe the banks.

Michael Hudson

It’s an unregulated public utility, because, again, as Bill Black has explained, there’s been regulatory capture. The problem in the United States is the creation of the Federal Reserve by banks. The Federal Reserve was created in 1913 to move to make banking a private enterprise, not a public utility. And very explicitly to shift the center of money creation and credit and credit rules away from Washington, towards Wall Street and Philadelphia and Boston, and to decentralize it, to get the government out of the credit and debt system and let the creditors run wild over the economy. That was what they said the result was. They even removed the secretary of the Treasury from membership on the Federal Reserve Board at that time. This was a new class war. And it wasn’t the kind of class war that Marx warned about. It was a class war of finance against the rest of the economy. It was a resurgence of the rentier economy, except the rentiers in the 20th century and the 21st century are the creditors and the bankers and the financial institutions, not the landlords.

Paul Jay

So we’ll have to see if there’s a people’s movement that can make this demand of banking as a public utility because it seems to me, among other things, it’s hard to imagine a climate change policy that’s going to actually be effective without weakening the power of the finance sector.

Michael Hudson

Well, right now, I don’t see how you can have a meaningful climate change policy if the largest market for banks are the oil industry and the mining industry. And they intend to keep it that way. You have the interest of the banks and the financial sector diametrically opposed to doing anything about global warming or about any kind of social or environmental reform. That’s why when President Obama was pushing for the TPP, the Trans-Pacific Partnership, and the TTIP with Europe, an element of that was the private ports. The government lost any authority to enforce environmental rules against any foreign investor. And so the whole world would have turned out to be Chevron versus Ecuador. Any government that would impose an environmental rule about pollution or global warming could be sued for damages so that the company would have made as much money as it would have made if it would have continued to pollute and destroy the environment. That was Obama’s great thrust, hoping to finally drive a nail into American democracy. And that was largely why he was voted out, because people were so appalled at the hypocrisy and the support of corporations against government, against civilization. That was what the TPP and the TTIP were.

Paul Jay

All right, well, this is just the beginning of the conversation, Michael. Thank you. And also for people that want to see more of Bill Black, Michael’s mentioned him a couple of times, I’ve just started publishing a series of interviews with Bill on the history of American financial fraud, starting with the S&L crisis in the 80s and we’re taking it up to today.

Michael Hudson

I was hosting, when Ralph Nader wrote a study of Citibank, the group all met at my backyard in New York, and the lawyers working on fraud got very disappointed in what Nader was doing at that time with Citibank because they all realized the problem wasn’t at that time fraud. It was that it was all legal. So the worst thing about the financial system is it’s legal. It’s not fraud. In other words, when the banks do it, it’s not fraud, to paraphrase Richard Nixon. Now, obviously, Ralph Nader subsequently has moved toward more reform and meanwhile, real fraud has taken place because of the regulatory capture. But the real problem is the structuring of the financial system itself. Even without fraud, the system is headed towards economic polarization, austerity and disaster.

Paul Jay

Thanks very much, Michael. And thank you for joining us on theAnalysis.news. Please don’t forget the donate button and all of that. And we’ll see you again soon.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

donate buton

Also, I’m thinking., as young man, I should have matriculated at UMKC, with Professors Hudson and Black rather than harvard with mr. supply-side.

So where did Mr. Biden make his political career and millions? In a Tax Haven named Delaware where huge banks incorporate and charge usurious interest (not Nebraska)…not to mention every other corporation and intergenerational trust. South Dakota not far behind. Should one think he gave a darn about the people of Delaware: the migrant labor on the chicken farms and processing plants?