By Paul Jay

theAnalysis.news

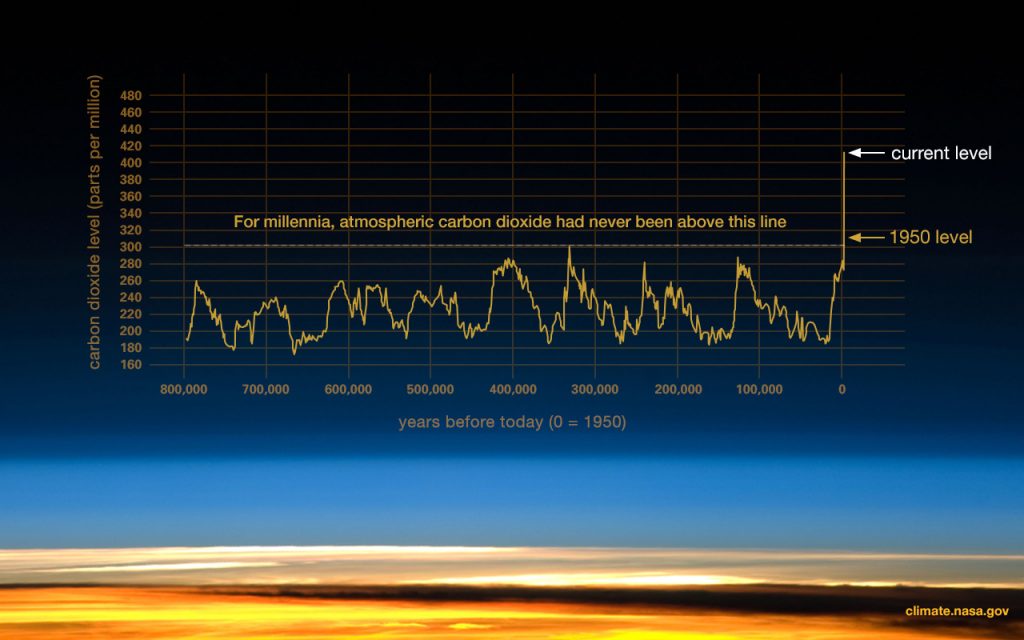

The Doomsday Clock has been set to 100 seconds to midnight; the closest it has ever been.((https://thebulletin.org/doomsday-clock/))

Climate change, nuclear weapons, Big Brother surveillance states, and artificial intelligence; we are at an existential crossroads.

Either we counter Big Finance’s control of politics and the economy . . . or not many of us humans will be around to see the end of this century.

Our fate is in the hands of a class that considers risking Armageddon an acceptable part of their business model. Big oil companies ignore the dire consequences of climate change to maximize return on their investment in fossil fuels. Seeking profit, the military-industrial-congressional complex risks nuclear annihilation.(( https://peacesciencedigest.org/effects-military-spending-economic-growth))

Climate crisis and nuclear weapons threaten life on earth, yet a climate denier is President and the bloated military budget includes a trillion-dollar investment in a new generation of nuclear weapons.

The Trump administration is a dangerous cabal of conmen, criminals, extremist billionaires, and far-right ideologues – but it’s not an aberration.

It’s the inevitable product of extreme parasitical capitalism which has created activist billionaires who manipulate elections and concentrated ownership of most major corporations into massive investment firms.

Rana Foroohar of the Financial Times writes:

The immense amounts of capital needed for the industrial and digital revolutions created unparalleled power for the big banks and financial institutions. They now own dominant positions in the industrial-military complex, fossil fuels, the media, big tech and everything else that’s important.

Huge financial services institutions have emerged as the goliaths of the sector. Sometimes called asset managers or money managers, they invest money on behalf of institutional clients like governments, pension funds, sovereign wealth funds, endowments, and very wealthy individuals.

These giant asset managers, on behalf of their clients, mostly invest in index funds that are a type of mutual fund with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500).

The money managers have enormous power as they invest trillions of dollars across a spectrum of companies and vote those shares on behalf of their clients. While they don’t get involved in day to day oversight, these giant asset managers do vote on management changes, board elections, mergers and acquisitions, special shareholder proposals and thus wield great influence on the CEOs of these companies. The big funds often vote together further strengthening their power.

Financialization of the economy produced two shadow banks(( http://blackrocktransparencyproject.org/2019/09/05/new-report-details-how-blackrock-fought-off-government-regulation-by-spending-big-in-washington ))that tower over the rest of the corporate world. Blackrock and Vanguard with other smaller money management firms, control 90% of the S&P 500 public companies,(( https://theconversation.com/these-three-firms-own-corporate-america-77072 )) including fossil fuel companies, arms manufacturers and major U.S. media outlets that own ‘mainstream’ news.

The top three financial services firms manage 15 trillion dollars of assets. That’s more than China’s 2019 GDP. Blackrock is the largest with 7.4 trillion, followed by Vanguard at 5.3 trillion and State Street Global Advisors at 2.5 trillion.

Trump was elected with the decisive support of two smaller parasites, the casino billionaire and drug money launderer Sheldon Adelson,(( https://therealnews.com/stories/the-bizarre-billionaire-that-backed-bannon-and-made-trump-president )) and high-speed trader, far-right billionaire Robert Mercer (who funded Steve Bannon, Breitbart News, Cambridge Analytica, and John Bolton’s SuperPAC).((https://therealnews.com/stories/the-bizarre-billionaire-that-backed-bannon-and-made-trump-president)) But Adelson and Mercer pale in significance to the real powerhouses of the financial sector who support and enable Trump.

Bloomberg News writes:

“Imagine a world in which two asset managers call the shots, in which their wealth exceeds current U.S. GDP and where almost every hedge fund, government, and retiree is a customer. It’s closer than you think. BlackRock Inc. and Vanguard Group — already the world’s largest money managers — are less than a decade from managing a total of $20 trillion, according to Bloomberg News calculations.”(( https://www.bloomberg.com/news/features/2017-12-04/blackrock-and-vanguard-s-20-trillion-future-is-closer-than-you-think ))

Financialization drew millions of people into the stock markets, relying on money managers.

NYU economist Edward N. Wolff writes:

That’s half the U.S. population whose fate is tied to the Blackrocks of this world. But there is a big discrepancy as to who really benefits from the markets. Wolff writes:

“The richest 10% of households controlled 84% of the total value of these stocks in 2016.”

Blackrock and Vanguard are among the top ten shareholders in all four major US banks. Institutional investors own 68% of Goldman Sachs. The ten largest stockholders of Exxon Mobile((https://money.cnn.com/quote/shareholders/shareholders.html))are also financial services firms. The same goes for Amazon, Facebook and Alphabet (Google) and so on.

This gives finance enormous political power and control over the economic policies of the federal government. When needed, the U.S. government is the “firefighter in chief”((https://www.versobooks.com/books/1527-the-making-of-global-capitalism (Leo Panitch and Sam Gindin) )) rescuing the finance sector and the stock markets when periodic crises or financial speculation and shenanigans cause a meltdown. The Federal Reserve and the U.S. Department of the Treasury manage global capitalism primarily on behalf of the finance sector. The leaders of finance go back and forth between the private sector and senior roles in The U.S. Department of the Treasury – no matter which party is in power.

The lords of finance own the corporate news media.

The financial services sector owns the controlling interest in all the media companies that own major news networks (except Bloomberg and the Washington Post which are privately owned).

The ten largest stockholders of Disney Corporation are financial services institutions. Disney owns ABC including its news division, and much, much more. The ownership structure of the other media monopolies is similarly heavily owned by the financial sector. ViacomCBS is 85% owned by financial institutions as is Comcast which owns NBC. AT&T, which owns Time Warner and thus CNN, is 56% owned by institutional investors. The New York Times is 93% owned by institutional investors.

Blackrock and Vanguard are in the top three investors in every one of the media companies listed above, except for Newscorp (Foxnews), where Vanguard is 2nd and Blackrock is 9th.

Trump turned out to be great for finance

In 2017 Larry Fink, CEO of Blackrock, said Trump’s economic policies represented a “bucket list of things we’d like to see done.”

Reuters reported in 2017 that Trump’s tax cut:

“Sliced corporate and individual income rates, also helped the company’s results in the fourth quarter ended Dec. 31. BlackRock said on Friday it saw a $1.2 billion tax benefit related to the law and raised its quarterly cash dividend by 15 percent . . . The New York-based company’s shares were up 2.8 percent at midday. Its shares have gained 47 percent over the last year, including dividends.”((https://www.marketwatch.com/story/blackrock-ceo-fink-likes-trump-policies-is-skeptical-on-trump-himself-2017-04-28))

Although Fink was apparently poised to be Hillary Clinton’s Secretary of the Treasury, when that didn’t quite work out,(( https://theintercept.com/2016/03/02/larry-fink-and-his-blackrock-team-poised-to-take-over-hillary-clintons-treasury-department )) he joined Trump’s business advisory group (later disbanded after the Charlottesville events). Trump was a client of Fink’s company before he was president.

Trump’s “Make America Great Again” echoes Mussolini’s “Revolutionary Nationalism”

In spite of Trump’s obvious corruption and megalomania, much of the financial elite now embrace Trump as their standard-bearer (with noted exceptions like Soros and Bloomberg). Trump has weakened regulations, given large tax breaks to the rich, and shown the ability to win over sections of the working class with a Mussolini-like flair.

They may be playing with fire. It took Mussolini only five years to pass various laws that led to a one-party dictatorship. Even for the finance sector, this wouldn’t be the first choice. That said, they may prefer it to a real democratization of the economy and politics.

In an interview I conducted with Col. Lawrence Wilkerson, Colin Powell’s former Chief-of-Staff, Wilkerson told me, “imagine what would happen if there was a major terrorist attack against a big U.S. city. It would be the end of constitutional rights”. He did not rule out such an attack could be staged.

The assassination of an Iranian General was a dangerous provocation

Trump’s assassination of Iran’s Major General Qassem Soleimani is the kind of provocation that could create the conditions for such an event, staged or real. Perhaps it was Iran’s, so far, restrained reprisal that prevented the worst from happening.

From the very start, regime change in Iran has been foreign policy objective number one of the Trump administration. Trump has waged an economic war against the country, and this assassination was an outright act of war.

Regime change in Iran is a long-held U.S. foreign policy objective; the empire can’t tolerate “a regional power with ballistic missiles that can deter U.S. intervention.”((https://archive.org/stream/RebuildingAmericasDefenses/RebuildingAmericasDefenses_djvu.txt)) The foreign policy hawks in both parties never accepted Obama’s willingness to accept Iran as a regional power.

In President Trump’s 2017 inaugural address he promised to:

“unite the civilized world against Radical Islamic Terrorism, which we will eradicate completely from the face of the Earth.”((https://www.whitehouse.gov/briefings-statements/the-inaugural-address))

What he meant was to “eradicate” the leadership of Iran and bring the country and its resources under the U.S. umbrella.

Trump didn’t actually mean “Radical Islamic Terrorism”, as he remains devoted to Saudi monarcho-fascism, the authentic source of “Radical Islamic Terrorism”.

Regime change in Iran is the primary foreign policy objective of the Saudi monarchy that seeks to dominate the region within the U.S. security alliance.

Blackrock has an office in Riyadh and in 2019 made “a substantial investment” in Saudi Aramco’s inaugural dollar bond. Larry Fink said “The region is not perfect. No region in the world is perfect . . . The fact that there are issues in the press doesn’t tell me I should run from a place; it tells me we should run to a place.”(( https://www.internationalinvestment.net/news/4004629/blackrock-office-saudi-arabia ))

Regime change in Iran is also a high priority for the Israeli state. Blackrock has major investments in Israel including listing its funds on the Tel Aviv Stock Exchange that can now be purchased in shekels.(( https://www.haaretz.com/israel-news/business/.premium-blackrock-funds-raise-israeli-ire-1.7603527 ))

The illegal assassination of Soleimani was meant to show the region that Trump is willing to fight without “restraint”, something he promised CIA officials in 2017.(( (Post removed by Whitehouse click to see the archived version on the Wayback Machine))) That means without the restraint of international or U.S. law. He also said the CIA would have a second chance to grab Iraq’s oil.

The Intercept analyzed television coverage of Trump’s assassination of Soleimani and found:

“Many of the pundits who appeared on national television or were quoted in major publications to praise the president’s actions have undisclosed ties to the defense industry”.((https://theintercept.com/2020/01/06/iran-suleimani-tv-pundits-weapons-industry))

The pundits appeared on media effectively controlled by Blackrock and Vanguard.

The ten largest shareholders of the major arms manufacturers are also these same financial institutions. They own more than 75% of Lockheed Martin, Boeing, and Raytheon. Again, Vanguard and Blackrock are in the top tier of shareholders in all of them.

War and almost war are good for the arms business.

The corporate leadership of both major American political parties willingly collaborates with the financial-military-industrial complex, pursuing policies that strengthen the empire. Both parties have waged regime change wars that destroyed whole societies.

Big power rivalry is necessary to justify big-dollar military budgets. Ford Class Aircraft carriers can’t be justified by the ‘war on terror’. This helps explain the Russo-phobia in Washington. Acting Defense Secretary Shanahan justified Trump’s proposal for a Pentagon budget that was higher than they asked for, with three words: China, China, China. Russia and China have their own weapons manufacturers that also benefit from the arms race. Six of the top fifteen largest arms manufacturers in the world are now Chinese companies.(( https://people.defensenews.com/top-100))

Blackrock and other Western investment funds are developing their presence in China, including developing index funds. This could mean Blackrock winds up owning shares of Chinese arms manufactures, while it also owns American weapons producers. Truly, they are merchants of death.

Both parties are dedicated to a nuclear war strategy that is primarily driven by commercial interest.

It was the Obama administration that committed to spending about a trillion dollars for nuclear arms modernization over the next few decades. Trump built on that legacy.

Daniel Ellsberg, who was a nuclear war strategist for Rand Corporation working with senior levels of the U.S. military in the late 1950s and early 60s, told theAnalysis.news that “there would be no ICBM’s if it wasn’t for the profit motive” and that there is no national security rationale for not reducing the nuclear arsenal to a handful of weapons. Ellsberg says the current strategy is driven by the interests of weapons manufacturers.

Russia and the United States remain on a ten-second hair-trigger, where a mistaken blip on a screen could trigger war and nuclear winter. Ellsberg calls it “institutional madness”.

Not a single nuclear war planner could honestly estimate a zero chance of either accidental or deliberate nuclear war. Why are political and military leaders willing to take any risk of ending life on earth?

Shouldn’t it be Mr. Fink’s fiduciary responsibility to speak against a policy that could wipe out all of his investors’ assets (including the investors themselves)? Instead, the leading shareholders in the top 18 companies that produce nuclear weapons are led by, you guessed it, BlackRock and Vanguard.((https://www.dontbankonthebomb.com/2019-hos))

The corporate leadership of both parties won’t break the grip of the financial-fossil fuel complex over energy policy.

As geopolitical tensions rise and the D.C. political circus continues, focus on the climate crisis recedes even further into the background.

In broad strokes what needs to be done about climate is clear. The world must urgently bring carbon emissions down to zero as soon as possible, but at latest by 2050. This is the issue that should preoccupy politics and the media. But it’s far from the case.

For example, economist Robert Pollin estimates that it would cost around 18 trillion dollars over thirty years to transform the energy system to achieve a reduction of 50% carbon emissions by 2030 and 0% emissions by 2050. This would hit the IPCC targets for the United States.

This cost is approximately half the Pentagon budget over the same time frame.

Pollin says that while reducing military spending is of critical importance, the economy is big enough to pay for the transition to a green sustainable energy system without winning that battle over the military budget. Pollin says:

He estimates a global program to hit IPCC targets would require an investment of 120 trillion dollars or 2.5% of global GDP.

While Pollin’s numbers can be debated, why isn’t this conversation dominating the media? Why isn’t settling on an effective plan for solving the climate crisis and simultaneously reducing the threat of destroying human civilization, a central theme of the news media?

The answer is, it wouldn’t play well on the quarterly earnings call where corporate media CEOs report to Blackrock and Vanguard. You must have heard, “people aren’t interested in climate change.”

Blackrock’s assets under management are more than Japan’s GDP. Along with its media holdings, the Guardian reports that it’s in the top three shareholders of every oil “supermajor” in the world (except for French Total). It’s among the top 10 shareholders in seven of the 10 biggest coal producers, according to Guardian analysis of data from financial information firm S&P. BlackRock effectively owns 2.1bn tons of thermal coal reserves, based on the size of its stakes in major mining companies.((https://www.theguardian.com/business/2019/may/21/blackrock-investor-climate-crisis-blackrock-assets))

In 2018 Blackrock and Vanguard voted against 80% shareholder initiatives to make industries more accountable for their effect on the environment and climate change.(( https://www.cnbc.com/2019/10/13/blackrock-vanguard-found-religion-on-climate-doubts-are-growing.html ))

The finance sector is laser-focused on a maximum return on investment. This means they are far more concerned with lower taxes and deregulation than transforming the economy away from fossil fuels towards green sustainability. Any media executive that thinks otherwise will not hit profit targets established by powerful institutional shareholders and would quickly be out the door.

Larry Fink, CEO of Blackrock said it best in his 2018 annual report: “The money that BlackRock manages is not BlackRock’s money. Our firm is built to protect and grow the value of our clients’ assets. We often get approached by special interest groups who advocate for BlackRock to vote with them on a cause. In many cases, I or other senior managers might agree with that same cause – or we might strongly disagree – but our personal views on environmental or social issues don’t matter here. Our decisions are driven solely by our fiduciary duty to our clients.”((https://www.blackrock.com/corporate/investor-relations/larry-fink-chairmans-letter))

After receiving criticism for the statement, Fink in 2019 began to talk about social responsibility. Blackrock joined Climate Action 100+, an investor initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change”.(( https://www.ceres.org/news-center/press-releases/blackrock-joins-climate-action-100-ensure-largest-corporate-emitters-act ))

It sounded good, but in 2019 BlackRock and Vanguard voted against all of the U.S. shareholder proposals backed by Climate Action 100+.((https://www.cnbc.com/2019/10/13/blackrock-vanguard-found-religion-on-climate-doubts-are-growing.html))

In 2020 Blackrock went further with their “long term” strategy in a declaration addressed to shareholders:

“We believe that sustainability should be our new standard for investing.” And addressing sustainability factors that could affect portfolios, “The most significant of these factors today relates to climate change, not only in terms of the physical risk associated with rising global temperatures, but also transition risk – namely, how the global transition to a low-carbon economy could affect a company’s long-term profitability. As Larry Fink writes in his 2020 letter to CEOs, the investment risks presented by climate change are set to accelerate a significant reallocation of capital, which will in turn have a profound impact on the pricing of risk and assets around the world”.((https://www.blackrock.com/corporate/investor-relations/blackrock-client-letter))

With a climate denier president, I guess it’s something that Blackrock’s CEO says he accepts climate science. Blackrock says it will demand climate policy transparency and accountability from its companies and:

“This should include the company’s plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized.”

The problem is, there is nothing in Blackrock’s promises that will achieve the objectives of the Paris agreement.

Take the much-ballyhooed pledge that Blackrock will no longer invest in thermal coal. A headline in the Guardian reads:

“World’s Biggest Fund Manager Vows to Divest from Thermal Coal.”

In fact, in the letter to shareholders, the pledge isn’t to divest from coal (or other fossil fuels by the way), it says

“We are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production, which we aim to accomplish by the middle of 2020.”

Here’s the rub. Take the second-largest coal producer in the U.S., Arch Coal Inc. As of January 2020, Blackrock owns 7.41% of the shares. If Blackrock sells those shares, it will be rather easy for other institutional investors to pick up the slack. Thus, the move will be carbon neutral.

Furthermore, the largest investor in Arch is Investco Advisors Inc., which owns 21.79% of the shares. Blackrock is the second-largest investor in Investco (after Vanguard) with 6.03% ownership. Coal does not represent more than 25% of Investco’s revenues so no need for Blackrock to divest from that.

So, it gets the world no closer to the Paris objectives, even if it appeases some of the pressure on Blackrock.

The problem is deeper and more alarming. The 2019 UN annual emissions gap report states that if all the countries that made commitments to the Paris Agreement fulfilled those promises completely, we are still headed for 2 degrees warming by 2050 and 3 degrees by the end of the century.((https://news.un.org/en/story/2019/11/1052171 ))Say it again. If the Paris objectives are fully met, we hit almost unlivable conditions in 30 years and a catastrophic tipping point in 80. Within the lifetime of our kids.

A similar estimate has been public since at least 2016. Why is Mr. Fink still talking about living up to the Paris Agreement?

These assessments were based on all countries meeting their Paris commitments. That’s not happening. President Trump pulled the U.S. out of Paris and is undoing the modest regulations the Obama administration enacted. What happens if the Paris targets are not hit, if we continue business as usual? The IPCC says by the end of the century warming hits 4.8 degrees. The Independent reported in 2016 that the IPCC estimate may be low:

Shouldn’t it be Mr. Fink’s fiduciary responsibility to speak out against Trump’s climate denial? Perhaps Blackrock’s investments in the arms industry and windfall from Trump’s tax cuts make it prudent to remain silent.

Referring to holding Blackrock’s companies accountable, Mr. Fink’s writes:

“This should include the company’s plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized.”

The IPCC says the world must avoid hitting 1.5 degrees warming because once 1.5 degrees is hit, it might be impossible to prevent further warming, and even at that level, the consequences of extreme weather will cause terrible damage. So why is Mr. Fink still talking about 2 degrees? He’s just not serious about climate change.

The Shareholder letter’s commitment to divest from coal refers to Blackrock’s active investment funds, where they pick and choose stocks. Their bigger fund is what’s called an index fund, investing in the entire S&P 500 for example. Here Blackrock says it’s can’t do anything because it’s a passive investment and the index includes coal.

But in an interview with CNBC, host Andrew Ross Sorkin asks Larry Fink an interesting question:

“What do you tell the public, so many of whom are going to look at your ownership of companies over the next several years and see fossil fuels and fossil fuel oriented companies in your portfolio, given that so much of it’s passive to begin with and say, ah, they’re hypocrites. They’re not doing more; they’re not pushing on the indexes themselves to eliminate these things.”

Good question, why doesn’t Blackrock, the biggest investor in the indexes, use its clout to throw coal off the index? Fink’s uncomfortable answer is:

“Well, the index is . . . an indexing company we’re going to be pushing to create more sustainable funds. So, our job is to create choice.”

Larry Fink says he believes in the science of climate change. If so, how can there be a choice between investing in climate catastrophe or actual sustainability?

Here’s the clip.

Mr. Fink’s letter states that many of his investors are concerned about how climate change will affect their portfolios. He also sees “opportunity” in green infrastructure and sustainable energy. And his “fiduciary duty” is to maximize return for his investors.

He talks about using a sustainability lens to look at investments, but the truth is, Mr. Fink uses an investment lens to look at sustainability.

He says as much in the CNBC interview. Sorkin asks if Mr. Fink believes in the science. Fink answers:

It’s the nature of the beast; it’s the business model; it’s systemic. These financial institutions have to put maximum return on investment first or perish. In fact, when it comes to pension fund money, it’s illegal for them to do otherwise.(( https://illinoislawreview.org/print/vol-2018-no-3/public-wealth-maximization)) Their clients, be it a sovereign wealth fund or a billionaire, are in the same paradigm. If a financial institution chooses a more socially responsible but less profitable strategy, most clients will likely move their money somewhere else. They think dealing with climate is government’s job, except they fight against public policy that sets out to do it.

This is why government must legislate and regulate effective solutions to reach the carbon emission targets set by IPCC (which many scientists consider too conservative). The market can’t do it. The problem is, the finance sector hates the idea of serious government regulation that interferes with their business.

The closest Mr. Fink gets to a role for government is:

“A successful low-carbon transition will require a coordinated, international response from governments aligned with the goals of the Paris Agreement including the adoption of carbon pricing globally, which we continue to endorse.”

Here we go with the Paris Agreement again. Of course, Blackrock endorses carbon pricing, anything but serious government regulation that phases out fossil fuels and enforces a whatever-it-takes policy of preventing 1.5 degrees of warming. That means a 50% reduction by 2030 and zero by 2050.

Carbon pricing is not enough to reach the necessary emission reduction.

One reason for Blackrock’s climate declarations is to create the impression that the private sector and finance can solve the climate crisis, thus forestalling more active government regulation.

But change will have to be imposed on these institutions by governments; it cannot come from within the financial sector or the market. The question is, can a mass movement develop that can elect such a government and then make sure, that instead of serving finance, it counters its power?

The financialization of the economy and the political power of Wall St. has created the greatest inequality in history.

This massive accumulation of wealth at the top makes it very difficult for the very rich to want serious change. Day to day life for them has never been better. In spite of the scientific evidence of climate change, they continue to vote for the politics of the status quo, perhaps with some lip service to address the problem.

And life gets tougher for workers around the world.

The digital revolution expanded globalization to a scale that unremittingly weakened workers’ ability to bargain. Cheap labor was now available to produce at a high quality in a superbly well-coordinated global supply chain. There’s no Amazon or Walmart without computers.

Capital roams the globe with ease, extracting concessions from workers everywhere. The gains in productivity and wealth creation pour into the coffers of the richest stratum of society. Corporations, largely owned by these financial behemoths, pressure governments and workers across the globe, making sure labor stays cheap and environmental regulations weak.

Even in Canada, a country with universal health care, poverty is systemic. In Toronto, one in four children and one of five adults live in poverty. The cost of basic needs such as housing, food, utilities and transportation have increased substantially and are some of the highest in the country. Between 2009 and 2015, the cost of childcare rose by 30 percent, and public transit by 36 percent. Between 2010 and 2017, average market rents in Toronto increased 30 percent. Greater Toronto Area food banks have consistently had over one million visits per year, with an increase of nearly 40 percent in Toronto’s inner suburbs since 2008.(( https://www.toronto.ca/city-government/council/2018-council-issue-notes/torontos-equity/poverty-reduction))

The conditions are as bad or worse in major U.S cities, and without a universal health care system.

The richest 5% of Americans own two-thirds of the country’s wealth; at the top of the American economic summit, the richest of the rich now hold as large a wealth share as they did in the 1920s.((inequality.org))

Sixty percent of the .01 percent’s wealth, according to Forbes, is inherited. Col. Lawrence Wilkerson, says “we are building an aristocracy of wealth as surely as any despotic regime in history.”

The Trump impeachment and the growing split in the political and billionaire class is driven by many factors, but it is primarily a fight over how to respond to rising anger over this vast economic inequality. People’s disillusionment is upsetting the status quo of both major political parties. This resentment is expressed as a demand for democracy and equality, but it is also taking the form of rising fascism.

The Republican Party, representing much of the financial and arms manufacturing elite, is all in with Trump’s unrestrained gangster capitalism and his undermining of even a pretense of constitutional government. They want to double down on more tax cuts, more military spending, deregulation, and militarization of the police to deal with the consequences of poverty. In a word, returning to pre-New Deal America.

The leadership of the corporate Democrats clings to the residual shell and rhetoric of Roosevelt’s New Deal, but since WWII, one Democratic administration after another has played their role in unraveling it. As globalization made finance even more dominant, corporate Democrats live in fear of Wall St. and believe no election is winnable without its support.

Corporate Democrats talk about restraining the excesses of capitalism and see the danger to the system in unmitigated levels of exploitation, but they are too invested in accumulating personal wealth and power and wind up cynically serving corporate interests.

Inequality grew at unprecedented rates under Obama with 95% of income gain after the 2008 recession going to less than 1% of the population. While Corporate Democrats may genuinely fear and oppose Trumpism and rising fascism, the Democratic Party’s policies while in power set the table for it.

The movement inspired by the candidacy of Bernie Sanders advocates a Green New Deal and reforms that if passed into legislation, would challenge the power and wealth of the billionaires. Medicare For All could put 20% of the GDP into the sphere of the public sector. Public banking could be a real threat to private finance. Serious taxes on assets and not only income could weaken this “aristocracy of wealth”.

If Sanders wins the nomination it will further spark a movement for a Green New Deal including economic and political democracy. But Wall St. will not easily give up their control of the Democratic Party, and as Sanders gains strength in the primaries, opposition to him will become more furious.

Witness the New York Times editorial board calls him over-promising and divisive (let’s remember who owns the Times, 93% by Blackrock and other institutional investors). Hillary Clinton launches ad hominin attacks (remember, Larry Fink was going to be her Secretary of the Treasury).

But millions of people, particularly youth, are in motion in a progressive direction and the conflict within the party is bound to intensify.

The 2020 U.S. elections are a pivotal moment in human history. Four more years of climate denial or halfhearted policy that won’t confront the fossil fuel companies and the financial giants that own them will undoubtedly mean we will cross the critical 2-degree threshold by 2050.

I’ve been told by those who know members of the billionaire class, that many believe they can escape the ravages of climate crisis. Some even think they can escape nuclear war, running to New Zealand or in some kind of protected bubble.

It’s a horrifying state of denial, but they are in such an unprecedented orgy of profit-making, they choose to believe fairy tales rather than accept a profound restructuring of society.

If Blackrock and Vanguard control AI, get ready for robot dystopia

The digital revolution gave us Big Tech, whose largest shareholders are again Blackrock, Vanguard and other asset managers.

With facial recognition technology and massive data collection, Facebook and Google are helping create repressive surveillance states around the world.((Rana Foroohar, “Don’t’ Be Evil”)) Artificial intelligence, the greatest achievement of Silicon Valley, could lead to smarter robots and mass unemployment. There is little serious planning or even discussion about the economic dislocation that’s coming for millions of people.

If the Blackrocks of this world are allowed to impose a maximum profit imperative, we can look forward to a dystopian future predicted in science fiction. Stephen Hawking has warned, a world where “Humans, who are limited by slow biological evolution, couldn’t compete, and would be superseded . . . The development of full artificial intelligence could spell the end of the human race”.(( https://www.telegraph.co.uk/technology/news/11342200/Top-scientists-call-for-caution-over-artificial-intelligence.html ))

It’s not that executives who run these financial institutions don’t see what’s coming; they have more access to information than we do. They just can’t defy the logic of the market. For example, by 1961 it was clear that smoking was linked to cancer, yet the executives of tobacco companies smoked and marketed cigarettes to children.(( https://tobaccocontrol.bmj.com/content/11/suppl_1/i110 )) Denial for the sake of short-term self-interest is a powerful force.

Instead of this nightmarish scenario, AI could be a great liberator, freeing people from the drudgery of mindless work. AI could play a critical role guiding a transformation to a sustainable green economy. In an open 2014 letter, leading AI scientists including Physicist Stephen Hawking wrote:

“We cannot predict what we might achieve when this (human) intelligence is magnified by the tools AI may provide, but the eradication of disease and poverty are not unfathomable”. [36]

This only comes about if AI is socially owned and democratically controlled.

Climate change, nuclear war, Big Brother surveillance states, and artificial intelligence; we humans are at an existential crossroads.

Either we radically transform ownership so the commanding heights of the economy are socially owned and democratize how government power is wielded . . . or not many of us will be around to see the end of this century.

Alarmist? No doubt, but it’s way past time for being alarmed. Feel overwhelming? Yes, how can it not be? I look at my seven-year-old twins and wonder if we should be calling them ‘generation last’. When they are in their eighties, what will be left of human civilization? We have no choice but to act now.

Is a mass mobilization to save the planet and against war, on a scale not seen before, possible? Given what’s at stake, what’s holding it back?

Can this global concentration of ownership and political power be countered with diversified social ownership and democratization?

Could large scale publicly-owned banking weaken the hold of finance on the politics of the country?

Can a demilitarized green new deal at a global scale bring all the threads of the solution together? What are the realistic steps that must be taken and what can be accomplished given the existing political conditions?

Daniel Ellsberg says we need a new political economy; we must convert military to green production or perish. Are we humans up to the challenge?

On theAnalysis.news, these are questions we will examine with some of the best minds on the planet. We hope you will join us when we start regular weekly programming early in 2020.

Please watch my interview with Daniel Ellsberg. According to Henry Kissinger, Ellsberg was the “most dangerous man in America” after releasing the Pentagon Papers and because of his insider knowledge of the American nuclear war strategy. Ellsberg’s most recent book is “Doomsday Machine, Confessions of a Nuclear War Planner”.

Join our mailing list, donate and spread the word to others. We want to hear from you about what you’d like to see on theAnalysis.news. You can email me at paul@theanalysis.news

I’m in a completely different world with what I have seen. What an article, & what a disappointment that no one really knows what they have done. Does anyone care how this group of cold hearted people took over everything?? Well I do but they are from my home town & they are ruthless!!! I’m surprised that no one has figured out who they are, but then snakes crawl on their bellies and deceive like no other. This group of pathetic excuses of human beings are none other than the EASTERN 8, & they are the housing market and they have done housing market manipulation, hmmmm. That’s right I’ve seen them work, hide their identity, committed bankruptcy frauds with every company that they touch!!! How do they get away with it??? Is government perhaps in with them?? They started this 60 years ago, buy stocks in companies, buying real estate & putting in deceased names, then they started taking over everything piece by piece. I had no clue that people would do such underhanded dealings, & I’m stupid to believe that everyone has a heart that follows God, because my attorney, Judge, realtors and several other’s has done the unthinkable, & took over the U S. How sad that I was married to one of them and had no clue, my son’s Dad was the horrible landlords people talk about. I’ve been in shock & I will be until I die. They have stopped me, they have been in my phone & took my files, I didn’t know how, then I found a company under my husband’s name and I understood. Dun and Bradstreet, they control credit reports, & they furnished phone numbers. Broadband internet, media, every type of business sector they could take they have, & I’m just a stupid country girl that don’t know how to use a computer, but by God I know how to push buttons on a phone. All started by accident when I started seeing properties under my husband’s name and they were all section 8 properties and all over the U S. Piece by piece I have put together a EVIL manipulating horrible world that they have took like a theif in the night. I lived in a house with holes in the floors and his mistress had 2 stories everywhere in Tipton County TN. Then I found pilot license and airplane’s and then companies, fidelity, insurance, bank’s, JP Morgan Wells Fargo, on & on & on. OMG I was in shock, & then came Black Rock and Vanguard I never heard of them, but seen things in my husband’s truck. Everything started coming together and for the past few years I’ve found unbelievable amounts of evidence that my husband was a lie and was living 2 lives. All you have to do is any company filing bankruptcy see who majority stockholders are, always same ones, and then all listed under bankruptcy majority dead. My ex husband committed bigamy thousands of time’s and I have the license to prove it, just to hide properties in tenancy by entirety. His mistress was obsessed with him and that’s how I caught him, she splashed his name all over, GREGORY HARRIS ROSE TN. He & my divorce attorney was in business together along with the judge and that’s why I lost my rights to everything, they set me up. I make nothing 11,000.00 a year and I didn’t get any of his 2 retirements, pension, savings, TSP, because my attorney Elizabeth Ziarko lied & said I couldn’t get alimony, adultery carried no weight, & I have suffered horribly because of their greed. That’s what greed does to people, they take away from the little guy to feed the rich guys. I’m still in shock everyday & now I found my son has been brought into their EVIL world. I will do whatever I have to do to make them face the hell they put many people through, this I promise them. I know where they will end up & HELL IS HOT, but I won’t stop & the sad thing is I have to do it all by myself, because they have used so many attorneys that no one is willing to uphold the laws and I am not afraid to die for my rights and the people’s Rights, the mistreated tenant’s of the U S.

The division of the world into nation-states since the end of the Thirty Years War has been superseded by financial capitalism. The political institutions in which national sovereignty are vested, congresses, parliaments, no longer call the shots. They have been bought out by the corporate interests in the most important countries of western international commerce: the US, UK, and Germany and Japan (part of the west). The function of the nation states is to enable the imperialism of the west. It is coercive and requires military force. That is now the chief function of the military in the US and Germany. It provides the force needed for market privileges and resource acquisition by the major corporations. These corporate interests are multinational, and the corporations have no allegiance to the nations in which their executives reside or of which they are citizens. They have no identification with the well being of fellow citizens. National sovereignty as rooted in the nation-state has been displaced by corporate interest which is rooted in markets and the sources of natural resources. Its princes are the CEOs of the corporate world and especially the major banks.

Great piece of content.

Love the site and the news.

Would also like to subscribe to the newsletter but have given up searching your site to find it.

Could you please add me?

done. but there are two places on the site. One below the first story and at the very bottom of the page. Can you suggest another place you would be more likely to see?

This is incredibly instructive Paul. Thank you.

Thank you.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three e-mails with the same comment.

Is there any way you can remove people from that service?

Cheers!

I”ll ask our tech guy

I got this web site from my friend who told me about this site and at the moment this time I am browsing this web site and reading very informative content at

this place.

Giants: The Global Power Elite

By Peter Phillips

My new book, Giants: The Global Power Elite, follows in the tradition of C. Wright Mills’ work the Power Elite, which was published in 1956. Like Mills, I am seeking to bring a consciousness of power networks affecting our lives and the state of society to the broader public. Mills described how the power elite were those “who decide whatever is decided” of major consequence. Sixty-two years later, power elites have globalized and built institutions for preserving and protecting capital investments everywhere in the world.

Central to the idea of a globalized power elite is the concept of a transnational capitalist class theorized in academic literature for some 20 years. Giants reviews the transition from nation state power elites, as described by Mills, to a transnational power elite centralized on the control of global capital around the world. The global power elite function as a non-governmental network of similarly educated, wealthy people with common interests of managing, and protecting concentrated global wealth and insuring its continued growth. Global power elites influence and use international institutions controlled by governmental authorities like the World Bank, International Monetary Fund (IMF), North Atlantic Treaty Organization (NATO), World Trade Association (WTO), G-7, G-20, and others. These world governmental institutions receive instructions, and recommendations for policy actions from networks of non-governmental global power elite organizations and associations.

The global 1% comprise over 36 million millionaires, and 2,400 billionaires who employ their excess capital with investment management firms like BlackRock and J.P Morgan Chase. The top 17 of these trillion-dollar investment management firms—which I call the Giants— controlled $41.1 trillion dollars in 2017. These firms are all directly invested in each other and managed by only 199 people who are the decision makers on how and where global capital will be invested. Their biggest problem is they have more capital than there are safe investment opportunities, which leads to risky speculative investments, increased war spending, and the privatization of the public commons.

My research effort was to identify the most important networks of the global power elite and the individuals therein. I name and provide biographies for over 300 people, who are the core members of power networks that manage, facilitate, and protect global capital. The global power elites are the activist core of the transnational capitalist class—1% of the world’s wealthy people. They serve the uniting function of providing ideological justifications for their shared interests through the corporate media and they establish the parameters of needed actions for implementation by transnational governmental organizations and capitalist nation-states.

The global power elites, who direct the world’s corporate giants, overlap with the leadership of organizations such as the Council of Thirty, the Trilateral Commission, and the Atlantic Council. These privately-funded non-governmental organizations provide direct instruction and policy recommendation to governments, international institutions, the G-7 and their intelligence agencies, and other top capitalist countries. The US/NATO military empire operates in nearly every country of the world to protect global capital and the wealthy 1%.

The global power elite are self-aware of their existence as a numerical minority in the vast sea of impoverished humanity. Roughly 80% of the world’s population lives on less than ten dollars a day and half live on less than three dollars a day.

This concentration of protected wealth leads to a crisis of humanity, whereby poverty, war, starvation, mass alienation, media propaganda, and environmental devastation are reaching levels that threaten our species’ future. Organizing resistance and challenging the global power elite should be foremost on the agendas of democracy movements everywhere, now and in the near future. Addressing top-down economic controls, monopolistic power, and the specifics of the global power elites’ activities will require challenging mobilizations and social movements worldwide.

The act of identifying the global power elite by name may persuade some of them to recognize their own humanity and take corrective action to save the world. Global power elites are probably the only ones capable of correcting this crisis without major civil unrest, war, and chaos. Giants is an effort to bring a consciousness of the importance of systemic change and redistribution of wealth to the 99%, and to global power elites themselves, in the hope that we all can collectively begin the process of saving humanity. In that effort, I highly recommend using the Universal Declaration of Human Rights as a moral base to offer a united thread of consciousness for all seeking human betterment. Humankind deserves nothing less.

______________________________________________________________________

Peter Phillips is a professor of political sociology at Sonoma State University, where he has taught since 1994. He teaches courses in Political Sociology, Sociology of Power, Sociology of Media, Sociology of Conspiracies and Investigative Sociology. He served as director of Project Censored from 1996 to 2010 and as president of Media Freedom Foundation from 2003 to 2017. Giants: The Global Power Elite is his 18th book from Seven Stories Press—it was released in August 2018.

Thanks. I will buy this book.

Interesting and thought provoking shapes in the mist. As a housewife I probably cannot judge their substance, but I do think society swings like pendulum, a little too far one way, then the opposite way. A black president and all of the social and political rightness were hard for some to take––can’t say Merry Christmas, can’t pray in school, abortions are government murdering babies, subverting your right to raise your kids as good Christians. I have some good friends, kind-hearted people who support you know who, think he is the greatest patriot, doing such good things for the country. The environment, the planet is so vast it belongs in the realm of God’s will, and after all the weather is always changing, right? In my opinion Trump is an actor, and the cabal, as you so aptly point out, has a script, checking it off one by one, load the judiciary and roll back environmental protections. The always Trumpers have their eyes fixed on their Christian values while the movers and shakers fixate on their profits. But the environment will win, probably faster than we realize, and good luck surviving such a massive upheaval. Everyone benefits from a stable, reasonably equitable society, a stable world economy, and together we can, or could tackle the biggest challenges that face our species…so says the housewife.

Awesome post! Keep up the great work! 🙂

Good post. I absolutely love this site. Keep it up!