The legendary regulator and white-collar criminologist William K. Black explains why, contrary to corporate media coverage, the bank failures set off by the Silicon Valley Bank crash were absolutely not sudden, unexpected, or unforeseeable, and why none of the regulations Democrats or Republicans are talking about would have stopped them.

Colin Bruce Anthes

Welcome to the Analysis. I’m Colin Bruce Anthes. In a minute, I’ll be speaking with Dr. Bill Black on bank failures and what is to be done. Please remember to like, subscribe, ring the bell, and consider hitting the donate button to support our work. Stay tuned.

Only 15 years after the last global financial crisis, three American banks failed in one week, and now Credit Suisse, after 166 years of independence, has been purchased by a rival bank with state intervention from the Swiss National Government due to a crisis in confidence. To discuss how and why this has taken place and what should be done next, we’re privileged to be joined by one of the major voices on the subject, Dr. William K. Black. He is a lawyer, an academic, and an expert in white-collar crime. He has personally served as one of the major bank regulators in the United States. He helped develop the concept of control fraud. He testified to Congress after the 2008 financial crisis, during which time he accused Timothy Geithner of engaging in a massive cover-up of fraud. He’s the author of the seminal book, The Best Way to Rob a Bank is to Own One. Bill Black, welcome back to the Analysis.

Bill Black

Thank you. It’s great to be back.

Colin Bruce Anthes

Before we jump into all of the things that are going wrong in corporate finance right now, I wanted to ask you a big systemic question that I don’t see being asked very often, which is about why corporate finance has the scale over our lives that it does. There are other ways of doing banking and finance. I live in Canada, where the province of Alberta– it’s a very large-scale public bank that’s in one of our most conservative provinces. I’ve done a lot of my banking at a credit union, which is a cooperative financial institution. I get democratic voting rights on the Board of Directors. I ask this not in a let’s burn all the banks down sense, but genuinely, if everything was regulated perfectly, if everything was running tickety-boo, what benefits should I, as a working-class person, expect to be able to get from these corporate banks under those ideal circumstances that I could not get at a public institution or a cooperative institution?

Bill Black

Well, if I put on my toque and lean back in my chesterfield while paying my hydro bill and channel my semi-Canadian from growing up in Detroit, Michigan, there are basically three big things as to why finance is so critically important. First, finance blows up the world, and that’s really important. Second, finance affects everything. Do you want to know why there’s not enough spending on the environment? Well, that’s largely thanks to finance on how it allocates. Third, particularly in the U.S. context, there’s enormous predation, typically on the basis of race and ethnicity, sometimes on the basis of age, and sometimes the basis of gender, and sometimes, of course, those things interact and such. So the combination of those three things means that lots of people lose money or are in crushing levels of debt, particularly, again, in a place like the United States, from their university debt and from payday lending. People are often caught in debt traps that crush their life choices. Those are the big three reasons why finance is such a big deal.

Oh, by the way, I’m sorry, the fourth one is supposed to be that it’s supposed to be the motor that drives innovation and growth. Not so much, but that’s the theory.

Colin Bruce Anthes

When we look at this, let’s go specifically into Silicon Valley Bank, which is the spark that has ignited a pretty big fire now. It was really a run that happened in the span of one day. This is a bank that was highly engaged in tech startups. The Silicon Valley Bank failure was immediately portrayed as something that came out of the blue that happened very suddenly. Since then, we have had the Democratic Party accuse the Republicans of having caused it through the rollbacks of some regulations that happened under the Trump administration, which did happen. From your perspective, part (A) of this question is from your perspective as someone who has been a bank regulator, was this out of the blue? Was this sudden?

Bill Black

It wasn’t remotely out of the blue. The fact that it’s being treated as if it were out of the blue is an enormous tell in the poker sense of that word as to the utter collapse of regulation, not, of course, just under the Trump administration, but under the last five administrations.

Colin Bruce Anthes

So that takes us back to, would you say, when Glass-Steagall was repealed?

Bill Black

Yes. So Glass-Steagall’s removal was incredibly stupid. It was one of those things where there’s a conservative maxim that makes a lot of sense, and it’s called if it ain’t broke, don’t fix it. If things are working, and Glass-Steagall worked brilliantly. The only thing that it wasn’t working for was bankers. It was working great for all those other things that I talked about that finance is supposed to do, and in preventing those nasty things that finance actually does. So they had to get rid of it, and both the Republicans and Democrats worked together like chums to achieve that. It was done in a particularly cynical fashion where they did a deliberately unlawful merger. But under Glass-Steagall, you would have had a year to unwind it, but it would have meant unwinding what was at that time the biggest financial merger, not just in the United States but in the world’s history. So, of course, the bankers knew that would never happen. They held the government hostage, and the government let itself be held hostage. So that actually occurred during the Clinton administration, but that wasn’t done over their opposition. They were all for it.

Repealing Glass-Steagall was terrible. It played a role, all completely negative, in the Great Financial Crisis. It’s got a peripheral role in the current crisis. It would have been bigger in Switzerland, except, of course, Switzerland never had a Glass-Steagall, which is one of the reasons its banking has been so corrupt, not for 10 years, but for over a century.

Let me go to the stuff about the Trump legislation. Was the Trump legislation terrible? Yes. Was it sold on the basis of lies? Yes. Were Democrats heavily involved in making that happen? Yes. Not all Democrats, but a significant portion. The lie was we were doing this for community banks. This is the little bank in the rural village that doesn’t much exist anymore in the United States. It is true that government regulation tends to be more costly per unit in those smaller banks. You got to admire the chutzpah.

They solve this as we need to therefore remove restrictions on banks up to $250 billion in assets. Now, a $250 billion bank is ballpark one of the 10 biggest banks in the United States and one of the 20 biggest banks in the world. It is not only not small, but it is also in that proverbial category of being systemically dangerous, that when it fails, it can bring down others. Of course, Silicon Valley Bank was a leadership that was specifically lobbying for this insane loophole to apply to it, even though it was ballparked $200 billion in assets and, of course, had no problems complying with the law.

Now, the Democrats have their own falsehood about this, and that is, oh, if Dodd-Frank had not been amended, this wouldn’t have happened at Silicon Valley Bank. We know that that’s 100% wrong. We know that’s 100% wrong because the same problems happened at places where it wasn’t rolled back. They just haven’t come home to roost at this point because they dare not act on banks that side.

Colin Bruce Anthes

Can you go into that for me?

Bill Black

The fundamental thing that the amendment did under the Trump administration that the Democrats are focused on is it got rid of the mandatory stress test. But it is critical to know why that’s nonsensical as a cause of this crisis. The answer is stress tests are useless. They’re designed to be useless. They do not stress the institution. They’re an oxymoron created by regular morons. What they don’t do specifically is look at runs. If you remove runs, then banks seem a whole lot safer, and they die in years, not in hours, which was your point about Silicon Valley Bank, which is why they don’t put that into the stress test because then you would say hundreds of banks are insolvent and are at enormous risk. If there’s a run, they will fail, and a run is in some sense rational in that they’re insolvent on a market value basis, which Silicon Valley Bank was into that category.

So even if the Trump amendment had never occurred and they had done the stress test, the stress test would have said, no problem here. We know that because this is what the following list of institutions have in common. Bear Stearns, Lehman Brothers, Fannie [Mae], Freddie [Mac], the big three Icelandic banks, all of them passed stress tests with flying colors, sometimes days before they failed because stress tests don’t actually look at the things that kill you. As a metaphor, liquidity, which is what a run is, is a bit like pneumonia. So you’re put into the hospital by some chronic disease that is actually going to kill you eventually, but pneumonia is an opportunistic infection, right? It’s often fairly common in hospitals, unfortunately. It puts enormous stress on your breathing, which puts enormous stress on your cardio system, and it tends to be the thing that kills people the quickest. So runs on the bank, kill you quick. But what was the underlying problem? Why did they have a run on the bank? And the answer is mostly it appears at this point in the U.S. context, interest rate risk. In the Swiss context, interest rate risk plus probably some more exotic derivatives, but Switzerland is super opaque, even more opaque than the U.S., well, much more opaque than the United States. So it may be months or years before we get the details on the derivatives. All we’re being told is that their financial derivative positions were a significant part of the problem and caused very large losses.

Colin Bruce Anthes

I want to just hammer home this point that it’s highly likely what we’re going to see next are the Democrats start talking about putting some things back in place that looked like they were before the Trump administration. From your point of view, that would be a cosmetic solution. It would not actually prevent these kinds of things from happening further down the road.

Bill Black

Correct. They’ve got to– the response to the Great Financial Crisis in the United States, which became the Dodd-Frank Bill, has many good ideas but no coherence. So it’s here’s an idea, here’s an idea, here’s an idea, here’s an idea, and they all threw them into the bill. So it’s an utter monstrosity of a bill. Then the secret I can tell you as a regulator, regulators don’t like enormously detailed regulation. It’s a pain in the ass from our perspective. You have to learn, and it’s incredibly boring to read it. It’s incredibly boring to draft it, and it’s easy to get it wrong, and you’re getting all kinds of abuse left, right, and center. Why do we have these super detailed regulations? Well, partly because this bill was a monster with literally hundreds of ideas thrown into it, but mostly because of big banks. Because the big banks always come in and say, oh, in our precise circumstance, this possible thing could happen, and if it did, it would be unfair. So this is the– ignoring the adage, of course– never let the search for the perfect become the enemy of the good, and that’s what exactly happens in these circumstances.

So at the staff level, I led the re-regulation of the savings and loan industry. That was desperately needed. I think it saved hundreds of billions of dollars, actually probably trillions. But I got rid of more regulations than I created. Of course, there are stupid regulations. The other secret thing I’ll tell you about competent regulators is we hate bureaucracy. You have to deal with bureaucracy once every three weeks, typically as a regular Canadian or American. We have to deal with it every day. There are bureaucrats, and they’re anal, and it just makes your life miserable. So when you see competent regulators, we are completely non-bureaucratic in our approach.

So what do we need for this particular crisis? Remembering crises change. Generals that only get ready to fight the last war are disasters. This one, we can put a really fine point on it because one of the disastrous things– disastrous may be too strong– one of the things that showed that they hadn’t learned the fundamentals is in doing Dodd-Frank. They overwhelmingly created the supposed answer to future problems in economists, conventional economists. Now, conventional economists create problems; they don’t solve the problems in finance. So this is significantly insane. Let me give a specific example that ties in so well with the Silicon Valley Bank. I may call it SVB collapse. As far as we know now, interest rate risk leads to liquidity risk, a run, and the place fails essentially within a day. But it’s been, because of interest rate risk, insolvent for the better part of the year. Finally, people go, oh, it’s insolvent.

Colin Bruce Anthes

It was a sitting duck.

Bill Black

And my deposits are way, way in excess of the insurance limit because that’s what was special at Silicon Valley Bank. Now it’s that old joke about the bear, which Canadians and Americans both tell. The bear appears, and there are two hikers. One of them starts getting out of his hiking boots and putting on his running shoes. The other one turns to him and says, “what the hell are you doing? You can’t outrun a bear.” Of course, the answer is I only have to outrun you. That’s basically it. If you were less bad than the other folks, you might survive even though you’ve been an idiot, gone into bear country, and done everything wrong. You’ve got honey smeared all over your arms and such.

Everybody knows– when I teach public finance, the first risk I start with is interest rate risk. It’s in some ways the most basic and the one that comes from economics the most clearly. Everybody that does this is an economist. So this should be their wheelhouse. They should be great at this stuff. FSOC, the Financial Stability Oversight Committee, which is this creation and is almost exclusively economists, did a report, circa 2015, on interest rate risk. Great. And you know what it says? This is almost a direct quotation. The banks should continue to address interest rate risk.

Colin Bruce Anthes

Well, that’s informative.

Bill Black

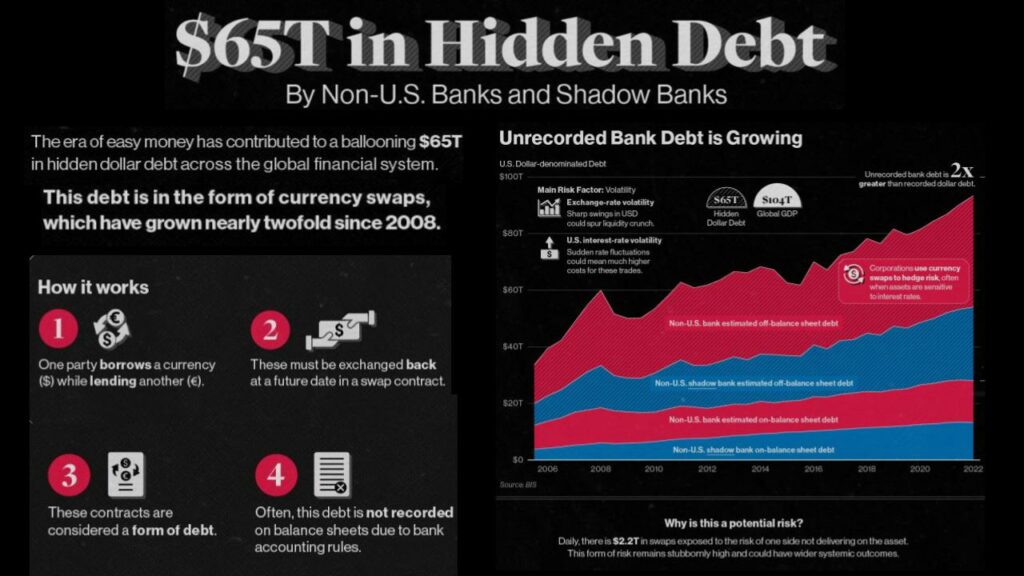

And the regulators should continue to address interest rate risk. You’re going, you got a Ph.D. in economics to do this crap? I mean, this is utterly useless, but it gets better. They put together this presentation. It ain’t all that long, but it has 75 PowerPoint slides with the guts of the number because they’re economists, chart after chart after chart. It doesn’t have the two charts you would absolutely want on interest rate risk. The two charts would be how big is the unrecognized, for accounting purposes, loss in market value due to interest rate changes? Two, if interest rates continue to rise by, say, 200-400,000 basis points– 100 basis points makes 1% of interest– how big will that loss grow to? Those are the two charts you’d want. Those two charts ain’t in it, and there’s nothing like it. There’s nothing from which you could infer, even if you had a Ph.D., what the numbers were. Have you seen either of those two charts?

Colin Bruce Anthes

No.

Bill Black

In the news coverage? No.

Colin Bruce Anthes

No. How is that possible?

Bill Black

Okay, so again, if you take interest rate risk seriously, then you know it can spark a run. You know if it sparks a run, your stress tests are useless. You base everything on your stress test. Tim Geithner, who ballyhoo stress test, even made his book, Stress Test. So this was largely created as a propaganda exercise to make people feel, oh, it’s not business as usual. The regulators turned over a new leaf, they got tough, and they put them through rigorous. Fannie and Freddie, since they were very good at publicity, they called their stress test nuclear winter scenarios. It was the equivalent of the Holocaust of all Holocausts on multi-dimensions, continuing for 20 years, and they’d just be fine. Whereas in the real world, they were dead, and they were dead at the time they were saying this nonsense. The regulators wanted, after the Great Financial Crisis, to say, “oh, we’ve looked, and it’s actually not a big problem. Look, virtually all of them passed their stress test, and it was typically maybe two that didn’t, and by the next iteration, they all did, or they did with an asterisk type of thing. It worked. Go back and look at the press coverage of the stress test. It got enormous play. All was well and such.” Okay, but it isn’t. So they don’t take interest rate risk seriously. Any time in the press coverage, you see these things. You know that either they don’t know what they’re talking about, or they’re lying deliberately. It’s only a paper loss, is one phrase, or, oh, and this is the Democrats doing this one, oh, these are good assets.

Colin Bruce Anthes

I know that what drives you crazy–

Bill Black

They’re good assets. You just have to hold them to maturity. And you’re going, yes, they are assets that are not going to default because of credit risk. But if I got a bond that’s only earning, which these bonds are earning roughly, according to the press reports, 1.8%, and inflation and market interest rates are more like 5%, then if your bond only makes less than half of market value return, your bond isn’t worth $10,000. Your bond might be worth anywhere between three and six. Remember, the asymmetry of this; they’re betting on the bank’s survival. If they win, they get 1.8%. But if they lose, they lose catastrophically, except that now we have to interrogate the pronouns.

Colin Bruce Anthes

Right so it goes back to–

Bill Black

[crosstalk 00:24:32] that loses is the bank, not the bankers. And it’s us that ends up bailing them out. Then we have a number of the Democrats saying this isn’t a bailout. Of course, it’s a bailout.

Colin Bruce Anthes

That was the next question I was going to ask you because everybody is bending over backward to say that none of this activity is a bailout.

Bill Black

The Swiss just said that it wasn’t a bailout because the Swiss passed a law after the Great Financial Crisis that said Switzerland renounces and will never again do a bailout unless, of course, we actually have a large institution fail, at which point we will rush on a Sunday night to execute a bailout. So yes, of course, it’s a bailout.

This next one is a particularly pernicious lie. Oh, no taxpayer dollars. Well, the FDIC fund. No, when you use FDIC fund dollars, that’s a bailout in these circumstances. So I don’t understand it. You could make a perfect criticism of the banks. You could say clearly regulation is a catastrophe. Financial regulation is clearly a catastrophe in the United States. Because, again, some things in finance are really complex. This aspect that we’ve been going through is an absolute no-brainer. It is super, super simple. Undergraduates in my class understand this just fine type of thing when they’ve never taken much of any economics class in their entire experience. Again, because of the asymmetry, there’s no advantage to the federal government in allowing this interest rate gamble. So why are they doing it? I haven’t seen a reporter ask that question. And they’re not just doing it at SVB. The things in the press suggest that the unrealized losses, remember that chart that should exist and should be famously there at the top of every news report, is in the 400 to 600 billion dollar range. So we’re talking about very, very large numbers.

Also, the Fed is the Fed. Do you know tautology? The Fed is a regulator, and the Fed is the one that boosts interest rates and knows that it’s going to boost interest rates. So the Fed, when it’s regulating, the Fed knows with certainty that we’re going to pound– because they act like there’s only one tool to deal with inflation, and that’s causing a recession. If that 60-pound maul doesn’t work, then they get a 120-pound maul and swing it.

So the Fed has examiners too. It’s a regulator of two different types of banks, bank holding companies and state-chartered nonmember banks these are called. So those people know with absolute certainty what’s going to happen, but incidentally, they don’t know exactly, but they don’t need to. They know interest rates are going to go like this, up, and they know that the value of fixed rate bonds and mortgage-backed securities is going to go like this when that happens [Black directs his hand in a downward direction]. So nobody at the Fed can claim to be surprised.

So again, not only have we not seen the two charts, right? One, how big is the hole? Two, how big will it become if interest rates continue to increase? Then there would be a third chart for bonus points, and that is the following. Here’s the scam that goes on. Generally accepted accounting principles don’t require you to recognize; currently, that means put on your actual books the loss from interest rate changes.

Colin Bruce Anthes

So they don’t even tell you the true story.

Bill Black

Unless you are holding the assets for sale, in the older days, which is to say last year, they were holding hundreds of billions for sale. If they continued in that categorization, they’d have to recognize hundreds of billions of losses. So they recharacterized them. Oh, no, no, no. We’re not holding these for sale. We’re holding them for investment. So that should be the third thing. Who’s deliberately hiding their losses through this process? That should be the third level of the chart. How big, in total, is that mischaracterization of the accounting? And which institutions are the big players in that? All of that should be publicly available.

But again, in addition to this FSOC report, remember, this is the economist. The economist specifically to look for the forthcoming risk to make sure we’re not fighting the last war, look ahead, economists, and say an interest rate risk, but then not actually saying anything about what our exposure was, and with this unbelievable, you should continue to monitor interest rate risk. Yes, you should continue playing the piano in the whorehouse. What? No, you should shut it down. There’s no upside to allowing banks to deliberately take substantial interest rate risk. None. There’s a massive downside to them doing it, which is we get stuck with those huge losses.

So the next test of regulation, right? Have you seen the head of the Office of the Comptroller of the currency, the head of the FDIC, and the head of the Federal Reserve issuing guidance saying, stop, don’t do this? I haven’t. Oh, and that’s the next part. I use the word guidance. They used a similar word at FSOC. It’s an advisory. That means it’s deliberately unenforceable. I was an enforcement head, among other things, as a regulator. I can’t enforce it if you’ve chosen to just make it an advisory. An advisory is telling your 16-year-old daughter that dress seems a little provocative. You can say it. It is utterly useless. Every parent knows it’s utterly useless. Every regulator knows the guidance. So if this is absolutely useless, it’s designed to cover your ass. Have you heard of any proposed rules?

Colin Bruce Anthes

No. The fact that this– it sounds very obvious when you say it, but the fact that there’s so much that’s missed. There’s this huge gap that’s missing here in the accountability of the institutions that control our economic life. We saw Barney Frank, who was one of the people at the heart of Dodd-Frank, then became a lobbyist for deregulation afterward.

Bill Black

Not just deregulation, for crypto.

Colin Bruce Anthes

For crypto.

Bill Black

And then he claimed that his bank was closed, not because it was a crappy bank, which it was. I mean, SVB was a clown car. It’s not even close. If you can’t get SVB right as a regulator, you really need to leave the job to somebody who can actually do things. But we do not pick regulatory leaders, and we have not picked regulatory leaders for decades. On the basis of they’re going to fix problems and prevent problems because if you do, you piss off the bankers.

Bill Clinton gave an address to banking regulators, and this is how he started it out. I never heard as many complaints as I did about you when I was on the campaign trail. He didn’t then say thank you. That’s exactly what we need. For him, it was self-evident that you had to get out. I got out when, and I witnessed this personally when they came, and they trained us on the new reinventing government of the Clinton-Gore administration. Their big dictate was you must treat the banks and the bankers as your client. Your customer, in fact, was the exact word. And in my own quiet way, I got up and said, surely you meant the people of the United States of America. And they said, no, we thought about that but rejected it.

Well, if you wanted to give an instruction that over the process of the next 30 years would destroy regulation, that would be exactly the mindset that would destroy effective regulation. We are not there. They are not our customers. We are not there to make bankers happy. Now, we do make good bankers happy when we get rid of crappy competitors who are going to blow up the system. But have you heard the bankers putting out a list of the worst institutions or saying interest rate risk is a disaster and it is critical for the banking regulatory agencies to adopt regulation? No, what they’re doing is the opposite. We have columnists and not industry columnists, regular columnists for Reuters who have their beat, finance is part of their beat saying, oh, the problem is we have deposit insurance. And you go, wait a minute, we had the run because they weren’t insured.

Colin Bruce Anthes

How much of it–

Bill Black

Frannie and Freddie were not insured. Bear Stearns was not insured. Lehman Brothers were not insured. The money market mutual funds with a $400 billion run were not insured.

Colin Bruce Anthes

It’s junk.

Bill Black

We get nonsense, utter nonsense, in the alleged specialty press for finance. Reuters thinks of itself as being particularly skilled in finance. The guy writing it, he has an undergraduate degree in English, which is a perfectly great degree. But it means that it didn’t come from him. Somebody in the industry told him this thing, and it sounded cool. His title is something like: Deposit Insurance is Not the Cure, It’s the problem; or something along those lines. It is exactly the opposite of what we’ve observed in life.

What did we have to do to stop the largest run in world history? How many people know what the largest run was in world history? It was $400 billion on the money market mutual funds, which were not insured after Lehman Brothers failed. The only way to break that run is that we temporarily extended, for over a year, federal deposit insurance to break that run.

Colin Bruce Anthes

And yet these are the lines that are getting released through the media at this time. So it’s just bogus going around.

Bill Black

Right. And as I said, neither party has it right. And these are people that ordinarily, I mean, ex-profs that are very good but are saying things that are nonsensical because they don’t understand finance.

Colin Bruce Anthes

Well, how much of this is caused by incompetence, and how much of it is incompetence that gets promoted through the revolving door?

Bill Black

They don’t need the revolving door anymore. For now, over a full generation, they don’t appoint people to run regulatory agencies if they believe in regulating. Tom Frank, I don’t know if that’s a familiar person– What’s the Matter with Kansas?– asked me early after the Great Financial Crisis because I had appeared in this Obama campaign thing about the savings and loan debacle because John McCain was one of the Keating Five. I met with him, and he tried to intervene on behalf of Keating and such. Tom Frank asked me early after the Great Financial Crisis, when are you going to get a senior position? About five minutes later, after I could stop laughing, I had to explain that at that time, about 350 million Americans would have to die before they would ever– I would be the literal last person they would ever allow to have authority again because we didn’t just put them in receivership properly, we put them in prison. They’re not about to recreate that danger. You saw both Republican and Democratic administrations; now they don’t.

Credit Suisse, in the Great Financial Crisis, we did a Justice Department deal with them, a sweetheart deal with them, in which one of the findings of the Justice Department was that Credit Suisse had been defrauding the United States of America with the same basic fraud scheme for over a century. I didn’t say a decade; I said a century. So you’re talking about tens of millions of frauds, and they gave them a sweetheart deal. Then they did four more scams since the Great Financial Crisis and then blew up the second-biggest bank in Switzerland. So now the largest is going to acquire it. So now we’re going to have the too big to fail problem, absolutely controlling. That bank, UBS, is going to have more assets than the GDP of Switzerland.

Colin Bruce Anthes

UBS, their statement actually said that they did not want to make this deal. Do you want to speak to that?

Bill Black

Yeah, part of that’s true. Now, obviously, they love being a monopolist, and they love being too big to fail. Especially, as I said, because Switzerland, after the Great Financial Crisis, put in statute, we cannot, we hereby promise and remove any ability to bail out. So they’re saying there’s no bailout. There’s no bailout. There’s no bailout. There’s a $160 billion bailout through various credit lines and other such things. But on top of that, so little in the weeds, bankruptcy priority. You pay off secured creditors first and unsecured creditors. Then there’s this category that’s actually what junk bonds are, which are called subordinated debt because you subordinate your priority in bankruptcy to regular creditors. Then below that, the last folks are the shareholders. Each group has to be paid in full for the group below it to get anything; each higher group has priority. Except that subordinated debt has a higher priority than equity, and they directed that the equity would receive three billion and the subordinated debt would receive zero.

Colin Bruce Anthes

I saw just before I logged on to this interview that there was an expected lawsuit coming from those people.

Bill Black

Oh, yeah, I bet you. But beyond that, conservative economists love subordinated debt. To them, the FDIC is the great Satan. Federal deposit insurance is the great Satan, and subordinated debt is the most wonderful thing. These people will be the ideal folks to exert private market discipline, which is to stage a run, except you can’t run unsubordinated debt. So it’s a really odd thing to deliberately screw the sub-debt holders when they should be paid in full, and they’re not only not going to be paid in full, they’ll get zero cents on the dollar. So again, as soon as governments get into a too big to fail institution, failing, all the rules depart. The bank holds hostage the entire national economy and sometimes the global economy. To which my point is, then why do we allow them to be that big?

Colin Bruce Anthes

Yeah. So that’s the next question I have. If they’re already this big, what steps would need to be taken to get us into something that is sustainable? And is there anybody out there who is talking about taking those kinds of steps?

Bill Black

No, other than fringey progressive types, as to the second question. As to the first, the way you would do it is say, we’re not going to tell you what to sell, but you have five years, roughly, to get down below a level of systemically dangerous. In the modern era, at the time of 2008, that was probably around 50 billion in assets. These days, maybe it’s 70 billion. But we have three trillion-dollar institutions. As your point is, we’re going in the wrong direction. Concentration is increasing. Back to your very first question, if you don’t ask about finance, but if you ask about the 20 largest banks in the world, they do ballpark 99% of all financial derivatives. So in many areas, it’s hyper-concentrated beyond the concentration numbers. And as big as finance is, financial derivatives– now there’s some technical stuff about how you number it, but they are much bigger than what they call the real economy. So this is completely out of control. There is no democratic control. There is no meaningful democratic process when it comes to finance. So if you want to take back– this could be you would think transcend right, left lines. If you want to take back democratic control, you would be really well advised to start with finance because (A) finance blows up the world periodically. (B) when it’s not blowing it up, it is systematically misallocating assets. It’s creating hyperinflated bubbles that are absolutely nonsensical. It’s creating palaces. It’s doing things the opposite of economic theory. The economic theory is providing finance is what drives economic growth. But since we’ve made finance all powerful, roughly 35 years ago, growth sucks. The places where they really made finance, absolutely in control, Japan, well, it ain’t a single lost decade at this point, folks. It’s really three lost decades in terms of Japan. So we’re not getting what the conservative economist promised us, which was things were going to be super great.

What are we getting? What do we really observe when we see the really big financial institutions– not financial institutions, really big commercial institutions, but where the whipped hand is held by finance? We see stock buybacks, and not little stock buybacks, stock buybacks that are staggering in their amount. All of that says we have no productive use for our capital to invest and make good products, hire workers, and things like that. We’re out of ideas, useful ideas. So we’re just going to– of course, what’s really going on is stock buybacks, raise stock prices, and make the CEO’s bonus.

Colin Bruce Anthes

That gets back to the other thing.

Bill Black

So that’s why it’s going on. The bank, SVB, Silicon Valley Bank, did not gain by buying a ton of 1.8% yield treasuries and mortgage-backed securities. That was something that doomed the bank. Again, the asymmetry of risk and return, (A) they did this gamble knowing that the Fed was going to massively raise interest rates and that they would lose. But that comes back to pronouns again. Who’s the they? The bankers were going to win. The bankers had paper, I don’t know, but maybe eight-tenths of 1% because rates were so incredibly low. Now they do 1.8%. Oh, well, then my nominal income, not my real income, but my stated income goes up, and it was all due to my brilliance in investment. So I get bigger bonuses, and the stock appreciates. The stock capitalization of SVB shortly before the disaster was $15 billion. Again, markets are not efficient. The markets that are most likely to be efficient, according to economist, are financial markets. They ain’t. They’re not a little bit off. In Yiddish, they’re farblunget [farblondjet]. This is literally lost, but farblunget is I’m trying to drive from Detroit to Toronto, and 18 hours later, I noticed that the signs, the highway signs, are all in Spanish, not Quebecois. I didn’t just take a little bit wrong turn and end up in Montreal instead of Toronto. I ended up in Mexico. That’s farblunget.

So that’s how crazy– again, it’s so obviously crazy. It has failed so spectacularly that neither party has actually seriously sought to fix it. I think the Democrats thought they did, and I’m sure some of them did, but it was absolutely incoherent. They didn’t actually ask people who had succeeded what works. That was the last thing in the world. So if they can’t fix the– and indeed now, they don’t even try to fix it. Now it’s just a you did it type of thing. The explanations are nuts. Wokeness or, oh, my God, if we’d only had stress tests, all would have been well.

Colin Bruce Anthes

So the bipartisan ignorance is not something that you’re seeing dissipate in the slightest way after this crash, after this crisis has taken place?

Bill Black

Yeah, it’s worse than just ignorance. It’s just not serious.

Colin Bruce Anthes

It’s an unwillingness.

Bill Black

Again, lots of folks are contributing to this. I know everybody picks on mainstream media, but it’s true in this case. You just don’t see serious analytics. You get descriptions but not serious analytics.

Colin Bruce Anthes

I wondered, as we get towards the end of this interview, if you could speak to something that the economist Michael Hudson, who cites your book all the time, recently said, which is that, in some ways, he sees this crisis as worse than what he saw in 2008 because 2008 was really a scam. Whereas in this case, what we’re seeing are some practices that have been standard among many banks for a long time being exposed by rising interest rates. So this is more of a problem at the heart of the practices that have been building in recent years across the financial sector. What do you make of that?

Bill Black

I won’t get into the definitional stuff about how you rate what’s actually worse, but I agree with this fundamental point on the difference. Again, this is what I’ve been trying to express. Fraud people are unwilling to admit, right? You can’t simply look at reports that the institutions provide and have a particularly good understanding of the fraud. That’s not true with interest rate risk. You just have to look at the numbers. Again, the point is, it’s just so easy. It was so easy for the bankers to avoid it. It was so easy for the regulators to avoid it. Not only did they not avoid it, but even now, where they see all these terrible things happening– this is the second and third largest bank failures in U.S. history, and it was easy to prevent.

Again, in the last one, there was all this hoopla around, we’re helping, in particular, poor minorities by lending to them. That was the whole shtick in the defense in the run-up to the Great Financial Crisis. There’s no such thing. This isn’t lending at all. This is what I do and how I invest my funds as a bank. It is a completely different function. As I said, undergraduates can figure this out. Again, just to ask you, have you even heard anybody else go, what reports would I want?

Colin Bruce Anthes

Well I guess the–

Bill Black

When I say that the reports that we wanted, and again, the reports were, how big are the unrecognized losses due to interest rate changes? And how much bigger will they get if interest rates continue to increase? Those are not hypothetical things. Those are charts that I and my counterparts used to look at in 1984. We didn’t invent them. So probably they were there before in 1984. I joined the federal agency in 1984. That is quickly approaching 40 years ago. I have a feeling technology has gotten better in the last 39 years, not worse. We never claimed to be geniuses. We could get it right, and now they have the benefit of our experience because remember, the first act of the savings and loan debacle was interest rate risk.

Colin Bruce Anthes

Right. I want to close with a two-part question. If you were speaking to a member of Congress right now about one thing that they should stand up and champion right off the bat, get up and make a speech about, and if you were speaking to someone in a major media outlet about the first way they should start reporting this, what would your advice to both of those figures be?

Bill Black

I would say I want those two charts.

Colin Bruce Anthes

Two charts.

Bill Black

And I want every regulator to provide them. Then my second thing would be, here’s the asymmetry between Democrats and Republicans. The following Democrats, as president, have reappointed Republican appointees as chairman of the Fed. That would be the last three Democratic presidents. All of them reappointed Republican appointees as chairman of the Fed, even though they knew they were hard-right, and we’re talking about Alan Greenspan of Ayn Rand.

Colin Bruce Anthes

A literal disciple of Ayn Rand.

Bill Black

A literal disciple of Ayn Rand type of thing, and Democrats reappointed him. Do you know the last time a Republican reappointed a Democratic nominee?

Colin Bruce Anthes

Has it happened?

Bill Black

I am not personally aware of it ever happening. It certainly never happened when I was an adult. So it has not happened in the last 50 years, roughly. Again, Democrats play slow-pitch softball and not the industrial league thing where you arc it 30 feet in the air. No, the kind when you want your kid to hit it. And Republicans play hardball. It doesn’t work well for the nation. I don’t care whether it works for the Democrats. It doesn’t work well for the nation.

Colin Bruce Anthes

Well said. I want to thank you so much for providing some much-needed clarity at a time when there isn’t much clarity going on. I hope some people out there are listening to the things that you’ve been saying because there’s clearly a lot of room for improvement from what we’re doing right now. So, Bill Black, thank you so much for taking the time and for providing some invaluable insight at this crucial juncture.

Bill Black

Thank you. Thank you for the channel’s efforts.

Colin Bruce Anthes

We’ll continue to do our best to cover these events as they unfold with figures like Bill Black. Please remember to like, subscribe, and ring that bell for notifications. If you’re able to hit that donate button, we would certainly appreciate your support. Thank you so much for tuning in.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

I surfed my way here to see that Mark J Lovas had pointed out the same thing I had observed.

Colin, your first question was brilliant but the affable professor didn’t address it straight ahead (or an edit left it on the proverbial cutting room floor.) I wish you would have followed up and given him a second bite at that apple. (It could have made a STRONG clip) You made a second comment/question later in the interview that was also great, but he didn’t appear to hear as he continued on. (I know the time delay, etc. make it a lot harder to pull it off, but…)

Dude, you have an warm and intelligent screen presence, a solid broadcast voice. (I’m not sure who’s editing the pieces) Please, trust what you have to bring to the plate — and get a bit more “assertive.” This stuff is IMPORTANT. (I’d love to pass along clips at some point to promo your work)

You can’t talk to anyone else like Bill Black because there is only one Bill Black.

Mr. Black is truly the only voice worth listening too on this subject. He could single handily take down the entire con of finance if millions of us understood what he’s done and who he is, the above comment notwithstanding.

Thanks for the Bill Black interview.

Bill Black didn’t really answer the first question. He spoke with his familiar sarcasm about how bad the private banks are, and then he gave a textbook style canned summary of what banks are supposed to do– which he could not actually believe given the first part of his answer. So, why didn’t the interviewer ask a further question?