One of the few working-class movements scoring victories, democratizing ownership, and gaining momentum is the method of economic development called Community Wealth Building (CWB). Colin Bruce Anthes interviews Neil McInroy of the Democracy Collaborative on how CWB works, what it has accomplished so far, and its potential to lead a “new common sense” movement beyond neoliberal capitalism.

Colin Bruce Anthes

Welcome to theAnalysis.news. I’m Colin Bruce Anthes. In a minute, we’ll be discussing the growth of community wealth building and its potential moving forward with Neil McInroy from the Democracy Collaborative. Please remember to like, subscribe, ring that bell so you get notifications, and consider hitting the donate button to support our work. Back in a flash.

The last 40-plus years of neoliberalism have seen precious few victories for the working class. The most affluent countries are now regularly characterized by economic crashes, intergenerational wealth gaps, high rates of suicide and depression, stagnating and even declining life expectancies, with the threat of global climate change thrown in as a bonus. But just under the radar, there actually has been a working-class movement that has scored some impressive victories and gathered a surprising amount of momentum.

Community wealth building is a highly replicable method of economic development that brings together local procurement strategies with inclusive models of ownership for land and enterprise. It was first used to pull people out of poverty in a very poor part of Cleveland, Ohio. A larger version was then taken across the pond to the city of Preston, England, and Preston went on to be named the most improved city in the United Kingdom by PricewaterhouseCoopers. Since then, it’s gone a bit viral as an international movement.

Community wealth building initiatives now pop up around the world, from small towns to major cities like Denver, Chicago, London, and Amsterdam. National governments are starting to pay attention as well. It’s made its way onto the $68 billion strategic plan for the U.S. Housing and Urban Development Department. It influenced the way the CHIPS Act on semiconductors was rolled out, while the Scottish government created the new position of a Minister for Community Wealth Building.

So how does community wealth building work? What challenges does it face as it looks to continue its expansion? Could it finally offer a path out of neoliberalism? To discuss this, we have one of its leading practitioners, Neil McInroy. Neil is a former CEO of CLES, the Center for Local Economic Strategy. He’s been an adviser to the Scottish Government on community wealth building, and he serves as the global lead for community wealth building for the “think and do tank,” the Democracy Collaborative. Neil, welcome to theAnalysis.

Neil McInroy

Nice to be here.

Colin Bruce Anthes

Let’s begin with Margaret Thatcher’s most haunting phrase: “Tina, there is no alternative.” I think a lot of people feel that over the past few decades, it hasn’t much mattered who they voted for. They’ve always ended up with some form of neoliberalism on the other side. Can you begin by speaking about how community wealth building offers a viable alternative to neoliberal methods of economic development?

Neil McInroy

Great question. Look, the fundamental woes that the world faces are down simply to wealth and power. Who has wealth? Where does it go? And how that wealth controls the very nature of how many of us, where we work, what we do, and how we nurture the planet with that wealth.

In simple terms, community wealth building is a correction to wealth and power. It’s not just a concept. It actually fundamentally seeks to rewire wealth and power through practical things we can actually do. We could start now, and we are starting now, so it’s practical. It’s step-by-step. It’s got a big attack on wealth and power, but we do it in practical ways. Chipping away. And that’s, I think, its strength. Many other great concepts are alternatives, but community wealth building is a concept, but also a practical way of chipping away at neoliberalism and the questions of power and wealth.

Colin Bruce Anthes

Can you talk about some of the component parts? You talk about how there are different ways of chipping away, and we can get started very quickly. I think one of the things that make it something that can speedily be accessed is this element of procurement and talking about how procurement can play a role in changing the game in a local community very quickly. Can you talk a little bit about some of those component parts?

Neil McInroy

Yeah. It’s worth mentioning that from my experience working 30 years in economic development, I also shared that consciousness with millions and billions across the world– things are getting worse. We’re not dealing with the climate crisis, poverty, and so forth. The way that community wealth building practically does things is to think about wealth, the different pillars, and the dimensions of wealth. I devised a simple way of basketing up wealth, land, a huge source of wealth, finance, capital, if you like, huge sources of wealth, wages, and workforce, a huge source of wealth. Thinking about institutions, and different types of enterprises, they’re a huge source of wealth. Also, of course, procurement and public spending.

Now, these five pillars are workforce, finance, inclusive and democratic enterprises, work, and procurement. The interesting thing about procurement, it’s not preeminently important; it’s one of the five. Procurement, particularly public procurement, that’s our money. That’s democratic money. It’s hard to influence commercial, private individuals, or private corporations’ money, but we can influence taxation. We can influence public money. Of course, that represents roughly 30% of the economy, which comes from that public money.

So what institutions, local government, national government, universities, colleges, hospitals, and public institutions, and how they spend their money is a particularly important feature. It’s particularly important to how we might change how the economy works and where wealth goes. So progressive procurement looks to start using that public resource. If a local government is buying a good or service, their question is then, “Well, how do I see that as starting to turn the dial on wealth and who gets that wealth?” Looking at local procurement, looking at firms who are not just extracting the surplus into the ether of the global economy, but nurturing the place, the environment, and also in terms of having ownership forms where wealth is locked in, employee ownership and co-ops.

So procurement, because it’s a democratically overseen part of wealth, it has an important leverage position in trying to see how we can shift the local economy through progressive procurement practice.

Colin Bruce Anthes

I want to talk about some of those other structures that you were talking about. In some ways, these may seem like common sense points once they’re made, but a lot of the time, when mainstream pundits discuss the economy, there’s the discussion of capitalism and government. So you have these corporations with a few owners, and then there’s government over here that owns other things. There’s hardly any discussion of anything in between. There are lots of other kinds of structures than just a capitalist corporation and government ownership. That comes in, in a very important way, in this, does it not?

Neil McInroy

What we need to do is democratize our economy. That doesn’t just mean the state controlled. It means control partly by the state. In certain instances, it might be fit for purpose; this could deal with railways or whatever it may be. But it’s also that wider democratization of ownership, that plural forms of democratization.

Increasingly, certain sectors in different parts of the world, you can see it lend itself to particular forms of democratic ownership, either railways or perhaps state-owned railways. When it comes to things like childcare or some forms of everyday retail, this might lend itself to workers’ co-op or other forms of democratic ownership.

Community wealth building supports effervescence, a flourishing of those democratic forms because, by their very nature, they are not wealth extracting; they are wealth-generating in terms of the people who own those forms. So we should not see this as capitalism versus government, rather than capitalism versus democracy and democratization of the economy.

Colin Bruce Anthes

I think there is some room here to bring together different kinds of coalitions by bringing in those different options. There was a poll by the University of Chicago in, I think, 2019. They asked 1,500 Americans what they would prefer to work for, a state-owned enterprise, an enterprise owned by outside investors, or a worker-owned enterprise. The results were pretty staggering. Seventy-two percent of Americans said they would rather work for a company that was owned by its employees. But it wasn’t just that a huge number said that they would rather work for that; it was the demographics. It included 74% of Democrats, 72% of Republicans, 67% of independents, and a clear majority of black, white, gay, straight male and female participants.

We live in this incredibly polarized world where we see different political camps constantly at each other’s throats. Then in comes this other form of inclusive ownership that suddenly has very, very widespread appeal across the political spectrum. That opens up some doors.

Neil McInroy

Yes, absolutely. I think what you touched upon there is that, as you said before, common sense. We all know, as citizens and as workers, that when we have more of a stake in something, a genuine stake, then it’s better for us. It makes us feel better. Also, in terms of cooperatives, we know that with a genuine stake, there are no distant shareholders. We are the shareholders, and we act in the interests of both making a viable, strong, growing concern but also mindful of the wider impact of that firm, that enterprise.

This is a common sense understanding. The thing is, though, is that I think the powers that be in neoliberalism don’t want these alternatives. There’s an intentional desire to squash them because it breaks the link between these corporations, excessive profits, and excessive shareholder dividends. So there is almost a natural bubbling up, as your figure has shown, of how people think employee ownership and worker ownership are a good thing. But there is a reaction, I believe, from political forces and from power and wealth and neoliberalism, who do not actually wish to see these things grow because it threatens their own power and wealth.

There’s a political tussle in community wealth building, which I think is an important dimension. Whilst I’ve said community wealth building is practical and you can get on and do things, there is also a political dimension if we’re really going to bring this to scale.

Colin Bruce Anthes

Yeah. We’ll touch a little bit more on some of the challenges that are faced in order to keep this movement expanding. Let’s go through a little bit more of the core practices. Then we’ll go into some examples of how this has operated in hands-on practice so far.

We’ve talked about employee ownership and cooperatives. We talked about local procurement. Then there starts to become this element in which these start to play together a little bit. You get more local investment happening in companies where the profits go into the hands of lots of local people. Then we’re talking about really seriously changing some trends. Do you want to talk a little bit about how these different pieces start to build into a complex?

Neil McInroy

They all interplay with each other. A simple example is a large anchor institution, a local city buying goods and services. It may wish to buy or seek to buy that good or service from an employee-owned firm so that it’s not a global corporation that would extract the surplus. It sticks with the local employee-owned firm, and the workers are, in a sense, the beneficiaries of that as workers but also as owners of that firm itself.

They also would have a supported living wage policy. So it supports a different form of ownership and clear real living wage policies. It will have, with that firm, that procurement process, be interested in the governance and the financial investment portfolio of that employee-owned firm. That would play into the financial pillar if you like. Also, it may be interested in terms of its use of land and property and what its ownership structure around that is, and also how it seeks to play beneficial, wider stewardship of land within the place that it exists. So they all interplay in different ways. I think the action planning process for community wealth building is where you really see the connective tissue between those different elements in community wealth building.

Just a practical point, Colin. Many areas starting to work on community wealth building, start with procurement or start with work. But ultimately, the full cream requires all of those pillars and how they all interconnect, interfuse, and relate to each other. That’s where you get the more scaled-up system change in terms of how the economy works and who it works for.

Colin Bruce Anthes

Something that I wanted to throw in here was this conversation about the land that you began there. We’ve done a number of interviews with the economists James K. Galbraith and Michael Hudson, who think that we really need to give more attention to some of the classical political economists who talked about the importance of land and rentiers.

One of the points that Henry George pointed out was that there is this double-edged sword to progress. He wrote a very famous book called Progress and Poverty, in which he pointed out that in the very places where we have growing populations, more productivity, and more prosperity, the value of land goes up. That means landlords are collecting more without actually contributing anything. In fact, the working class, by contributing, drives up their own cost of living. Often that leads to the working poor or people being thrown into poverty. That’s also known sometimes as the problem of gentrification.

How do we create forms of land ownership, at least in getting a foot in the door, so that we are keeping people from being pushed out through gentrification? When we get more local procurement, we get more inclusive ownership of enterprise that will create more prosperity, but there’s the risk of a gentrifying effect.

Neil McInroy

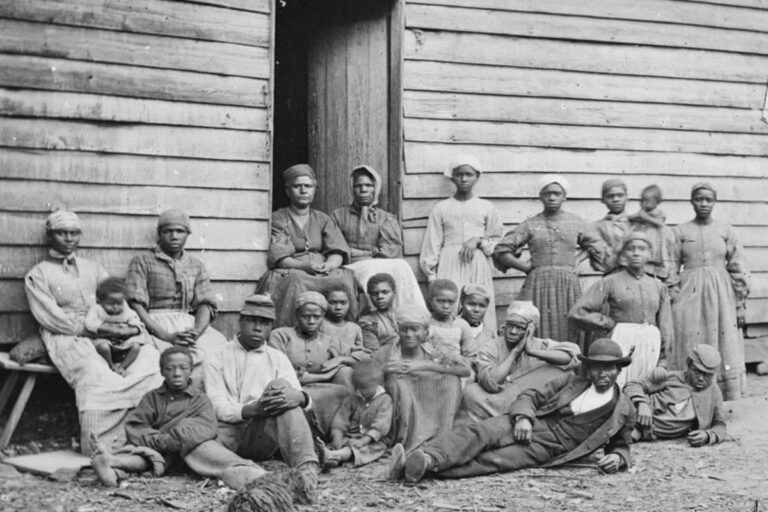

Yeah, absolutely. I completely agree with what you said there. I’m familiar with the people and writers you mentioned. Land is fundamental, and land is not really a commodity. It shouldn’t be a commodity. It’s the very nature of humankind in terms of land if you extend it to the wider biosphere and environment. So land is fundamentally important. It’s not a commodity. It’s been commodified and largely accelerated through modern capitalism, in terms of commodification. It’s extraordinarily hard to uncouple land ownership that goes way back to historic injustices. The idea of going deep back into the history, I think, is really, really important. It’s thorny, difficult, and fraught.

From a community wealth building perspective, there are big questions about land and land change in historical reparations. There is this need to start whatever we can to increase this democratized ownership of land, either state ownership, community ownership, community land trusts, or different forms of land reform.

For instance, in Scotland, where I live, we have a Land Reform Act, which means that when a piece of land comes up for sale, communities have the first option to purchase that. There’s a small window when communities get the opportunity to get their stuff together to potentially buy it before it goes out into the market.

You said it, and I’m repeating myself, but clearly, land is fundamentally important. We need to have a new mechanism by which we seek to have community ownership, community land trust, and different mechanism, legal mechanisms to increase the opportunities for communities and collective ownership of that land.

Colin Bruce Anthes

There is another pillar that needs to be brought up here, and that is the big pillar of finance. That’s a big question because, of course, the 1% are not particularly eager to put funding toward other people’s ownership of enterprises and land.

When it comes to things like worker cooperatives, corporate banks are often very hesitant to offer anything in terms of loans. There’s also the question of whether we even want those corporate banks in that conversation in the first place.

I recently did an interview with Bill Black, who was one of the major bank regulators in the United States. He feels that the big banks in the United States have to be brought down to a scale of under $50 billion each if we’re going to avoid having them as systemic threats. They’re so corrupt and so big at this point that they can crash the economy at any moment. What can we turn to in terms of finance if we cannot turn to these big lenders and these big corporate financial institutions?

Neil McInroy

Good question. Again, some of the pillars, in a sense, are more readily ready in the grasp of municipalities, communities, nation-states, and procurement. It’s more readily grasped in terms of its entirety of what you could do. Other pillars are less down the line, less realizable, and clearly, we need huge changes to the global financial system and the global banking system. That’s huge. It’s international. It’s legislated regularly.

What one can do in terms of the financial ecosystem is to think about how we increase the circularity and the virtuous nature of national or local finance. So public banking, and there are many in North America, has an intimacy with place. It has a relationship to that place. I think that is a thing that we need to see accelerations of. How do we use our public pension funds, how are they used, and how do those public pension funds, what are they investing the resources in? Are they investing it in things to make a return, Dubai, nuclear warheads, cigarettes, or is it actually a local investment? Also, those are the more localized forms of financial activity like community development finance initiatives, credit unions, and other forms by which we can capture some of that wealth and make it more circular and virtuous.

Also, we have the role of public resources and national investment banks. In Scotland, we have a national investment bank, public-private. I think using our own public resources to create investment vehicles that are more virtuous and community wealth building centered is important. So a very localized neighborhood community level, we need to start to find ways by which we can put some of our spare capital, but also vehicles by which it can be made recirculated when we do get a return to different enterprise activities back into the economy. So there are things we can do at a very micro level, I think, that’s important to start to break the dominance of the national and international financial system. Ultimately, that will need to be heavily regulated in the future if we’re going to save the planet and save us all.

Colin Bruce Anthes

Yeah, well put. You brought up credit unions, and that was something that, when I was growing up, I didn’t know the difference between a credit union and a standard corporate bank. That was something that I learned in my 20s.

As I was looking in Canada, where I’m based out of, the French-Canadian province of Quebec has a huge array of cooperatives of all kinds of different sorts. They have about 45% of Canada’s cooperative housing. They have the biggest collection of worker cooperatives of any state or province across Canada or the United States. I was asking, where did this come from? How did they get all of these different forms of cooperatives? The answer was, well, they actually had a huge credit union movement at the turn of the 20th century against usery, against the shenanigans of corporate bankers. They developed this huge infrastructure of credit unions that then provided loans for all kinds of other cooperatives that made life a lot easier in that province. As I started to learn about that, I realized that there are also credit unions around where I live, and there are democratic sources of finance that I had never thought about. That also brings in this second layer of, once I know that those exist, I also have to start thinking about how those can be used because even people who are maybe banking at a credit union might not know that they’re part of a democratic institution and that they have outlets for facilitating some of the other things that they want to see in their community. So there’s a huge educational component to this.

Neil McInroy

No, you very eloquently put it, Colin. You’re spot on. I think that is where we get to the realms of the economic strategy, the narrative. These are very important. I think there is a lack of economic literacy, broadly speaking. We tend to be consumers, recipients of, rather than active players within the economy. The best economic strategies around the world, I feel, start to surface– the five pillars of community wealth building– how we are constructing an economy that does work for us and our communities. It starts to, in a sense, by creating a narrative, the understanding of how these things relate to each other.

The classic is the individual who may have some spare capital in their bank account. Most people don’t give it a second thought. They just sit it in the bank, and it incurs interest, be it an ethical bank or whatnot. Where are the opportunities for them to invest in community shares or a local project, which may also bring a return, perhaps an equal return, maybe even more of a return? So the options are not there. I think that the important thing about community wealth-building strategies and links to economic strategy is to raise the bar on how one uses the capital that is in a place, the finance that is in the place, and what we as individuals do in that locality.

Colin Bruce Anthes

Could you talk a little bit about some of the models of community wealth building that have been implemented thus far in some of the communities that have used these strategies and how they’ve gone about doing that, hitting the ground running?

Neil McInroy

Community wealth building began as a term invented by my organization, the Democracy Collaborative in Cleveland. We coined the term. At that point, 17 years ago, it was broadly about the procurement of anchor organizations and how they promoted the growth of cooperatives. Then I helped to transfer it to the United Kingdom. In Preston, we also focused initially on procurement and anchors. Since then, it’s grown to think much more about cooperative development, a real living wage, public banking, different forms of finance, looking at community land trusts and different forms of land ownership. It started to spread its wings, if you like, to encompass the wider pillars.

In Scotland, where I now live, I used to work for the Scottish government as a community wealth building adviser. In Scotland, they adopted the whole model of the five pillars and have a series of action plans in a number of localities across Scotland where they take all of the five pillars and assess where they are in terms of community wealth building and then seek to put in strategies to grow them and how they all interconnect as well. That, in a sense, is becoming the mainstream approach. All areas have a community wealth building approach, and it’s fast becoming, I hope, the mainstream way we do economic development strategy in Scotland, in localities.

Places like Sydney in Australia, they also have an assessment of the five pillars, state of play, and look at strategies and how they develop. I think the five-pillar model, through an initial landscape assessment of where a place is across those five elements and then a strategy to improve them, is now becoming the accepted framework for many areas across the globe.

Colin Bruce Anthes

So you were involved in the pilot project in Chicago, were you not? Were you part of the planning process for that?

Neil McInroy

Yeah.

Colin Bruce Anthes

Can you describe some of the nuts and bolts of what Chicago used as a pilot?

Neil McInroy

The Chicago process already had begun by the Office for Equity and Racial Justice, the Community Wealth Building Initiative. We came in using our action planning model to do a fairly light touch assessment of where Chicago was, particularly in southwest Chicago, across the five pillars. So we did an assessment around procurement, workforce, finance, inclusive democratic enterprise, and land. We came up with a number of recommendations of how they could build on what they have anyway, progressive stuff that was happening anyway in Chicago, so how they could amplify and scale some of the good stuff that was there. That is now part of their Community Wealth Program initiative, which is partly funded through ARPA, the American Recovery Plan Resources. I think it’s a £15 million initiative, which is very much a seed to community wealth initiatives. They have a range of different interventions, policies, programs, and activities that looks to grow community wealth across a number of the pillars and across a number of the pillars joined together.

Colin Bruce Anthes

Are we talking about things like worker cooperatives in this case?

Neil McInroy

Yeah, they have an emerging new cooperative network of support, urban food growing, connecting up demand for food from, say, the big anchor institutions with the producers and the distribution mechanisms, catering contracts and so forth that are worker co-ops. So it is those sorts of relatively small-scale but powerful demonstrators of what could be done in terms of tackling some of the ingrained injustices that parts of Chicago face. It’s one to watch, I think, in terms of how it matures and grows. Obviously, as a new Mayor now of Chicago, I’m interested to see how he takes that forward.

Colin Bruce Anthes

What about the concern that some people might have that a focus on local procurement could lead to inferior purchases, that people will end up with more expensive products, possibly worse products? Is that a serious concern for community wealth building?

Neil McInroy

It’s certainly a comment I hear a lot. In all my experience of 15 years in community wealth building, I’ve never yet seen a piece of procurement happening through the work of community wealth building that sees a hugely inferior service or inferior product or something that hugely increases the price. The reason I think that happens is because most of the goods or services that we purchase are virtual monopolies. There’s actually a lack of competition, and there’s huge extraction of wealth and investment in that product by shareholders.

If you were to take a neoclassical stance, though I don’t, but if you were just turning it completely on its head, what community wealth building does is actually increase competition. It increases the range of different potential providers of a good or service. It heightens competition, and we know competition can improve demand and we know it can decrease prices. So I think if every area in Canada or anywhere in the world was to do community wealth building, I think you’d see a better quality, lower price, and you would see a whole effervescence of innovation in our economy, which in some places, sadly, lacking through the dangerous extracting of wealth.

Colin Bruce Anthes

I know Matthew Brown, the Council lead in Preston; his take on it is that community wealth building in Preston by massively expanding the number of living wage workers in the city actually led to a drastic increase in local government tax revenues, and they were able to invest more and more as a result of doing these practices. So perhaps it’s more of a slogan than an actual practical concern. Am I not putting words in your mouth if I were to say that?

Neil McInroy

No. Clearly, there’s a fiscal gain potentially of more enterprises in a place through the flourishing of community wealth building—Matthew’s right on that. I wouldn’t say it’s more a rhetorical thing. I think if community wealth building was done badly, if there was someone who wished to choose a very narrow procurement line that says, I’m going to take it off that firm, and I’m going to give it to this firm whose just a startup worker ownership, worker-owned firm who has got no track record in this, then clearly that would be a mistake and it wouldn’t work out very well. But I’ve never seen anyone interpret community wealth building or doing that act. In fact, it’s more likely to happen within the existing anti-progressive procurement process where an influential big corporate influences the public bodies and ends up getting a contract and doesn’t deliver on it, which is actually where the scandal that happened with public procurement in the United Kingdom through its protective equipment during the COVID era, where large firms got these contracts, who donated to the ruling party, and actually the materials were useless.

Colin Bruce Anthes

There are some movements that are finding that the Venn diagram between what they’ve been working on and what community wealth building is working on have very strong overlaps. Two that come to mind immediately would be Kate Raworth and Doughnut Economics, talking about building an ecologically sustainable economy. Increasingly, as she goes into how that actually functions in practice, her recommendations are increasingly about community wealth building, building employee ownership and more local procurement because this stuff, of course, shortens supply chains, gives people affordable housing and living wages in the first distribution. It’s a much more efficient use of resources.

The other one would be Pickett and Wilkinson’s work on well-being and talking about how their analysis of equality is that more equal societies don’t just tend to produce better education and health results because their programs work better; it’s actually that the equality itself is helping to facilitate these things. It’s less likely that people are going to get left out of friend groups because some can afford to go to the movies, and others can’t. You get more trust and cooperation. You get less anxiety and less exclusion and loneliness. They were talking about community wealth building extensively.

Do you want to talk a little bit about how some of these well-being and environmental movements are increasingly overlapping with the community wealth-building movement?

Neil McInroy

Yeah, it’s great. I think common sense naturally comes together. I don’t see all these complementary agendas as alternatives. I think it’s the new mainstream, or it should be the mainstream and the new common sense. Of course, I know Kate’s work very well, and I know the well-being economy work, and Kate Pickett and Richard Wilkinson know their work. They’re fantastic. There are many others as well, agendas.

I see them as all complimentary and all dovetailing. I would say as a movement of alternative economics, we always need to be generous and extend a hand. I think neoliberalism wants to splice and dice and pick divisions. I think it’s important that we come together and see them all as one. There are differences, though. I think that community wealth building, its key point of difference for me anyway, is that it’s always been practically focused. It comes from practice. Its provenance, of course, lies in cooperatives, democratizing the economy. The economy has an oikouros, keeper of the household, a social construct. It has its rich, rich provenance, but it’s always been rooted in practice and taking the fight on directly to those economic strategies at a local, regional, or national level. So it’s very much focused on a practitioner level. Here’s what you can do in one day. Here’s what you can start.

I think the crisis we face, we can’t procrastinate, we can’t conceptualize, we can’t just describe the problem. We need to get on. Many, many people who are not particularly interested in concepts, they just want to know, what have I got to do on Monday to start to turn the dial on these things? That is the beauty of community wealth building.

The reason I came to community wealth building 15 years ago or so was that I was looking for a practical alternative to the neoliberal economic development that I’ve seen. I was well aware of alternative concepts I wanted to practice. So I think it’s brilliant that doughnut economics and others are starting to move more towards practice because that’s what we need to do. We need to win this fight every day on streets, in neighborhoods and show how these alternatives truly make a difference in people’s lives.

Colin Bruce Anthes

That’s brilliantly put. I love that phrase, the new common sense, and I hope that certainly is what is taking place.

Neil McInroy

Me too.

Colin Bruce Anthes

What resources should people be turning to if they want to make the next jump in an intelligent way, know where they can find research and data and things that will be of use to them?

Neil McInroy

Well, two things come to mind. The Democracy Collaborative, we’re just about to finish a guide on community wealth building, which will be on our website soon. So hopefully, within the next month. In Scotland, the Economic Development Association of Scotland, EDAS, Economic Development Association of Scotland have a website, and they have a guide called Implementing Community Wealth Building. The Center for Local Economic Strategies, CLES, has a range of resources on community wealth building too. So I would say Democracy Collaborative in the US has a website and a new guide, the Center for Local Economic Strategies in the United Kingdom, and the Economic Development Association of Scotland. Those three organizations have altogether the best that you would have everything you ever need about community wealth building if you went to those three websites.

Colin Bruce Anthes

Fantastic. Neil McInroy, thank you so much for joining us today. This has been very enlightening. I think you’ve given a wonderful overview of both the theory, the practice, and the next steps that anyone can start taking. At this time of a series of different crises, we need that more than ever. So thank you so much for being here.

Neil McInroy

Thanks very much, Colin.

Colin Bruce Anthes

Thank you for tuning in. If you enjoyed this content and would like to see more like it, consider going to our website and hitting the donate button. We’d certainly appreciate your support. Take care.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | Email | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

“Neil McInroy is a leading urban economic policy thinker, expert, practitioner and organizational director. He is currently the Global Lead for Community Wealth Building at The Democracy Collaborative. Based in the USA, TDC is a leading think, do and change tank, working to grow the democratic economy.”

This is not a reply to Bob Spencer. It is a comment on the transcript.

At no point does CBA call his interlocutor on his lack of specifics. In this entire fairly long exchange, there is not a single example of a specific, concrete,

m e a s u r a b l e

action, transaction, event or initiative to demonstrate the connection of these lovely, good-intentioned abstractions to the realm in which actually existing neoliberal capitalism’s fangs continue to crush the life out of what order remains in our disintegrating global productive process.

“Ultimately, that will need to be heavily regulated in the future if we’re going to save the planet and………”

…”in the future…” being the operative idea here, gets one safely away from the questions of who will be “heavily” regulating, by what methods and under what authority. B/C the truth is that the sabre-toothed predator isn’t going to stop harvesting its prey or comply with a politely proffered cease-and-desist order from “The New Order.” aw

This is an important story. I wish we could see an on-going progress report about community wealth building.

Many thanks!!