Central banks are raising interest rates to create more desperation amongst workers and weaken their bargaining power. Bob Pollin joins Paul Jay on theAnalysis.news.

Paul Jay

Hi, I’m Paul Jay. Welcome to theAnalysis.news. In a few seconds, we’ll be back with Bob Pollin to discuss inflation. Speaking of inflation, don’t forget there’s a donate button on the page. We can’t do this without your support. If you’re on YouTube, please subscribe. If you’re listening to one of the podcast platforms, please come over to the website. Same thing if you’re on YouTube; get on the email list because that’s the only real way to know when our news stories are coming out. We’ll be back in just a few seconds.

The annual inflation rate in the U.S. slowed to 8.3% in April, slowed. That’s after a 41-year high of 8.5% in March. Energy prices increased 30.3%; that’s a little bit below March. Gasoline was at 43.6%. These are annualized inflation rates in April, compared with 48%. So down a little bit from March. While fuel oil actually increased a little bit in April over March. Foods up around 9%, and in many key products, even higher. Housing is at least 5%, and in some places, far higher. But it’s a little bit down. So is inflation trending down? Is raising interest rates the answer? What’s really driving inflation?

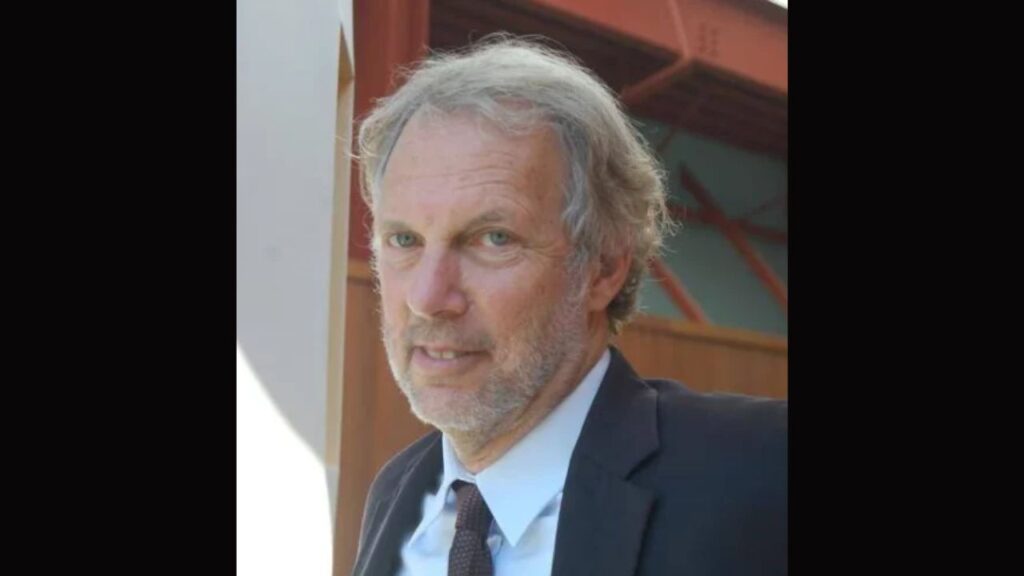

Now joining us is Bob Pollin. He’s the co-founder of PERI, the Political Economy Research Institute in Amherst, Massachusetts. He’s an author of the book he co-authored with Noam Chomsky titled Climate Crisis and the Global Green New Deal: The Political Economy of Saving the Planet. Thanks for joining me, Bob.

Bob Pollin

Thank you very much for having me, Paul.

Paul Jay

So before we get started, after our last interview about inflation, there were all kinds of comments and everything. You were saying you weren’t expecting a lot of inflation, and a little inflation, if it’s caused by higher wages, isn’t so bad. Normally when wages are higher, they go higher than the rate of inflation, so there is a gain. Where we’re at now is far beyond, I guess, what you and most other economists were imagining back then. So deal a little bit with this question. How much are wages part of what’s happening now? What are the other and perhaps more important forces driving inflation?

Bob Pollin

So, yes. I don’t need to recite the numbers you just gave, which are all accurate and critical figures. So if the overall inflation rate is 8.3%, the average increase in labor costs over the last year was about 4%. So that means that the overall inflation rate is rising twice as fast as the labor costs, including wages and productivity, the amount that the workers are contributing. So what that tells us, at the very least, it tells us that there are other factors driving the overall inflation rate beyond anything to do with wages because the wages, on average, are only going up by 4%.

By the way, where are the wages going up highest? Well, the fastest wage increases are workers in food and accommodation: hotels and restaurants. These are people who got laid off during the COVID lockdown and experienced real income losses. It’s about time they got a bit of a wage incease.

Paul Jay

I assume that a lot of people working in that sector didn’t even want to go back to that sector because of COVID. They have to raise wages to attract people.

Bob Pollin

Yeah, and their wages are still obviously barely above minimum wage, barely a survival wage. So that’s where the largest jump in wage increases is. For example, wage increases for union workers are below the average. It’s about 3.5%. The average is 4%. This notion that workers are strong-arming their way through unions to higher wages is obviously inconsistent with the facts.

Paul Jay

Let me just add one other thing. Whole sectors of the economy where people are at the lowest end of the scale and not in the service industry, I don’t think their wages have gone up much at all. They’re getting the most screwed by this inflation.

Bob Pollin

Right. What are the other two factors that are driving this overall inflation rate? We already mentioned one, and we need to come back to it, which obviously is energy. The energy price increases if we look at gasoline and heating oil, as you mentioned, huge jumps. Close to 50% jumps, and that far exceeds anything that might be resulting just from supply chain issues. It’s because the oil companies, the fossil fuel companies, are able to mark up their prices well beyond their costs. The war in Ukraine is part of the story, but this was already going on before the war started. This represents their pricing power, their monopolistic pricing power. They did experience a major dip during the COVID lockdown, and they’re more than making up for it, and we can see it. Their stock prices are up 40, 50, and 60% relative to pre-COVID. Their profitability is up relative to pre-COVID. So that’s one thing that’s going on.

The other thing that’s going on is, generally, the supply chain breakdown that occurred during the COVID lockdown is still working its way through. One example, used cars are up about 40% relative to a year ago. Why used cars? Well, primarily because of the shortage of computer chips for building new cars. About 2,000 computer chips are integrated into a new car assembly. Without those, we have a slowdown in new car manufacturing, resulting in higher demand for used cars, and that’s kind of representative of what’s going on.

So the supply chain issues, I think, are working themselves out. This is why, as you noted, we are starting to see a bit of a decline in inflation. The other two factors, wage increases and energy prices, are still locked in. Gasoline is 150% higher than what it was a year ago. Gas at the pump is averaging at about $4.50 a gallon in the U.S. It was $2.20 a year ago.

Now let’s focus on the wage increases because that’s the part you asked about: the Federal Reserve raising the interest rate. So effectively, the Federal Reserve’s policy of raising interest rates to fight inflation is effectively a policy of raising the unemployment rate and weakening worker bargaining power. This is stated explicitly. I actually just printed out yesterday a story from Bloomberg News that is saying how the financial markets and the Fed are very happy to see that the workers’ bargaining power is going down, that they anticipate higher unemployment rates, and that is going to bring down inflationary pressure from the side of workers.

What does this all mean? On average, workers haven’t gotten a raise in the U.S. for 50 years, close to 50 years. The average worker’s wage at about $52,000 a year in today’s dollars is basically what it was in 1973/74. When we started to see a little drop in unemployment due to the stimulus programs to fight the COVID lockdown, they were effective at driving down unemployment quickly and giving workers correspondingly a bit of bargaining power. A bit of bargaining power. What we’re saying now is that the U.S. economy cannot operate with workers having any bargaining power. It’s effectively what we are saying. The unemployment rate officially is 3.6%, and that’s giving workers too much bargaining power. Workers’ bargaining power is reflected in this 4% average wage increase. That’s giving workers too much bargaining power.

Now keep in mind that inflation, just as a matter of definition, inflation is not wages going up by definition. It is businesses marking up prices maybe because the wages have gone up or maybe because they have pricing power. What we are really seeing, and this requires a lot of reflection, is that we’re seeing an economy which is unable to give workers wage increases that are sustained under our current institutional environment. The result of workers getting any wage increases is a business markup by equivalent or more. We’re saying that the only solution to that is to drive back down the workers’ bargaining power. Down to where it’s zero. Down to where they get no wage increases.

Forty years ago, the average worker was making about $50,000 or roughly. The average CEO was making $2 million, 15 times. Today the average worker is still making about $50,000, and the average CEO is making $20 million. The average CEO’s compensation has gone up tenfold relative to what it was 50 years ago, whereas the average worker has basically remained flat. This, to me, defines neoliberalism as well, if not better than anything else. We’re saying that this is the institutional environment that we have to defend by forcing the interest rates up, which will turn engender declining employment.

Paul Jay

I remember maybe around a year ago, I would listen to Bloomberg Radio, and I would hear Wall Street experts come on supporting the big stimulus packages. They would say, look, inflation is really structurally gone now. The spending itself is not going to cause inflation. Then I would hear Republicans and conservative Democrats going on and on about all this debt and deficit that is going to be inflationary. It kind of hit me, and this is what you were saying. It’s not that the spending, quote-unquote, was inflationary. What these guys didn’t like was the money people were getting in their bank accounts and the financial support they were getting, which frankly was pretty modest, but at least it was something. It was going to do something that the Republicans said most openly but didn’t use these words, but it’s what they meant: it was going to weaken labor discipline. They had got the working-class used to shitty wages. They had got the working class used to not quitting a job because you were afraid you’d never get another job.

Now, and in fact, what they were worried about, these Conservatives, has actually come to pass to a large extent. People aren’t always going back to the job they hated. People are more willing to quit because unemployment is not as high as it had been. The prime directive now for these guys is you got to squeeze this back out of the economy. You got to get the working class back in line.

Bob Pollin

You mentioned the quitting. It’s true. The so-called quit rate has gone up. The percentage of workers who are quitting their jobs is higher. It’s starting to dip down, which is what the bosses want. The peak rate, the quit rate, was 3.5%. So 97.5% of workers are not quitting their jobs, and 3.5% were. During COVID, it was much lower. It was only 1.5%. So, yeah, the stimulus programs did succeed. They succeeded in preventing a 1930-style Great Depression. They did succeed in bringing down unemployment really quickly.

During COVID, the top unemployment rate spiked to 15%, and then it came right back down. Within months, it was down to roughly where it is now, less than 4%. After the 2009 financial crisis, it took a decade to get unemployment down to less than 4%. We did it this time in less than a year. So the stimulus program did succeed. Yes, it did give workers somewhat modest but gave them some bargaining power. The child credit lifted millions of children out of poverty. It enabled their parents, mothers, primarily, to not have to hold two or three jobs. This was good. This money has run out now, and that’s part of the reason why we’re going to start to see inflationary pressures dip. That would happen in any case, but the Fed is now focused on bringing it down further via raising interest rates to slow the economy.

Let’s say what it really is: to raise the unemployment rate and to eliminate whatever modest increase in worker bargaining power workers have experienced in the last year.

Paul Jay

The stimulus spending itself, even the effect it had on a very modest increase in wages and lowering of unemployment, how much has that got to do with the inflation? If it’s such a minor component of the bigger causes of inflation, as you’re saying, the cost of fuel, supply chain issues and such, then what the hell is raising interest rates going to slow inflation?

Bob Pollin

Well, if we say that inflation is roughly 8% and wage increases are roughly 4%, if you can get that 4% wage increase down to zero, now you’re down to a 4% inflation rate. If the supply chain issues are 2% of the overall, and that is going to work itself out, well, guess what? We’re back to 2% inflation caused mainly by oil prices. We have been running an economy at roughly 2% inflation for decades.

Paul Jay

How much of this inflation, when you say wages 4%, so that’s 4% of inflation. Is it really a one-to-one relationship? It could be that wages go up 4%, but it’s actually only 2% of inflation. They did a study here of a grocery store called Loblaws, here being in Canada where I’m living now. It’s probably the biggest grocery chain. They compared the profitability pre-COVID to the profit ratio now, and it’s significantly higher the amount of profit. They’re using all this as an excuse to raise profit.

Bob Pollin

So it’s definitely not one-for-one. Even in that 4%, to be more precise, it’s not all wages; it’s labor cost. So if we factor in wages plus productivity increase— productivity, let’s say, if it goes up by 1%, the wage increase is 3%. In any case, you’re right. The fact that workers get wage increases of 3% or 4% does not mean that the businesses necessarily raise their prices by that amount.

Number one, you could increase productivity. Number two, it means that, okay, effectively, we are modestly building in a more egalitarian distribution of overall income. So if businesses sell their products, they get income. Who gets the shares of income? Well, it’s not written by law that workers can’t get a somewhat bigger share of the income. We are effectively saying that that’s true. Workers cannot get a bigger share of income.

What we’ve experienced over more than two generations is that workers in the U.S. just don’t get raises. They have basically experienced wage stagnation for almost 50 years, while average productivity has more than doubled. So if the workers were making on average $50,000 a year now— I’m speaking in rough numbers— productivity has gone up two and a half times. If the workers got wage increases equivalent to the amount they produce every day, they’d be making over $100,000, and the income distribution in the U.S. would stay the same. But like I said, instead, the workers made $50,000 in 1970, and the CEOs made $2 million. The workers make $50,000 now, and the CEOs make $20 million. That’s the reality that this policy is defending. Gains from productivity go entirely to the ownership class, whether it’s CEOs or whether it’s coupon clippers on Wall Street.

Paul Jay

It seems to me there are two things that kind of operate from the point of view if you own a business and you’re looking at your workforce or even bigger picture at the working class. One is the level of desperation versus the amount of confidence workers have. The lower unemployment is, and because of the stimulus and a certain lack of lessening of desperation, at least for a while, it’s given rise partly to a new militancy in the working class. People are getting organized into unions. There are strikes all over the country. This issue of labor discipline is a thing. We got to raise the desperation factor and shake the confidence.

Through globalization— I’m saying we, I’m putting on a hat as if I’m a corporate guy. Through globalization, we shook the confidence of the working class. They were so afraid that if they organized, we would ship their jobs offshore. Now they’re getting confidence back. There’s even talk that we can’t trust the global supply chain, and we may have to bring production back to the U.S. Well, if we’re going to do that, we need to do it in a way that doesn’t increase workers’ confidence.

Bob Pollin

So, I mean, look at where the organizing is taking place—for example, Starbucks. You can’t ship coffee delivery to China or to Guatemala. I mean, the workers are here.

Paul Jay

Same thing with an Amazon warehouse.

Bob Pollin

That’s right. Same thing. Exactly what I was going to say. They have to be able to deliver here in the U.S., so that creates this problem, which is worker discipline. By the way, let’s give credit where it’s due. This is like front and center, Karl Marx, Das Kapital, Volume One, Chapter 25. This was one of the most critical points he makes in all his voluminous writings. Capitalism cannot operate effectively at full employment because full employment will give workers too much bargaining power. He coined this term, the reserve army of labor, which we call mass unemployment, is critical to the operation of capitalism. That was his point. We are experiencing this Marxian scenario right now.

Paul Jay

I asked a friend of mine, a youngish friend of mine, what she thought was the reason for rising inflation. One of her first answers was my friends are saying wage increase. I think it’s very true that in sectors of the working class that are not unionized, they often blame unionized workers for inflation. It’s simply not true.

Bob Pollin

No, it’s not true. I mean, that’s not true from the government statistics. The wage increases for unionized workers are slower than the wage increases for the average worker right now in the U.S.

Now, the other factor, just to get into it a bit, is the energy prices. My position, which may be a bit controversial, is that I don’t think energy prices should come down. I think energy prices and fossil fuel energy prices need to stay high and maybe even go up higher. Why? Obviously, to discourage people from consuming oil, coal and natural gas because they are the major cause of climate change.

So what do we do when we also have to defend the well-being of the working class? Actually, there’s a pretty good proposal in Congress now, which is a windfall profit tax that would tax at least 50% of the profitability of the energy corporations, and private corporations and distribute that money back to people.

My own rough calculation, if you did that at current gasoline fossil fuel prices, it would be about $130 billion in revenue over the year. Then you could distribute that in equal shares to every single person in the country. To keep it simple, everybody gets $400—every single person. Say a family of four, therefore, gets $1,600. So it does a pretty good job of defending the living standard of working-class families. Ideally, we shouldn’t have the oil companies having pricing power at all, and we should therefore have the oil companies nationalized.

Paul Jay

Yeah, that’s the proposal I like. If you nationalize fossil fuels, you could lower the cost of gasoline for ordinary people because it would be part of a plan to phase them out.

Bob Pollin

Then we just keep cutting the supply. Yes, we could have reasonable prices, but we factor in that you don’t need price disincentives. You don’t need high prices to prevent people from buying gas. You just make the supply lower, and you say, you know what, go buy an electric heat pump, and you can electrify your house rather than requiring you to buy heating oil, which would be the most rational policy now. Short of that, the windfall profit tax is better than lowering the fossil fuel price because right now, we’re still making almost no progress in eliminating CO2 emissions.

Paul Jay

Well, let me jump to that then in the few minutes we have left here. What is left of what wasn’t much of a climate plan, to begin with, but it was something? The Biden climate plan, is there anything left of it?

Bob Pollin

Not so much. Nothing has passed. Build Back Better started with Bernie Sanders as a very robust program. It was climate and several other things, but the climate part was a good third of the overall program. Biden cut it in half, and then he cut it again to satisfy Senator [Joe] Manchin and Senator [Kyrsten] Sinema. They still won’t support it, at least in my reading of the chatter out of Washington. Manchin said he would support something focused only on climate and not all these other social spending areas. That’s what I read, but nothing has happened. So to date, no. Meanwhile, to date, Biden has reneged on his promise not to allow drilling, exploration and drilling on federal lands. The excuse being, well, we need to expand the oil supply to bring the price down. Of course, allowing drilling on federal land will have absolutely zero impact on prices, if at all, maybe for a couple of years.

Paul Jay

Well, it makes no sense. There’s no national oil price. There’s a global oil price. Just because you produce more in the United States, they’re still going to sell it at global prices.

Bob Pollin

The amount that you could increase supply in the United States on the land of the minuscule relative to the global market. So it has no impact whatsoever. I’m sure the people in the Biden administration really know this. This is simply for optics to show, well, we’re doing something to lower gas prices. It won’t lower gas prices. In any case, that means overthrowing Biden’s promise. He promised as a candidate, “I will not allow any new increase of exploration drilling on federal lands. To make the point, he says, “period, period, period, period. I will never allow it.” Okay, well, so much for that promise. He’s allowing it.

What we also, therefore, need again— [Vladimir] Putin isn’t the only bad guy in the world. The world depends 80% right now on fossil fuels for energy. There’s always going to be some kind of crisis, short-term, or something with oil supply and prices. Therefore we need to have, as part of the climate transition, we have to factor in these short-term shocks that are going to continue happening. That’s just the way the world works. Every time one happens, we can’t have the administration say, oh, for now, okay, we’re going to forget about climate, but just a few months. We’re going to run this other thing to lower prices, and then six months again, we’ll pick up our climate program. We have to have, for example, something like this windfall profit tax. We have to hugely subsidize energy efficiency and hugely subsidize the expansion of renewable energy; that’s the way through which we can build a new energy infrastructure as quickly as possible.

Paul Jay

With today’s politics, that ain’t happening. This 2022 is going to be a rather critical election.

Bob Pollin

You’re right. So what we have to do, if we can’t succeed at the federal level, keep fighting at all levels, at the State level, at the local level. At my own institution here, UMASS, we have instigated a program to be at zero fossil fuels in ten years. So let’s, let all the campuses do the exact same thing. We have to move. We have to make something happen, whether it happens at the federal government level or not.

Paul Jay

I was talking to some organizers in West Virginia, and I was kind of surprised how little they’re actually talking about climate and basically saying people aren’t interested. They’re not even really talking about a just transition, which I would have thought would have been one of the number one topics for West Virginia.

Bob Pollin

Yeah, we wrote the study that you and I talked about. The just transition was actually received pretty favorably by the unions in West Virginia, including the mine workers and even Senator Manchin’s own staff.

Paul Jay

Except that he ignored it. What’s the staff?

Bob Pollin

The Senator ignored it. Yes, that’s true. The staff was very nice listening and said they were very favorable toward it. I mean, one of the things we showed, if they could just sink in, is that West Virginia itself could build a green energy infrastructure that would generate about 25,000 jobs. The job losses per year to wind down fossil fuels in West Virginia, we’re looking at maybe 1,000 jobs a year. So we have a program that is going to be beneficial as long as, of course, we have to build in the just transition. We have to have the jobs getting generated and the decent pay; that should be the struggle in West Virginia. That’s at least what we laid out. Other people know it. It’s kind of straightforward. That’s where we need to really move consciousness, whether it happens within the administration or not.

Paul Jay

Yeah. We got to find ways to talk to ordinary people in places like West Virginia. I saw a crazy statistic or fact that I wasn’t aware of. West Virginia, whole sections of West Virginia are more prone to extreme flooding as part of the extreme weather events caused by climate change than Florida. Like West Virginia is one of the most threatened places in the entire country by climate change.

Bob Pollin

And it’s one of the poorest States, if not last I checked, the poorest State. So what is the great benefit that they’re getting from their dependency on coal? They would be much better off through a green transition, and that’s what we tried to show in our study. Again, it’s out there, and we’re happy to talk to anybody who is willing to pay attention and think about the well-being of people in the State.

Paul Jay

So just to get back to inflation, if Biden had the backbone and willingness, which I don’t think he has either, but at any rate, by executive order, are there things he could do that would deal with inflation, which is so tied to the fossil fuel issue anyway?

Bob Pollin

I think that the windfall profit tax to me it’s on the table. It’s there. I think at least a version has passed in the House. It’s not called the windfall profit tax. It’s called the price-gouging measure. Let’s push those as far as they can go. I think that we have to get the energy prices, recognizing that we are living in a world that requires these high fossil fuel prices and then rebate people. I think people can recognize— if you got a $1,000 check from the President and it said this is to make up for the extra money you’ve been spending on gasoline, I think people would be willing to accept that and understand it and then accelerate the supply chain costs down. That I think will be happening. I mean, the Fed is projecting inflation at about 5.5% by the end of the year. I think that is probably reasonable. And then the wage increases, I think we should be arguing for more. We should say wage increases don’t necessarily mean price increases if we assume that there can be more equality in this society as opposed to what we’ve experienced for the last 50 years, which is more inequality every year. That’s the critical thing that needs to be reversed.

Paul Jay

I know what I’m dreaming is in technicolor because it’s not going to happen, but shouldn’t Biden declare a national emergency and use executive orders to simply deal with climate? We’re looking at it— in the next five years, there’s more than a 50% chance that one of the next five years, global warming will already hit 1.5° above the pre-industrial average. By 2033, we will be at 1.5°. At 1.5°, especially the way we’re going, we’re going to hit 2°. You’re going to hit 2°, you’re going to hit 3°. Like we are on the road to armageddon here.

Bob Pollin

Well, look at what’s happening in India and Pakistan just this last month. The average temperature is 124°. It’s unlivable. I mean, it’s livable if you have air conditioning, but 90% of the people don’t have air conditioning. Of course, they generate the air conditioning through electricity produced by burning coal, which in turn contributes to climate.

Paul Jay

They are increasing the amount of coal they’re using.

Bob Pollin

So yes, I would certainly endorse that. I think that we have to recognize that there is no excuse for postponing any kind of climate action and defend whatever Biden can do in terms of executive power, absolutely. He should be doing it.

Paul Jay

Well, it won’t be Biden. If there’s any chance of this happening, progressives that are primarying conservative Democrats, there really needs to be some kind of radical upsurge here because Biden is a prisoner of these forces as much as the other potential candidates are.

Bob Pollin

Agreed.

Paul Jay

Alright, well, that’s the call to action. Take over the world. Thanks very much, Bob.

Bob Pollin

Okay. Good talking to you.

Paul Jay

Thanks for joining us on theAnalysis.news.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

Robert Pollin is an American economist. He is a professor of economics at the University of Massachusetts Amherst and founding co-director of its Political Economy Research Institute.

I always enjoy your interviews w/ Prof. Polin, and with most people generally.

I -probably- agree w/ Prof. Polin about fuel prices needing to be high, but I feel that there’s another very important component present at this time. I wonder if our current fuel cost-crisis is largely a function of International diplomatic effects, i.e. wars, and sanctions. The bottom of current prices might completely fall out if Iranian and/or Venezuelan and/or Russian sanctions simply ended. If high oil/gas prices AND -low- market stability exist, things like new pipelines, nat. gas fracking, tar sands, etc. are much less than viable. Negative $40 per barrel oil happened for a bit a few years ago.

I believe there might be an interesting discussion about the possibility of fossil fuels being so cheap that they can’t even be taxed, and aren’t worth any effort to bring to market. Sounds kinda silly, but maybe imagine a future where fossils are 98% phased out – would gasoline be super-expensive, or just hard to get like racing fuels, or specialty coal for antique railroads? -Fuel prices: High or low? would be an interesting topic just on it’s own IMHO.

Regards inflation- my impression continues to be that the numbers we’re all gasping at are derived from a small basket of items, and everybody else is merely seeing what they can get away with and/or concerned about their own costs in the unknown future.

Regards unemployment/labor shortage/worker power as pertains to inflation- it’s possible that we’re merely picking up from where we left off before covid, and well before massive inflation. Many of the industries facing labor pressures currently were having a hard time finding employees long before covid -transportation in particular.

I’ll just stop now…

great interview