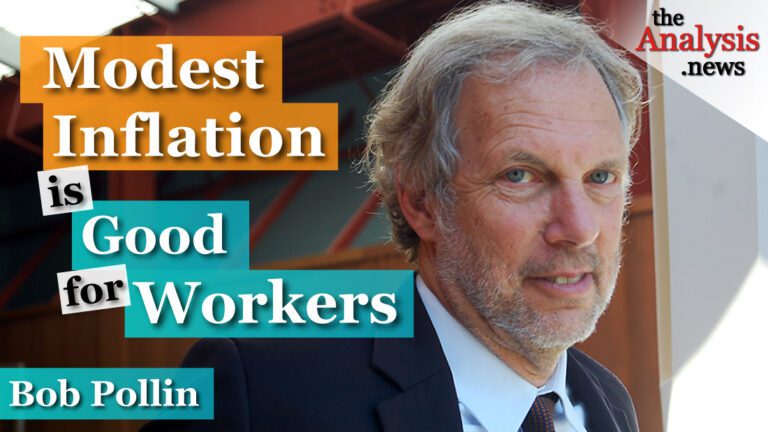

High oil prices and supply chain disruption are driving inflation, not workers’ modest wage increases or government debt. Bob Pollin joins Paul Jay on theAnalysis.news.

Paul Jay

Hi, I’m Paul Jay. Welcome to theAnalysis.news, please don’t forget the donate button and subscribe and all the buttons. We’ll be back in just a few seconds to talk to Bob Pollin about the economic crisis for inflation and supply chains and all the various issues that are rising.

So we are in what’s being called the post-pandemic recovery, and it’s never been clearer that the United States is divided into those who are awash in cash, of course, at the highest levels, they’re completely, perhaps, drowning in cash. But there’s larger segments of the society that do have some spending power right now, disposable income. Of course, there’s large sections of the society who are struggling and do not have disposable income and got really hammered during the whole pandemic crisis. But there is an interesting situation now where there is “a labour shortage.” People, at least for now, seem to be having some choice in what kind of jobs they want, and people don’t want jobs that are paying minimum and crappy wages and are exercising some judgment on where they’re going to work.

Unemployment benefits are running out. Various other kinds of government subsidies are running out. And of course, there’s this supply chain problem, which it seems to me was completely foreseeable, but I don’t know if it’s because of the irrationality of capitalism or there’s something else going on. But there’s dozens and dozens of ships, as everybody has seen on the news, filled with containers sitting off the Port of Los Angeles and other ports. And they’re talking about the consumer price index. What people really pay to live could be going up as much as 4% or 5%. If you listen to Bloomberg Radio, some things people have to buy might be going up in price by as much as 10%. And there’s, of course, a big debate on whether this is temporary as the recovery sets in, or is there something more being baked in? And the Fed is saying, the economists at the Fed, who apparently are supposed to know more than others, seem to think it’s temporary. But right now, even if people have some disposable income, they’re getting hurt in the cost of their day-to-day life.

So now joining me to talk about all of this is Bob Pollin. Bob is the co-founder of the PERI Institute, which is the Political Economy Research Institute in Amherst, Massachusetts. He co-authored a book with Noam Chomsky titled Climate Crisis and the Global Green New Deal: The Political Economy of Saving the Planet. And of course, Bob has authored many books on income and equality and the issue of the rights of workers and so on. So thanks for joining me again, Bob.

Bob Pollin

Very glad to be on. Thank you, Bob.

Paul Jay

So one of the interviews we did last we talked about, this was a few months ago. We talked about the possibility of some inflation, and you were saying a little bit of inflation isn’t so bad if it’s because workers’ wages are going up. Well, the inflation that seems to be setting in now, whether it’s temporary or not, actually doesn’t seem to be all that connected to workers’ wages, at least not very much. It’s to do with the price of energy going up, its global supply chains, to my mind, complete irrationality and lack of planning or deliberate chaos because maybe there’s money to be made out of this crazy shit.

But I know when I played that interview, I got a lot of feedback on YouTube saying, “Yeah, sure. Pollin’s saying a little inflation is not so bad, but he doesn’t have to worry about what would it cost to buy groceries every month.” So start with a little bit of dealing with what people are objecting to; how you were saying a little inflation is not so bad, and then where are we at?

Bob Pollin

Okay, what is inflation? First of all, inflation means a rise in the general price level. So if we look at overall prices, we take a basket of goods that includes necessities, and it’s not just one price that’s rising, but it’s this overall basket, which means that in order to sustain someone’s living standard, it’s going to cost more. So that’s what we mean by inflation. So there’s two basic causes of inflation, and one is, yes, when workers achieve more bargaining power, they bargain up their wages. So that’s the part that I was saying was good. They bargain up their wages, and then businesses try to pass on those additional labour costs in the form of higher consumer prices. So the good part of the inflation would be if the wage increases are exceeding the price increases that the businesses are trying to pass on.

Paul Jay

And that’s usually the case, isn’t it? That even if they try to pass it on—

Bob Pollin

They can’t fully pass it on.

Paul Jay

They can’t really fully pass it on. So increased wages actually is an advantage because some people try to argue there’s no point even trying to fight for higher wages.

Bob Pollin

No. So, for the most part, I’ve been working with different Unions on wage bargaining right now. I’m doing it without revealing the details with one of the largest Union contracts in the country right now. And so we know what the wage increase that we want to get in order for the real incomes after we factor in inflation. After we factor in inflation, the living standard of the workers is still going to go up. So that is one source of inflation.

The other basic source of inflation is what we say in the economic world is supply shocks. In other words, when you have something, the most prevalent form of a supply shock is really big jumps in oil prices. You can also have supply shocks if you have, for example, breaks in the supply chain. So the big one that’s happening right now, in addition to the energy issue, is with the semiconductors that go into, in particular, into cars. And it’s slowing down the rate at which new cars get built because there is this shortage of semiconductors.

So right now, when we talk whenever it was a few months ago, it looked like the major source of inflation was going to be wage increases. And I took that to be positive. So when we talk about, well, I don’t know what it takes for people to buy their groceries. Well, maybe I don’t, but I think I have a reasonably good idea. And if your wages are going up by 5% and the cost of buying groceries is going up by 2%, well, then you’ve just improved your living standard by 3%, which is not trivial once it’s compounded over some years. So that’s one thing.

Paul Jay

Okay. Just before you talk about supply, let me just add one thing to that. I think it’s going to be true that unionized workers that get a pay increase may get that extra, say 3%, but unorganized workers may not. They actually might get hit. And there’s a very simple answer to that, which is, excuse the language, fucking get organized because you’re going to get screwed if you don’t get organized. It doesn’t matter whether wages go up, down, sideways. If you don’t get organized, you’re going to get screwed. So that’s the only answer there is to that. But sorry, go ahead.

Bob Pollin

Yeah. So in terms of the supply issue, what’s going on right now is there’s really two supply shocks happening right now. And one is the oil energy prices. So I’m just looking; I just printed this out a couple of hours ago from the Department of Labour. So for September of this year, relative to September last year, we do have a very high measured inflation rate: 5.4%. That’s very high by historical standards. It’s high.

Now, what is this? It’s not evenly distributed across the whole country. The biggest price increases by far are in the energy sector, in particular, gasoline prices. Gasoline prices relative to last year have gone up by 42%. Now, it’s true that they were really depressed during the severity, the most downturn period of the COVID crisis because people weren’t travelling as much. And there was a glut of energy because of airline travel and so forth having collapsed.

Nevertheless, what we’re observing now is this increase in oil prices. In particular, what we’re seeing, gasoline at the pump is up 42%. That’s massive. And that’s a big part of people’s overall spending package. Other energy prices are in the range of 20%.

The other big area of price increase is used cars. Used cars because what happened there is that the car rental agencies have been selling off their cars when their businesses were collapsing. So they were selling off their supply of cars. And so then we have this situation where those cars are already either mothballed and now to rebuild the stock, we have the shortage of semiconductors. So those are the two big areas. And, of course, the energy cost increase feeds into everything else in the economy.

So let’s focus on the energy supply issues. Okay, right now. So we have this debate, and [Vladimir] Putin is strutting around saying, well, guess what? You all need me more than I need you. And we have [Viktor] Orbán of Hungary saying that the green agenda is destroying the global economy, that was just today or yesterday. So what do we do about that? I mean, the basic answer is straightforward in that one of the things that even this Commission, led by Alan Greenspan and other leading Orthodox economists in terms of addressing the climate crisis, they are proposing, tax, energy tax, and a subsidy for people to help them absorb the increased cost of energy. So tax and rebate. Tax and rebate.

And so what we could do right now is, for the moment is instead; we’re effectively getting the tax part because the prices of energy are going up. So let’s just introduce the rebates. And so people will be rebated. People will be covered to address these increases in energy costs. And that’s how we get through the immediate crisis. In the meantime, it serves the benefit of okay, we have much higher gasoline prices. Well, over time, we’ll figure out how to save on energy consumption, buy more efficient cars or start buying electric vehicles. And you don’t have to worry about the price of gasoline. But that’s obviously not a short-term solution, but for the short-term solution, then people should be rebated for this spike in energy cost.

Paul Jay

And there’s another thing that could be done, which has been talked about from the point of view of climate change, which is nationalizing the fossil fuel industry phasing it out. But if you nationalize the fossil fuel industry, you could also decouple from the global oil market because the United States produces enough oil for itself. Why do you have to sell at those prices? Just because “global market is that?” The same thing in Canada, Canada has enough oil for Canada. Why is Canadian oil being sold to Canadians at some global market price when it could be sold.

In fact, in Venezuela, they sell at a much cheaper price to their own people. I mean, too cheap, actually, probably. The whole issue is this irrationality of the way capitalism is operating now at a time of existential crisis. Even the semiconductor story is the same kind of irrationality. It just got explained to me the other day by the guy that actually invented the silicon chip. He’s not the only one who knows this, but this is the first time I really heard it clearly. Because Intel and the other American companies that use and sell semiconductors, it was cheaper for them to outsource semiconductor production to Taiwan and South Korea.

And then it turns out there’s only one country that produces the machines that make the high-level semiconductors, and that’s Holland. And if all the factories in Taiwan and all the semiconductor producers in South Korea, which is mostly Samsung, all buy from Holland. When there was this big downturn in the pandemic, and the car industry and everyone thought they weren’t going to sell much. They pulled back on the orders of the semiconductors. So the whole production line was slowed down. And it’s the same irrationality that’s affecting the other parts of the global supply chain. And it’s all because of globalization as a way to undercut the wages of American workers. The irrationality just boggles the mind. And now, apparently, it’s going to take them five to ten years to try to repatriate semiconductor production, assuming they actually really do it.

Bob Pollin

Well, you could say it’s irrational, or you could say it’s rational, because if it has led to increased profits for capitalist.

Paul Jay

Short-term rational. Yeah.

Bob Pollin

But the point is that, and I think we talked about it some months ago. I actually wrote an article about nationalizing the fossil fuel industry a year ago when the price of the oil companies had fallen by whatever it was; it was fallen by more than half. The U.S. Treasury could have bought the entire fossil fuel industry for maybe a 10th of what they were putting into Wall Street to bail out Wall Street. They could still do it now. They can’t do it at the price that was available a year and a half ago. But okay, that’s a good one. I like it. Let’s be real. That one’s not going to happen.

The one that I’m proposing, at least it’s endorsed effectively by the leading Orthodox economic wise people in the world. You have this document supported by the likes of Alan Greenspan, Janet Yellen, Larry Summers. I don’t agree with all these people on a lot of things, but you could say, I mean, this is effectively what they’re saying, tax and rebate. Or actually, in the terms of my U-Mass colleagues who really developed the whole concept, Jim Boyce, he called it tax and dividend, but whatever we want to call it, you make people whole. And it would be easy to make people whole. They are not losing any money, but you also have the disincentive to fill up with oil, as opposed to other alternatives, such as high efficiency or transitioning to electric vehicles exactly because the price of consuming oil is up. And so, making the people whole, though, is critical.

And the fact that in France, whatever it was three years ago when President [Emmanuel] Macron introduced a carbon tax proposal, and he got destroyed by the so-called Yellow Vest movement. Working people saying, “You don’t know what our lives are like. You don’t know what it takes to put groceries on the table.” That was not because he introduced the carbon tax but because there was no rebate part of it. Without recognizing the distributive impacts on working people, it’s always going to blow up. It’s always going to be a disaster. It can be successful in Alaska; it’s been going for years. And even Sarah Palin supported that when the revenue from the oil companies came into the state of Alaska, they just distributed it to the citizens. Everybody got a share. It’s the same idea.

Paul Jay

And workers don’t get how much subsidization is taking place. For example, in the stock market, the stock market is at historic highs in spite of global supply chain catastrophes and on and on. Every week you read about a new high in the market. And of course, it’s like, what is it, 3% or 5% of the population that really benefits the most? I mean, a lot of people are in the game because of pension funds, but the real gains in terms of the amount of money, people who reap the benefit of the market. I think it’s 3% to 5% of the population. And it’s because the Fed is essentially guaranteeing that they won’t let the market crash.

Bob Pollin

No, not effectively. Absolutely explicitly. We had the bailout over the last year of unprecedented proportions, 20% of GDP, $4 trillion the Fed pumped into Wall Street. Absolutely unprecedented. And if that hadn’t happened, Wall Street would have collapsed. Who knows where capitalism would be right now? And so, that has to be recognized as absolutely central to our understanding of how capitalism is working now.

Wall Street is massively subsidized beyond people’s belief. The fossil fuel companies are massively subsidized right now. And those are the things that once we factor those in and our understanding of those, that’s how you can, and it’s the only way that you can explain the fact that when we had the COVID crisis, half of the U.S. workforce was laid off over the course of 12 months and were getting unemployment insurance. At the same time, Wall Street goes up by 50%. Never happened. Nothing like that has ever happened.

Paul Jay

All right. What’s your take on this debate? Is this inflation relatively temporary, maybe a year, maybe 18 months, or is there something more being baked in here?

Bob Pollin

The likelihood, in my view, that it is temporary because the inflation that we’re seeing is supply shock, supply chain oil. And the main thing with respect to oil, as we’ve talked about, is just stopping dependence on oil and other fossil fuels. And if we can’t do it within the next 12 months, okay, we can’t do it. Well, then subsidize people to protect them against the depredations of the oil companies. And then we transfer our spending out of oil and other fossil fuels altogether. That will be key.

And I’ve argued this for a long time, especially when we talk about developing economies that getting off of oil is the most important thing they can do. Forget about the green agenda just in terms of running an economy, a macroeconomy, because oil importers in developing economies, they’re completely dependent on the global oil market. So, of course, it hurts us, but if you see a 40% increase in the price of oil in, say, Kenya or other sub-Saharan African countries. I mean, that’s absolutely devastating. That means that they have to impose austerity just to pay for the oil in order to keep the economy operating minimally.

So we have to get off of this dependence, if for no other reason, just in terms of stabilization, even beyond advancing a green agenda.

Paul Jay

All right. Thanks very much, Bob.

Bob Pollin

Great. Thank you.

Paul Jay

And thanks for joining us. And instead of asking for donations, I’m only going to say, get organized.

Bob Pollin

Get organized. I agree.

Paul Jay

Get organized. Thanks again.

END

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

Why not take proper energy control measures, price and distribution, Mr Pollin? The energy problem is not just its increasing cost, but its increasing danger. I look back to WW2, when our country had a different sort of energy crisis, but the remedy then would be a remedy now: fuel rationing. Then it was rationed because of scarcity; now ration it for its disutility. The unrationed consumption of fossil fuels is an impending threat to civilized life on earth and not just to workers’ needs. When domestic consumption of gasoline had to be rationed to meet the threat of the fascist and Japanese enemies, the US did what was required. The threat is far more serious now. The US should nationalize the petroleum industry and ration its consumption, this time to the military as well and the home-front ! The military is the greatest institutional producer of greenhouse gases. Only the government can stop it!

Mr Pollin seems persuaded that workers’ pay increases cause inflation. Going back many decades to a brief few years after WW2 that was arguable. For a very long time since then, unions have been amputees. The butchering of their limbs began with the Taft-Hartley Act of 1947. They were hamstrung by the Red Scare of the 1950s, when union militancy could be mistaken for Communist conspiracy. By the time Ronald Reagan cut not just the limbs but the throats of the Air Traffic Controllers, the major unions had learned that the way to get along was to go along. That lesson was learned especially well by union leadership. None of the inflations that emaciated the US dollar’s potency had anything to do with unions or workers’ demands. They had to do with Reagan’s arms race and the cost of US aggression in the world and the borrowing done by the US to pay for it. The tie of the dollar to gold was cancelled by Paul Volker in 1971, and the Fed was freed to print dollars without limit for Reagan and for his successors. Since then, workers’ incomes no longer kept pace with productivity, and there is not much that the unorganized, vast majority can do about it. Inflation in not being caused by workers’ demands, as Pollin tells. Wages do not lead prices, they lag them. Wages have a long way up to go to match productivity gains since Reagan. Mr Pollin, John L. Lewis, leading the UMWA and CIO was yesteryear, 1944. Today, we have men and women in suits. You can’t distinguish them from CEOs.

I confess, I did not take the time to listen to the rest of Pollin’s discourse. Maybe he said something about the criminality of the Federal Reserve; about its theft from the dollar assets of citizens, from their pensions and annuities. Maybe he said something about the Fed’s inflation of asset prices, not just stocks and bonds, but housing prices, rents, and now food and other necessities. He and Paul Jay seem to think well of the expertise of the Fed. I’ll finish by reminding them what a real economist wrote (paraphrased): Don’t be impressed by the fools in the blue, pin-striped suits. (John Kenneth Galbraith, Sr.) I dare to add: They are not just fools but knaves as well !

Note: When Paul Volker stopped the bargain sale to European speculators of US gold for $35/oz and ended convertibility, he was following the course that Bretton Woods began. Under the advice of J.M. Keynes, much maligned since 1936 when he published his “General Theory of Employment, Interest and Money”, Lord Keynes tried to persuade, Harry Dexter White and other USians to accept a governing council on money and exchange rates. The US was in control and wanted to keep it; White determined the US to rule the money markets. By 1971, the US had spent so much on the S.E. Asian War and had so greatly become an importing nation, that Volker had no choice but to force the European banks to accept US Treasuries for the dollars that were flooding their books. American citizens, today, have no choice but to hold lifeless dollars (no interest!) and watch them wither from the Empire’s inflationary militarism. No matter what our Fed states, it will drive down the value of the dollar until it is nearly worthless and a new currency can be issued: the great “reset”.

The American experiment, as it has often been called since the Constitution was ratified, has been a failure in terms of progress towards representative government. For whom the government of the US represents, it might just as well be the Kingdom of Monaco!

Hi Paul,

Every interview you do or give is a lesson full of important and useful information, I don’t want to miss. I was happy with the latest format which was giving me the chance to download with MP3 format. For me this is the way I can listen to every interview. I have to time to seat and watch and I don’t want to use the smart phone.

I appreciate your work very much and I don’t miss anything.

Thank you so much!!!