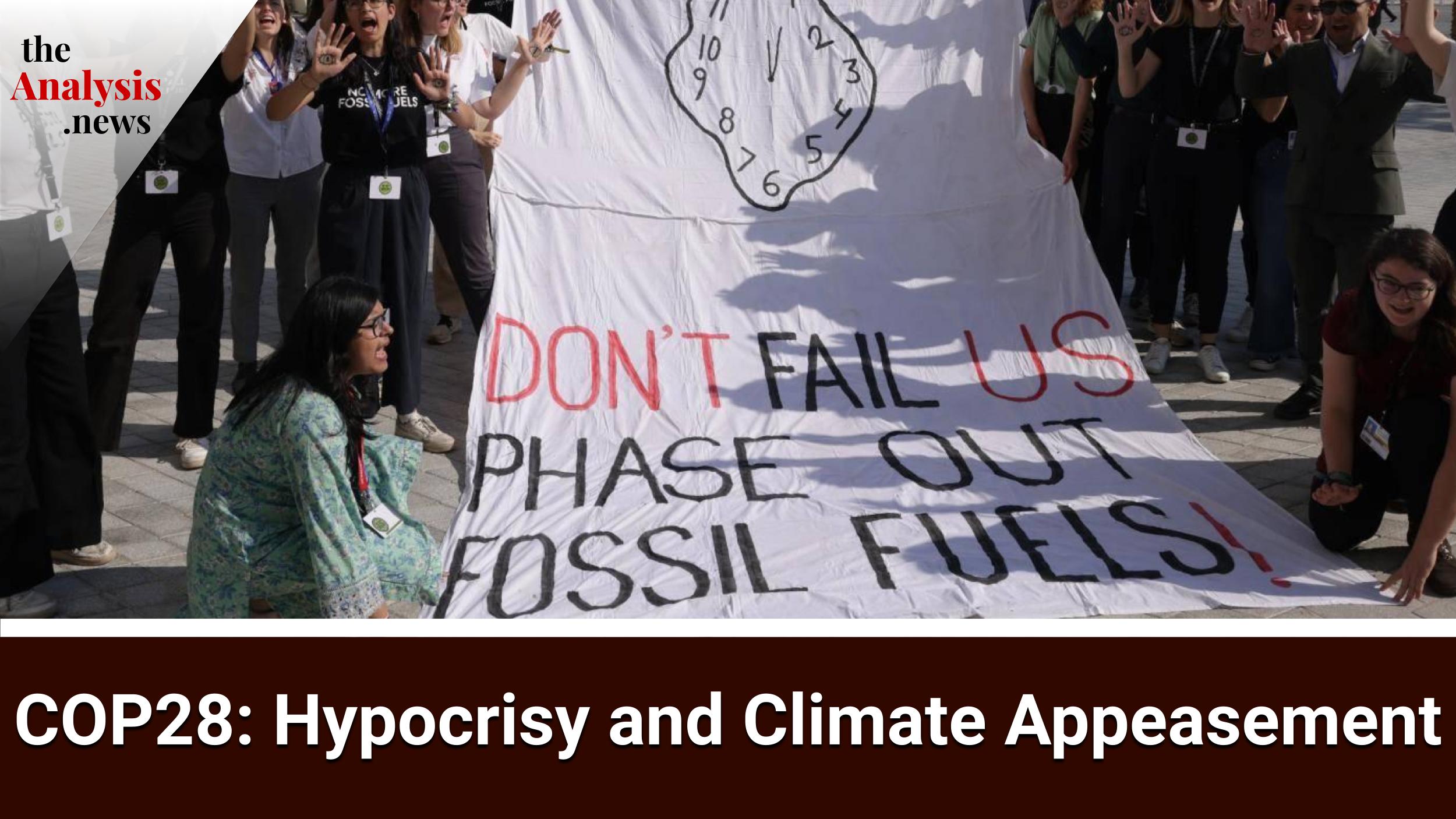

Bruce Robertson, independent energy analyst, exposes the hypocrisies and lobbying taking place at COP28 and how talk of investing in a green transition is belied by increasing fossil fuel subsidies worldwide. He explains how the industry employs terms such as net zero and carbon capture and storage (CCS) to appease social opinion and pretend that emissions are being cut, while CCS technology has largely been a failure. Lastly, he tears into deceptive emissions accounting frameworks, which purport to reduce domestic emissions by exporting gas to other countries but, in fact, contribute to higher emissions globally.

Talia Baroncelli

Hi, I’m Talia Baroncelli, and you’re watching theAnalysis.news. I’ll shortly be joined by Bruce Robertson to speak about the controversies surrounding technologies such as carbon capture and storage, as well as COP28.

We’re nearing the end of the year, so if you’d like to make a donation to theAnalysis, which is a 501(c)(3) nonprofit, you can do so by going to our website, theAnalysis.news, and hitting the donate button at the top right corner of the screen.

Don’t forget to get onto our newsletter and to like and subscribe to the show wherever you listen to it, whether it be on YouTube or on podcast streaming services such as Spotify or Apple. See you in a bit with Bruce Robertson.

Joining me now is Bruce Robertson. He’s an independent energy analyst based in Australia. Thank you so much for joining me today, Bruce.

Bruce Robertson

Thank you very much, Talia, for having me.

Talia Baroncelli

Well, the past two weeks have been pretty remarkable, laying out the contradictions on the global scale in terms of climate leadership. The President of COP28, Sultan al-Jaber, is also the Executive of ADNOC, which is the Abu Dhabi National Oil Company. There’s inevitably a huge conflict of interest there if he is the head of an oil company and is also directing or serving as the envoy to COP28 at the same time. That was exemplified in some of his comments recently where he said that there’s no science backing up the fact that we need a phasing out of fossil fuels. What do you make of those comments?

Bruce Robertson

Well, it’s pretty amazing because COP has been hijacked by the oil and gas industry, to put it bluntly. You look at ADNOC, which al-Jaber is, Sultan al-Jaber is the Chief Executive Officer of. They used COP28 as an opportunity to announce this big announcement of a cooperation agreement with Australia, Santos, to do carbon capture and storage hubs. They’re using it as a commercial opportunity to promote their business interests.

If you look at the number of fossil fuel executives or consultants at COP28, the place is overwhelmed with oil and gas companies, their representatives, and their consultants. In the form of companies like McKinsey and Ernst & Young, the big consulting firms globally whose clients are the oil and gas industry to a large extent, they have large oil and gas businesses.

There’s an awful lot of greenwashing going on at the conference. Sultan al-Jaber comments about going back to the caves if we don’t have oil and gas and we don’t need to phase out oil and gas. All these comments are just speaking to his own business interests.

Talia Baroncelli

I think one of the final results of COP, or at least the draft that was produced, the so-called global stocktake, was that they should phase down fossil fuels rather than phase out. That seems like very banal lingo, but in fact, it makes a huge difference as to whether you phase down or phase out fossil fuels. How is this being received in Australia, where you are? There was a recent mining magnate, Andrew Twiggy Forest, who made some really interesting comments recently.

Bruce Robertson

Yeah, well, Twiggy Forrest is one of Australia’s biggest businessmen. He owns one of the huge iron ore mines, Fortescue. He made a comment that fossil fuel industry executives should have their heads handed to them on spikes, echoing medieval days. A medieval solution to the problem. Now, these rather intemperate comments have sparked a lot of interest.

Basically, they were born out of extreme frustration with the way that the COP28 is going. I think many people are very frustrated with the fact that COP28 really has turned into an oil and gas industry event rather than an event about climate. I think that a lot of people are frustrated with that and his comments. While I think they were a little over the top, nevertheless, he had some good points to make there.

He was saying that carbon capture and storage doesn’t work in practice. He said 19 out of 20 projects fail to achieve their objectives, and that’s pretty close to the mark as to what is actually the case historically. Carbon capture and storage has been around since the 1970s. It’s an old technology, and it’s quite interesting because if we have a look at what TotalEnergies’ CEO said at the conference, he said that capturing carbon dioxide was still too costly and not the solution to decarbonization.

It’s interesting that there is this dichotomy, not just within society more generally, but even within the oil and gas industry. Some people do see the need to phase out fossil fuels. The way the CEO of TotalEnergies was talking was along those lines. He said, “Decarbonization is all about electricity and electrification.” Those were his words. While his company has a long way to go, to actually live up to its CEO’s words, TotalEnergies is still a very heavy investor, a very heavy investor in new fossil fuel projects.

There is what is said and what actually occurs. At the moment, we all know that what’s occurring is emissions are continuing to rise. That’s one fact we can indisputably say. Emissions are rising, and to achieve any goals, we need emissions to fall, not to rise. That’s the position we’re in.

Talia Baroncelli

Well, we will get to some of those failed projects, especially the LNG projects of the Gorgon LNG facility that’s run by Chevron. Before we get to that, I did want to ask you about some of the other general comments made at COP28. I was watching one panel which was hosted by the IMF, and they kept going on about the need to invest in green technology and subsidizing research and development. It wasn’t that they were not talking about fossil fuels, it wasn’t that they were denying that fossil fuels need to be cut in order to reduce emissions, but it didn’t seem like that was really the focus. Their solution was that there has to be trade, there shouldn’t be domestic subsidies, and there should be subsidies targeted in certain areas, such as in R&D, research and development. What’s your assessment of that approach? Is that enough?

Bruce Robertson

Well, quite simply, it’s not happening. Always with this item, we have to divorce what is said with the reality. Just like Total’s CEO saying that this was the way of the future and what their company is actually doing are two totally different things. It is the same with the IMF. If we actually look at what is happening, we’re seeing increased subsidies for fossil fuel industries at the very time that those subsidies should be being decreased. It’s almost as if we live in an Alice in Wonderland Through the Looking Glass type world at the moment, where what is said and what is actually occurring are two totally different things. This is the fundamental point.

Talia Baroncelli

Well, what is occurring in Australia, where you’re based? It seems like there are quite a few liquefied natural gas projects, such as the one that’s run by Chevron, the Gorgon LNG plant. Chevron has invested an incredible amount of money. My impression is that they promised that they would be able to capture and store a lot of the emissions. But it seems like the first three years they weren’t even able to store any of it. They didn’t have enough, they didn’t drill enough water out underneath the plant to store the emission. That wasn’t successful. Now, it seems like they’re not making any of their targets. Is it just the technology that’s not working, or are they not doing it?

Bruce Robertson

I think it really goes to the fundamental problem with carbon capture and storage. The fundamental problem with carbon capture and storage is you’re relying on what’s underground. As we all know, that’s never a certain thing. You can drill it out, you can have geological models, but they are just that. They are models. They are not what is exactly under there.

What Chevron has found is that the operating conditions underground are far more complex and far harder to deal with than they thought. They thought that they could drill into this formation, dewater it, and then fill it with carbon dioxide. Chevron’s Gorgon project is a pure carbon capture and storage project. It isn’t trying to use it to produce more oil like most carbon capture and storage projects actually are. The vast majority are to produce more oil and gas. This one isn’t. It’s the largest one in the world that isn’t. When you look at it, you have some of the best petroleum engineers on the globe, on the planet, working on this. Chevron is the operator of the project, Shell and Exxon are major shareholders in the project, and they can’t get it right.

This is a key point. The performance of that project is not improving. It’s actually going backward. It is not achieving its targets. It only achieved to capture 80% of the emissions from producing the gas at the plant. That’s not 80% of Scope 1 and 2 emissions because there are all sorts of other emissions that they’re not attempting to capture. That’s only 80% of the emissions from the plant and the field emissions.

If you have a look, what does that actually mean? Even if they were successful, they’re only trying to address part of 10-15% of the emissions from their product. Most of the emissions occur when the product is burnt by the customer, not by producing the gas. That’s not when the emissions occur. The emissions occur when the product is burnt. Carbon capture and storage, even if it worked, is a partial solution to part of the problem, a small part of the problem. The big part of the problem it doesn’t address is what happens when the fuel is burnt.

I really think that the oil and gas industry saying that we can decarbonize our industry is really very land stuff. It’s not born of real-world experience, as shown by Chevron’s large project.

Incidentally, in the U.S., you had the Occidental Century plant. It was recently sold for a fraction of its build cost. Getting back to TotalEnergies’ comment, it’s still too costly, this carbon capture and storage, and it’s not a solution to decarbonization. That’s what the TotalEnergies CEO said, and I wholeheartedly agree with him.

Talia Baroncelli

It’s funny because I did hear John Kerry, the U.S. climate czar, recently say that Chevron needs to do more on all fronts. They’re not doing well at all in order to meet climate targets, but ExxonMobil is doing a bit better. I don’t really know the details there, but it does seem like the Gorgon plant has been extremely costly. They spent like $54 billion.

Back to what you were saying originally, the Gorgon plant was supposed to be a one-of-a-kind plant. It was supposed to capture most of the emissions or a lot of the emissions. That’s different from other plants that rely on enhanced oil recovery, so using carbon capture and storage in order to get more oil out of the ground. Can you clarify how the Gorgon plant didn’t rely on enhanced oil recovery?

Bruce Robertson

They didn’t have the opportunity to. There was no field nearby that they needed the carbon dioxide for, that they could use the carbon dioxide for. The Gorgon plant was a new plant. At the time, obviously, they didn’t need the CEO to extract the gas out of the field. It was naturally pressured.

They came up with the idea of dewatering formations that were near Barrow Island. The first problem they encountered, funnily enough, was sand. The sand was clogging the injection points. Then, they found out that the fields that they thought had a certain capacity had a far lower capacity. That’s a common problem with carbon capture and storage, is that the fields that they store them in don’t have the capacity that the geologists first think. That happened at one of the successful plants, supposedly successful plants, it’s held up as a model plant by the global carbon capture and storage industry.

The Snøhvit plant by Equinor in Norway thought they had a geological structure that had 18 years’ worth of CO2 storage. When they actually started drilling it and using it, it had two years. Eighteen versus two. Eighteen, they expected, and they got two. Then, they had to go and drill more holes to discover more fields that they could put the carbon dioxide in. Subsequently, the project was far more expensive than they expected.

This is a common theme in carbon capture and storage, is that it ends up being far more expensive than they first thought. Chevron has spent far more money than they expected to on carbon capture and storage, both in building the plant and subsequently now in having to drill more holes and find more formations to store the CO2 because the fuel capacity isn’t what they modeled it as. This is a very common problem, and it really affects the economics of carbon capture and storage.

Basically, that goes again to the comments that have been made at COP28 that it’s not economic, and it’s not economic. This is the key point, is that costs are always much higher than they expected both to build the plant and then in the implementation, the field costs and having to drill more wells. It’s a very common theme throughout this industry.

Talia Baroncelli

Well, the Prime Minister of Australia, Anthony Albanese, has had certain climate goals, I guess you could say. He’s committed to reducing emissions by 43% by 2030 compared to 2005 levels. I believe some of the legislation that was passed recently in the spring is supposed to bring about or make possible some of those commitments. One of the measures was to introduce legislation that would target 215 of the largest emitters. I’m assuming the Gorgon plant falls under that rubric. What would happen was that if they were able to cut some of the emissions, then they could get carbon credits. I’m wondering, what do you make of the carbon credit system? Is it effective, and is it legitimate? Does it have any integrity?

Bruce Robertson

Well, the Australian scheme, globally, they’ve come under a lot of criticism, the global carbon credits. There have been a lot of schemes that have shown to be basically fraudulent.

In Australia, we’ve had similar problems. I think it would be fair to say one of the people who was engaged in setting up the scheme came out and said that he believed that the credits don’t have integrity, the Australian carbon credit units. There was something called avoided deforestation, which was rather amazing because I farm. As well as I look at energy, I have a farm and I understand pretty well how farming works coming from a bit of a farming family. In Australia, the land that hasn’t been cleared really is not economical to clear because knocking down the trees is more expensive than the beef or the crops you’re going to grow on that land. They were paying people not to knock down trees that they were never going to knock down anyway. The whole thing was a little bit of a fraud, really. The carbon credit scheme doesn’t really work.

With the Australian scheme, though, to reduce emissions, the safeguard mechanism, there is a hard cap that was put on there by the Greens in negotiating this deal. What that means is that it limits the usage of carbon credits to offset emissions. There has to be some real reduction in emissions. The baseline is set at the beginning of the scheme, and then every year that drops by 4.9%. That difference has to be made up by carbon credits or by real reductions. But the Greens have put in this clause that some of the reductions will have to be real.

It will be interesting to see how it all develops over time, how much industry pushes back over time, and what the upshot of all this is. It’s still rather uncertain as to whether it will result in real emissions reductions, but it looks like it will reduce emissions overall. It acts a little bit like a carbon tax, which is a word that can’t be said in Australia. Luckily, I’m not saying it. I’m saying it in an international interview. It’s political poison, the idea of a carbon tax. That’s essentially what the safeguard mechanism is in the end. It is forcing them to reduce emissions. It’s unknown yet whether it will be highly effective, effective, or not effective.

Talia Baroncelli

Well, you’re saying that the baseline would decrease, so companies would have to reduce their emissions over time. I’m just thinking of another example. For example, in the banking industry, companies or banks like HSBC are involved, or traditionally, they’ve been involved in money laundering. As opposed to changing their practices, they’ve just paid fines because they could afford to pay a fine without radically transforming the way business is conducted within the bank itself. Do you see that happening with these big polluters? Are they getting away with it by paying a fine here or there? By maybe giving carbon credit or paying for carbon credit and actually continuing to emit as drastically as they are?

Bruce Robertson

Yeah, look, I think that for some of them, that will occur. Some of them will just pay fines or buy a CCU, carbon credit unit, which is essentially like a tax, if you like. Yes, some of them will, but look, I think also some of them will make some genuine efforts.

To operate in Australia there are a lot of people that hold climate pretty dearly to their future existence. Australia is not a cool climate where I sit today. It’s going to be 36 degrees today, and that’s Celsius, not Fahrenheit, which is a pretty warm day. We’ll see 38 or 40 on the weekend, 40 degrees Celsius, which is really hot. The idea of increased heat is not very welcome amongst the Australian populace, and it’s a pretty era-defining issue of climate change, I think, in Australia.

A lot of these companies will want to make a genuine effort and be seen to be making a genuine effort because they want to operate in Australia. Increasingly, we’re seeing it’s harder and harder to do projects of any description in Australia, where we’ve been finding that with renewables. Getting power lines in, for example, is very, very difficult now. Getting pipelines in is very, very difficult. The oil and gas companies are finding that in New South Wales, landholders are simply saying no to projects on their land. Under law, that’s an interesting thing because they can’t really say no in the end, under Australian law, but they are at the moment. There is a bit of social conflict going around generally, I think, in Australia. It’s not necessarily renewables or oil and gas industry focus, but it’s everywhere.

There is a need for companies to gain a social license to operate. It sounds almost like a nebulous concept, but it’s not a nebulous concept because companies of all descriptions are finding it’s a very real business risk not having society on their side. I do think that there will be real reductions coming out of the scheme because I think the companies are being forced by societal pressure to actually do something.

Talia Baroncelli

In Australia right now, are oil and gas companies allowed to begin or initiate new projects, or is there a cap on that currently?

Bruce Robertson

There’s no cap on it. They are forging ahead with massive oil and gas projects or LNG projects. Not focused on oil, but focused on gas—liquified natural gas projects in the northern territory. You’ve got the Santos Barossa project. Off the northwest shore, you’ve got the Scarborough LNG project of Woodside.

Talia Baroncelli

Woodside, right?

Bruce Robertson

Yeah, Woodside Petroleum. These are globally significant projects. Incidentally, those two companies, like many oil and gas companies, are now looking at merging. Woodside took over BHP Petroleum over a year ago, and now Woodside is looking at merging with Santos. This is a global trend in oil and gas. You’ve seen massive consolidation in the U.S., with ExxonMobil buying up people and Chevron buying up the companies. Hess Corp was bought up. All these quite large oil and gas companies are merging together. It’s because they’re finding the going pretty difficult. You look at Woodside and Santos; they’ve been appalling performing stocks on the Australian Stock Exchange over the short, medium, and long term. Their access to capital is shutting down because they can’t produce the returns that the market needs from them.

There’s a fascinating global phenomenon that’s occurring. You’re seeing the industry consolidate massively globally, and the number of players reduce. They will use that power to monopoly price, basically. That’s what they’re trying to do, is to get to the position where they control everything energy-wise in the fossil fuel space, and then use that to push the prices up for domestic consumers.

It’s already happening in gas in Australia. We pay ridiculous prices for gas in Australia, but if Woodside and Santos merge, it will get much, much worse. It will be interesting to see if our competition regulator will actually allow it, but they’re talking about it right now. That’s hot off the press this morning, actually, that they’re in talks.

I think it’s a really interesting phenomenon, not just in Australia but globally. As I said, you’re seeing this massive consolidation in the oil and gas industry. We have to face facts. We still do rely on oil and gas in our daily lives, much as we would like to wean ourselves off them and have to wean ourselves off them. At present, that’s the case. If you allow all these mergers to go ahead, it does mean that these companies are more powerful and can rely more on monopoly pricing to force up energy costs globally.

Talia Baroncelli

Well, on the topic of this convergence or consolidation of resources within the big oil and gas sector, let’s hope that the Australian Antitrust regulator is able to prevent the merger of those two companies, Santos and Woodside. I recently saw a Woodside executive speak about Woodside’s role in the energy transition, arguing that they’re providing cleaner energy being liquefied natural gas to other countries in Asia, such as Japan, countries which still actually burn coal so that they’re part of the clean energy transition. But liquefied natural gas is still a hydrocarbon. It’s still a fossil fuel. So yeah, it’s better than coal, but it’s not renewable.

Back to the issue of monopoly, how would you say these companies are contributing to the increase of prices globally?

Bruce Robertson

When the consolidation goes ahead, yes, because basically, there’ll be less people for our offshore companies to deal with. It’s that simple; they’ll have more bargaining power, so globally, it will force out prices. What does this tell us? It’s actually hastening the demise of the oil and gas industry, particularly the gas industry because it’s coming up against big competitive pressures now from ever-cheaper solar. Solar is getting cheaper and cheaper to roll out.

In our own country, we’re seeing a lot of people here in Australia with rooftop solar. The one thing the government has done really well is implement rooftop solar. It’s easy to connect to the grid in Australia with a rooftop system. Local electricians know how to install rooftop solar systems safely. They had good training schemes to get them to do that which were government-sponsored. It’s not often I can say that our government’s done something well, but they did, and they did with rooftop solar. What it’s meant is it’s very competitive as a form of energy. We’re going to see increasingly gas come under pressure. Gas usage in Australia is falling quite dramatically, both in the power sector and in industry, and it will begin to fall now in the domestic scene as well.

I think we’ll see similar trends globally over time. Gas is an expensive fuel. I think that particularly liquefied natural gas, which you’ve got to compress the gas, which involves burning an awful lot of gas, about 9% of the gas that goes into an LNG plant is burnt. You’ve got to ship the gas in a specialized vessel, and then you lose some when you regasify it. There are huge energy losses and costs involved in using LNG. I think increasingly, you’ll find that our customer countries will turn away for climate and cost reasons, will turn away from gas.

Talia Baroncelli

Well, what is the debate like in your part of the world when it comes to the nuclear question? This is a very polarizing debate because there are some people who say that the only way to get to decarbonization is to also have nuclear power, and others who say that the risks surrounding nuclear power are just too high, that nuclear waste can be fatal. It could be fatal to future generations. What’s your opinion?

Bruce Robertson

Well, look, setting aside the environmental arguments, and certainly, I think in Australia, it’s one of those things that the opposition has jumped upon, the idea of having nuclear power in Australia, which is pretty bizarre because we don’t have a nuclear power industry in Australia at present. We have a lot of gas, coal, sun, and wind. They are far cheaper than nuclear power. The opposition has jumped on this as a cultural issue, if you like, and they have promoted the idea of nuclear power here.

I actually don’t think it will happen because the lead times are too long. We don’t have an indigenous industry. It’s going to be very, very expensive. There have been a number of inquiries into having a nuclear power industry in Australia, and they’ve all come to the same conclusion: it’s not economic.

Then you have the problem of where you’re going to put it. Australia is a society that certainly knows how to protest. I don’t think you’re going to get one up, practically speaking.

In addition, they were looking at small modular nuclear reactors. This was the big hope for the future. As you know, in the U.S., in North America, some new-scale nuclear reactors, small modular nuclear reactors, have basically failed. They’ve failed to proceed with it. They had massive cost overruns, and the project has been pulled. The idea of small modular nuclear reactors is really a concept. It’s not something that’s in existence today.

Relying on nuclear to get us out of this pickle is somewhat strange when particularly small nuclear is just a concept. It’s not really a thing in existence in the Western world. I don’t really think it’s going to get us there. It’s too far down the road. We need to decarbonize in the very short term, not in the out decades. We need to be doing stuff now to be able to get to net zero by 2050, not rely on some magic bullet that may or may not come in just before 2050.

The lead times on nuclear are horrendously long. Globally, the cost overruns have been mind-blowingly large. When you look at the ones in Europe, even in the home of nuclear, France, they can’t build one anymore for a reasonable price. Flamanville was years over schedule and multiples of the original cost. ED&F Man, the French company, tried to build one in the U.K., and that’s years over that due and multiples of the original cost. They can’t really get it right in Europe.

In the U.S., they’ve been unable to get nuclear in recent history as well–witness new scale that we’ve already talked about. But even with traditional nuclear plants, they’ve had tremendous trouble with a vertical plant, for example, in just building them. I don’t see it as being an economic solution to decarbonizing.

I think that that’s the key point. Even if you divorce yourself from the more emotive side of the argument, which is the environmental side, even if you go, all right, let’s forget about the environment for a moment. Can we actually do one of these things on time, on cost, and get power at a reasonable price to the populace? The answer’s no, we can’t. It hasn’t been demonstrated anywhere in the Western world in recent history. Anywhere in the Western world in recent history. By recent, I mean the last 20 years. There has to be some element of reality about the nuclear debate, and at the moment, there’s not.

Talia Baroncelli

Yeah, it does seem like it’s a pipe dream at the moment. It’s just too expensive.

Bruce Robertson

Just too expensive.

Talia Baroncelli

I do want to ask you again about Anthony Albanese, who’s the Prime Minister of Australia, and he’s from the Labor Party. He has presented an amendment to the climate bill, which would require policymakers to take into consideration the well-being of children when they’re debating or making climate policy. I’m wondering how feasible this legislation is and how much teeth his climate legislation has had in general. How do you compare it to his predecessor, conservative Scott Morrison?

Bruce Robertson

When you look at the change in administration, the new administration, the Labor government in Australia, has talked a big game on climate. But really, it has missed one very fundamental point, one very basic point, and that is to reach net zero, we cannot have any coal, oil, or gas projects, and this government is permitting new coal, oil, and gas projects.

While it has some good policies on climate, like strengthening the safeguard mechanism is one of those. It’s a good idea. While it has some good ambitions in renewable energy to produce more renewable energy in Australia and decarbonize the electricity sector quite rapidly and quite ambitiously, the Labor government has pursued that goal. It has to recognize that all this is a wasted effort. All this is totally a wasted effort if we continue to fuel the global need for more oil and gas, the global demand out there that is frying the planet. The government in Australia deals with global warming as if it were a local problem, and by its very nature, global warming is a global problem. So it’s no good for Australia to reduce its emissions if we give the world gas to increase emissions. The two are totally opposed. This is fundamental, if you like, dishonesty about the current government’s climate policy, as it is fueling global warming.

Talia Baroncelli

Well, that’s an excellent point. You can’t meet those commitments. If you have two contradictory policies, if you have one at home and one abroad, that’s obviously not going to help with reducing emissions and trying to prevent global warming from going past 1.5 degrees and potentially reaching other tipping points.

Bruce Robertson

Yeah, well, I think the fundamental point is global warming is a global problem. Until we start thinking that way, all the solutions we come up with don’t address the problem. Until Australia realizes that it is the cause of global warming by providing increased amounts of gas globally, until we face that fundamental fact, we are just chewing around the edges.

Talia Baroncelli

Well, I do have one more question now that you mentioned that. Would you say that that strategy is part of this money-making scheme where the elites benefit from the oil and gas sector, where you have a different policy at home? So you try to cut emissions at home to keep the domestic population content, especially if they’re more aware of the impacts of climate change and they do want to make a difference domestically, but you still keep exporting all of your gas in order to make a buck and keep the system running to ensure that there’s consolidation and monopolization of the big oil and gas sector.

Bruce Robertson

Look, certainly, it is a policy of appeasement, if you like. They are trying to appease. If you look at the safeguard mechanism, the actual economic effect of the safeguard mechanism is fascinating. By treating emissions as a local problem, they penalize domestic industry and encourage the oil and gas industry.

Only a small slither of the emissions, 10-15% of the emissions from oil and gas are produced in Australia. That’s all that the safeguard mechanism addresses. If you have a domestic manufacturing industry or value-adding industry, most of its emissions will be in Australia. They will be paying to try and reduce their emissions while the oil and gas are exporting emissions. That’s the key point.

What the safeguard mechanism does is penalize domestic industry and encourage the oil and gas industry through this quasi-taxation that the safeguard mechanism is. What it does is it appeases the oil and gas industry at the expense of the domestic industry, and that’s a terrible thing to do. Not only does it have bad employment effects, it also has the effect of distorting economic signals for domestic manufacturing. Obviously, some level of domestic manufacturing is a very good thing because it involves less shipping and transport and lower emissions.

As I always say, it’s far better to burn gas for gas-intensive industries in Australia and produce emissions in Australia than it is to export that LNG up to China, where typically that happens, and produce the fertilizer in China or whatever the product is, and then re-import the fertilizer, which is the model that Australia has gone to. We’re penalizing domestic industry that would, by burning gas in Australia and producing the product here, we would be lowering emissions. That’s a bizarre concept when you think about it. Producing more emissions is actually a good thing. Because it’s lower in the long run, it sounds strange, and I often have trouble explaining that one.

Talia Baroncelli

This is a concept I’ve never heard of, and it is a bit counterintuitive. Can you explain how Australia, by exporting its natural gas and letting the natural gas be burned abroad, is actually contributing to higher emissions globally than if it were to burn the same gas at home in Australia?

Bruce Robertson

Well, it’s a bizarre fact of the way it’s accounted for. When you actually think practically… practically what happens when you produce LNG, it takes 9% of the gas just to produce the LNG and a further 2-6% to ship it. You’ve lost 13% of the gas in that process, and then you have to re-import the product that’s been made offshore, which is an energy-intensive process in itself. If you burnt the gas in Australia and made the product in Australia, you don’t go through the LNG process. You don’t go through the re-importation process. The emissions are far lower.

However, under the accounting stand, under the emissions accounting that we have, the emissions would occur in Australia, and our emissions would be higher. But in fact, they’re lower. This is a bizarre thing. It is much better if you have a process that we don’t have an alternative for at the moment, and we need some high-heat gas to do, we’re much better off doing that in Australia than doing it in China, which is where typically it’s done now and we’ve exported our manufacturing. This means much higher global emissions. That’s the key point. Global warming is a global problem.

Talia Baroncelli

Well, we’re actually ending on the exact same note that we did last time we spoke, which was how most of the world’s emissions are exported to China, essentially. That just confirms another thing we were speaking about last time, where a lot of the manufacturing that’s done throughout the world has been, over the past few decades, sent to China, and so they have higher emissions. It seems like this is another example of exporting oil to other countries such as China, where the emissions are actually then released there.

Bruce Robertson

Yes. Yet, who’s the consumer? It’s the Western consumer that’s driving the emissions. That’s the key point.

Talia Baroncelli

Well, Bruce Robertson, it was fascinating speaking to you again. I always learn a lot whenever I speak to you, so thanks so much for making time.

Thank you for watching theAnalysis.news. If you enjoy this content and would like to help us continue making this show, you can help us out by going to our website, theAnalysis.news, and making a small contribution if you can. Thanks for joining us.

Podcast: Play in new window | Download | Embed

Subscribe Apple Podcasts | Spotify | Android | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Never miss another story

Subscribe to theAnalysis.news – Newsletter

Bruce Robertson is an energy finance analyst of the GAS/LNG sector for the Institute for Energy Economics and Financial Analysis. He has been an investment analyst, fund manager, and professional investor for over 36 years. He has worked with Perpetual Trustees, UBS, Nippon Life Insurance, and BT. He has appeared as an expert witness before a number of government enquiries into energy issues.