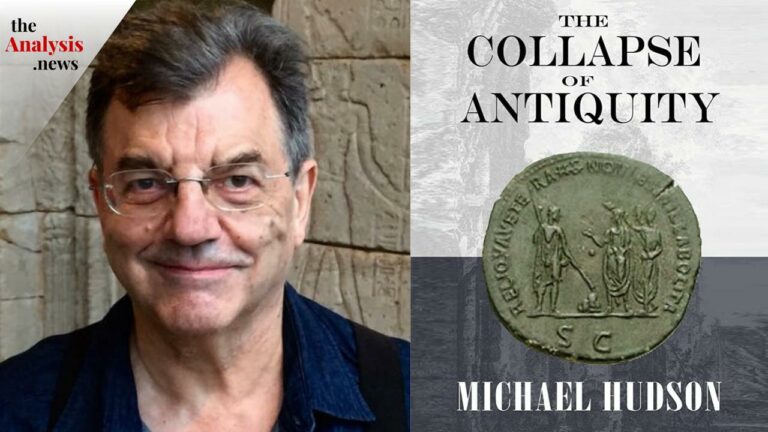

Part 2: Debt and the Collapse of Antiquity – Michael Hudson

In part two, Michael Hudson discusses his new book “The Collapse of Antiquity.” Hudson challenges the traditional beliefs about the fall of the Roman Empire, arguing that it was caused by a financial crisis brought on by excessive debt, wealth inequality, and the concentration of economic power. Hudson draws parallels to modern-day economies and highlights the dangers of financialization and wealth concentration.