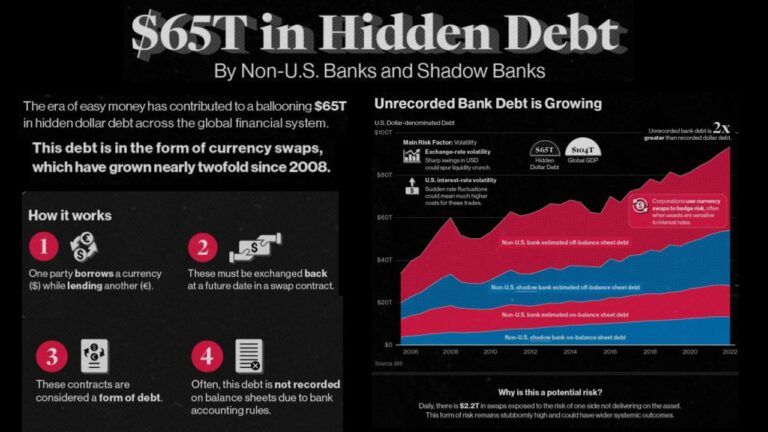

The Failure of Global Finance is Systemic

Jane D’Arista walks us through a comprehensive analysis of a global economy flooded with US dollar liabilities, economies bound to damaging export-led growth models, and vulnerable households piling up useless debts. She offers a rigorous template of policy and regulatory solutions encompassing reform of the US Federal Reserve and the International Payments System and calls to continue fighting to get ideas out. Produced by GPEnewsdocs.