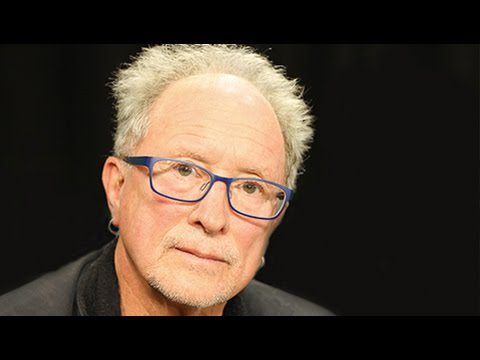

This interview was originally published on September 3, 2014. Mr. Johnston, a leading investigative journalist, says everybody who gets to make a serious run for president is a Wall Street candidate; weakening the estate tax is one way billionaires defend their power and fortunes.

PAUL JAY, SENIOR EDITOR, TRNN: Welcome back to The Real News Network. I’m Paul Jay, and this is a continuation of Reality Asserts Itself with David Cay Johnston.

…

Welcome back to The Real News Network. I’m Paul Jay in Baltimore.

This is a continuation of our series of interviews on Reality Asserts Itself with David Cay Johnston. And David now joins us again in the studio.

Thanks for joining us.

DAVID CAY JOHNSTON, PULITZER PRIZE-WINNING INVESTIGATIVE REPORTER: Glad to be here.

JAY: So, one more time, quickly, David is a lifelong journalist, a bestselling author. His recent books include The Fine Print: How Big Companies Use “Plain English” to Book Rob You Blind, Divided: The Perils of Our Growing Inequality. He was awarded a Pulitzer Prize. He writes regular columns for Al Jazeera America, Tax Analysts. And he’s doing a weekly piece for Newsweek.

And so watch the earlier parts, ’cause you’ve just got to, ’cause they’re so good, and also we’re just picking up where we left off, which was the exposure, David’s columns in the L.A. Times exposing much of what was going on with police chief Gates and how the L.A. Times closed down that line of investigation.

Just to finish that story, your final act of your piece they simply wouldn’t print.

JOHNSTON: Yes. I was shut down just as I was going to lay out the two officers who’d been undercover for 20 years each, one of whom I had interviewed, a couple of very inconvenient murders (I did get one into the paper), and most importantly, that they had officers undercover. Chief Gates, I was told by one editor, had told someone at the paper that that was evidence that I needed to see a psychiatrist ’cause it was crazy. But when he wrote his autobiography, Chief, there’s a line in it that says, I had officers undercover in Moscow and Havana.

JAY: What you uncovered is that some people call today–more at the national level, but you can see it exists at even city levels–some people use the term, like, deep state, which is that there’s kind of a state power that no one really wants to talk about, that doesn’t show up in the newspapers, but wields tremendous power, and much of it through secret police type agencies and such. You saw that up close.

JOHNSTON: Yes.

JAY: You saw its relationship to one of the most powerful, wealthy–family that owned the L.A. Times, which you described in last segment as essentially most of the family had essentially fascist politics.

JOHNSTON: Yes.

JAY: So you’re getting a picture of the ruling class you wouldn’t have had before, I assume.

JOHNSTON: Right.

JAY: Does what does that do to your vision of America?

JOHNSTON: Well, it’s very troubling, largely because it’s not seen by most people and it’s not held to any kind of account. And one of the flaws in our notion that we live in a democracy is that a very narrow group of people select who we get to vote for. Someone like Dennis Kucinich might have a lot of popular appeal, but he will never be a serious candidate for president, because those people who have a lot of money in this country are going to use the system to make sure he isn’t there.

JAY: And the media.

JOHNSTON: That’s right. President Obama–look at how closely he’s identified with Wall Street. I chuckle every time somebody says he hates white people. Almost everybody on the staff is white in the White House–overwhelmingly white. He’s an enemy of Wall Street. Really? Really? Zero prosecutions of the big bankers for what are well-documented frauds, including by the Federal Crisis Inquiry Commission, whose report Congress paid for and then threw in the round file ’cause they didn’t want to look at it?

JAY: Yeah, African Americans may have voted for him, but he is the Wall Street candidate.

JOHNSTON: He absolutely is. And everybody who gets to run is the Wall Street candidate.

And so the fundamental problem we have is, look, most people want to live their lives, and if they can have a reasonably decent place to live and a car that’ll start in the morning and a job with a reliable income and they can have a dog if they want one, they’re pretty much happy. Part of that is because our education system is designed to make sure that we produce nice, compliant factory and office workers. You can have a better conversation about politics, sociology, wealth, culture with the average waiter in rural Ontario or rural Hungary or rural France than with the average MBA in a suit sitting in the first-class section of an American airplane. Trust me, I’ve tested this. Alright? And so we live in a society where we just put blinders on to these things we don’t want to see.

I mean, think for a moment about this use of drones to take out people who I have no doubt are serious enemies of the United States, but which also have taken out wedding parties and children. Just imagine (and this, I think, can happen with the technology): somebody puts a drone up and they want to take out me because I’m seen as a horrible person, and in the process they take out a whole bunch of children who happen to be standing nearby. Do you think that we would react to that by saying, oh, well, that’s just casualty of war? So we aren’t thinking very carefully and deeply about the long run.

And, Paul, the biggest observation that all this has made me come to is if you look at our policies in America today, whether they’re economic policies, political or diplomatic policies, if you believe, as James Watt, Ronald Reagan’s interior secretary, said, that we’d better use up all the resources quickly, because Jesus is coming back and he’ll be really ticked off, all of our policies make sense. But if you believe human beings are going to be here for way beyond any period of time they’ve already been here, our policies don’t make any sense at all. We need to be thinking about the fact that we’re just stewards for the time that we’re here, and we should be thinking about the great-great-great-great grandchildren none of us alive today will ever see.

JAY: Well, that’s certainly not the mentality of the majority–not all, but the majority of people who own the wealth and wield the power in this country. It’s, like, how much of–.

JOHNSTON: And we also have this ideology that if you’re wealthy, somehow that’s virtuous.

JAY: And whatever shit hits the fan, you will be shielded from it, ’cause we’re in a big house, and we’ve got guards, and me and my kids will do okay.

JOHNSTON: Right.

JAY: But I want to go back to where we were. So you see this. You get a real insight into who wields power, both at the level of–you know, the kind of police-state level, if you want, and much of what you describe is the beginnings of what can become a real police state–

JOHNSTON: Oh yes.

JAY: –and the wealth behind the media that helps cover this up, and there’s at the very least a symbiotic relationship here, and perhaps more, in the sense that it serves–.

JOHNSTON: But it’s important to see that there’s no monolith. It’s very fractious, okay? I mean, after all, L.A. Times–.

JAY: It’s systemic.

JOHNSTON: But the L.A. Times did run many of my stories before they shut me down. It’s not like they completely covered this up. They ran stories that really–they changed the LAPD’s reputation. So within this sphere there are fractious elements, different elements, people who have different and contending interests, people who have no interest in this but care a lot about that.

But nonetheless, yes, there is a power elite, as C. Wright Mills called it. It operates on its own interests and behalf. And it certainly doesn’t like people like journalists.

So what do you see has been going on now since the beginning of the age of Reagan? Bumper stickers: “I don’t trust liberal media”. Really? You’re going to trust Fox News, where I can document to you beyond question they just make things up, and they don’t correct when they’re wrong, and they knowingly mislead? I mean, I’ve made mistakes. Journalists make mistakes. When journalist make mistakes, we [not only (?)] run corrections, but the Jayson Blair episode at The New York Times, where this sociopath got loose in the newsroom, 90 percent of what he did was inconsequential stuff, didn’t cause any damage–lying, but inconsequential–Times ran a 14,000 word Sunday front page self-exposé. When The Philadelphia Inquirer found out its star political reporter was the mistress of the Democratic political boss of South Philly, they ran–I think it was 32,000 words exposing how they had missed this and not seen it. You ever seen that on Fox News? And yet they tell lies all the time.

And so you understand that an important element of the wealthiest class in America maintaining its position is making sure that most Americans do not think critically about these things, that we have two-income families who are having trouble getting by, so that they are devoted entirely to trying to hold their family together and they don’t have the ability to be involved in political activities, to then make it hard to vote, to reduce the number of voting machines, to challenge people’s right to vote, to make these robo calls, if you go to the polls and you don’t have your ID, you’ll be arrested sort of stuff that is nonsense, but people who don’t know better are afraid. And it’s very, very troubling. And, by the way, many of the very, very wealthy people that I know in this country–and I know lots of them–they are as troubled as you and I are about this. They’re just not going to assault it frontally.

JAY: There are several big lies this narrative is based on, and two of them you’ve been working on. I mean, you’ve been working on several, but you’ve kind of–in terms of where your career was headed. One of those big lies is the tax system is unjust because it takes the earnings of hard-working people and gives it to the poor.

JOHNSTON: Undeserving poor.

JAY: Undeserving poor, thank you. That’s the narrative. That’s one thing. And you’ve been working on exposing that it’s actually quite a different story, which we will get to.

But the other thing you’ve worked on–and I think it’s critical, and you did, I think, a very important piece for The New York Times in 2001–is about the estate tax, and it doesn’t get talked about very much anymore. But if you want to talk about the Chandler family, who own the L.A. Times,–

JOHNSTON: Multibillionaires.

JAY: –I mean, this whole stratum of billionaires that wield such tremendous political power in the country, ’cause they essentially can buy politicians, it’s the transmission of that wealth from generation to generation that creates what essentially becomes an American aristocracy.

JOHNSTON: Right.

JAY: And the argument there is, well, why shouldn’t we? It’s our hard-earned wealth, so we’re going to give it to our children. And then the thing that always gets dragged out is the farmers.

JOHNSTON: Right.

JAY: If you have an estate tax, hard-earned farmers can’t pass on their farms. So tell us about what you did on that.

JOHNSTON: Well, I went to the richest counties in Iowa with a photographer from The New York Times, and we said we’d like to find somebody who’s lost their farm to the estate tax. And people just laughed. I interviewed 24 local elected officials, all of whom were farmers, all of whom turned out to be Republicans, and they just laughed–that was hilarious. Nobody loses their farm. And one of them said to me, yeah, I don’t understand all those New York boys (you one of them? I guess not) who swallow this stuff. It’s just ridiculous. There’s not a single documented case anywhere in America of anybody losing their farm, and certainly not since 1981, when the law was changed to say that when you die, your spouse no longer owes estate taxes. It happens when the second spouse dies.

JAY: And you looked. You couldn’t find a single farm.

JOHNSTON: I interviewed a professor, Neil Harl, who is a brand name person in Midwest farm households. He said, so I’ve been looking for 35 years; I can’t find it.

Now, to be honest, I did find a rancher whose property was lost. He didn’t make out a will. He hadn’t filed his income taxes for ten years. He didn’t take advantage of the many, many provisions in the law to protect his business. Well, I’m sorry, we’re not responsible for people who are irresponsible.

JAY: So give us a quick history of the estate tax.

JOHNSTON: Sure.

JAY: Like, start, like, right after World War II and what–and where are we–.

JOHNSTON: I actually want to go back to ancient Athens.

JAY: Okay. Do it, and then where are we now.

JOHNSTON: The ancient Athenians–and this is what I teach at Syracuse–the ancient Athenians, after the period we call the tyranny, where tyrants seized power, got to this idea that every man is equal. Their notion of man is a little narrower than ours today, but every man was equal. Well, if every man is equal and is entitled to one vote, they said, well, we should pick jobs by lot.

JAY: Let me just–we should add, every man who’s not a slave, and not–.

JOHNSTON: Yes, no, no, that’s what I mean. Well, what I mean is more narrow, is that you had to be a man born in Athens, and women had no political power at all. So they said, well, everybody gets one vote. Well, wait a second. What about the people with all the money who can influence things? And they said, well, no, having more money doesn’t give you a bigger political voice. That’s not one-man, one vote; that’s not democracy; that’s oligarchy. And then they said, well, you know, thinking a little more about that, the only reason you can acquire wealth is because you live in Athens, because we’re civilized. So we have rules about what’s your property and what’s mine. We have laws to adjudicate disputes and a system to enforce them. We have a military to protect your property. So the wealthier that you manage to become because you don’t live in the jungle, where thieves will just take your gold, but you live in Athens, the wealthier Athens makes it possible for you to become better off, the greater the burden you should bear, the larger the share of your wealth you must turn back to Athens so that Athens will endure.

This principle of the moral basis of progressive taxation has endured for 2,500 years. Even George Bush says that he believes in this principle.

Now, World War II comes along–I’m sorry. World War I. Horrible war, right? People dying left and right. There’s a draft. And it is argued that the conscription of young men should be matched by the conscription of wealth, because after all, winning this war will protect that wealth. And so we get an estate tax, which says that on your death, if you have a very large fortune, the government is going to take a share of it.

Now, most of those fortunes have never been taxed, even today. I mean, that’s what the definition of wealth is, right? Bill Gates starts a company with $50,000 of borrowed money from his parents and turns it into the biggest [grown (?)] fortune in America. He hasn’t paid taxes on any of the stock that he still owns. And were we to eliminate the estate tax, it would never be taxed. Well, the idea of the estate tax is we catch up with you at death and you pay the tax that you deferred until you died.

Now we have an exemption of $10 million. And here’s where the law is totally porous. I got the Romney campaign to acknowledge in writing in December 2011, just a year ahead of the campaign, that the $100 million trust fund for the five Romney sons–each have $20 million bucks worth in it–no gift taxes were paid. And anybody who has any money at all has heard you can give $14,000 to [as] many people as you want, but you’ve got to pay a gift tax about that, and you have a lifetime exemption of, today, $10 million for a married couple. Back then it was $1.2 million for a married couple. How do you get $100 million tax-free to the kids?

Well, this is where the law is porous. What they did is they went out and created a company. It had a bunch of shares. It had no business or anything else. It’s just a paper company. They give the shares to the kids. Then they start Staples. Now you’ve passed on to the kids all this money. You and I can’t do that, but somebody like Romney can. And, by the way, the Romney children, the sons, they get their income tax-free.

JAY: Why?

JOHNSTON: Because mom and dad paid the taxes, and by paying the taxes on behalf of their children, in effect they pass even more money to their children. So instead of giving you $100 million one year and then you’d have x million after taxes, they give you the $100 million and they pay the taxes. So they’re really giving them the $100 million plus the taxes.

JAY: This idea that on death, if you’ve done so well because you live in a society that helps create such wealth and you got such a big piece of it, there was still some sense of that after World War II. You get to where–I mean, chart how we go from–I, frankly, forget the rates, but they were very high after World War II.

JOHNSTON: Under President Eisenhower, a Republican, the highest marginal tax rate was 91 percent.

JAY: Yeah, I thought it was over 90.

JOHNSTON: Yeah, which I think is excessive. But basically–.

JAY: But it was accepted.

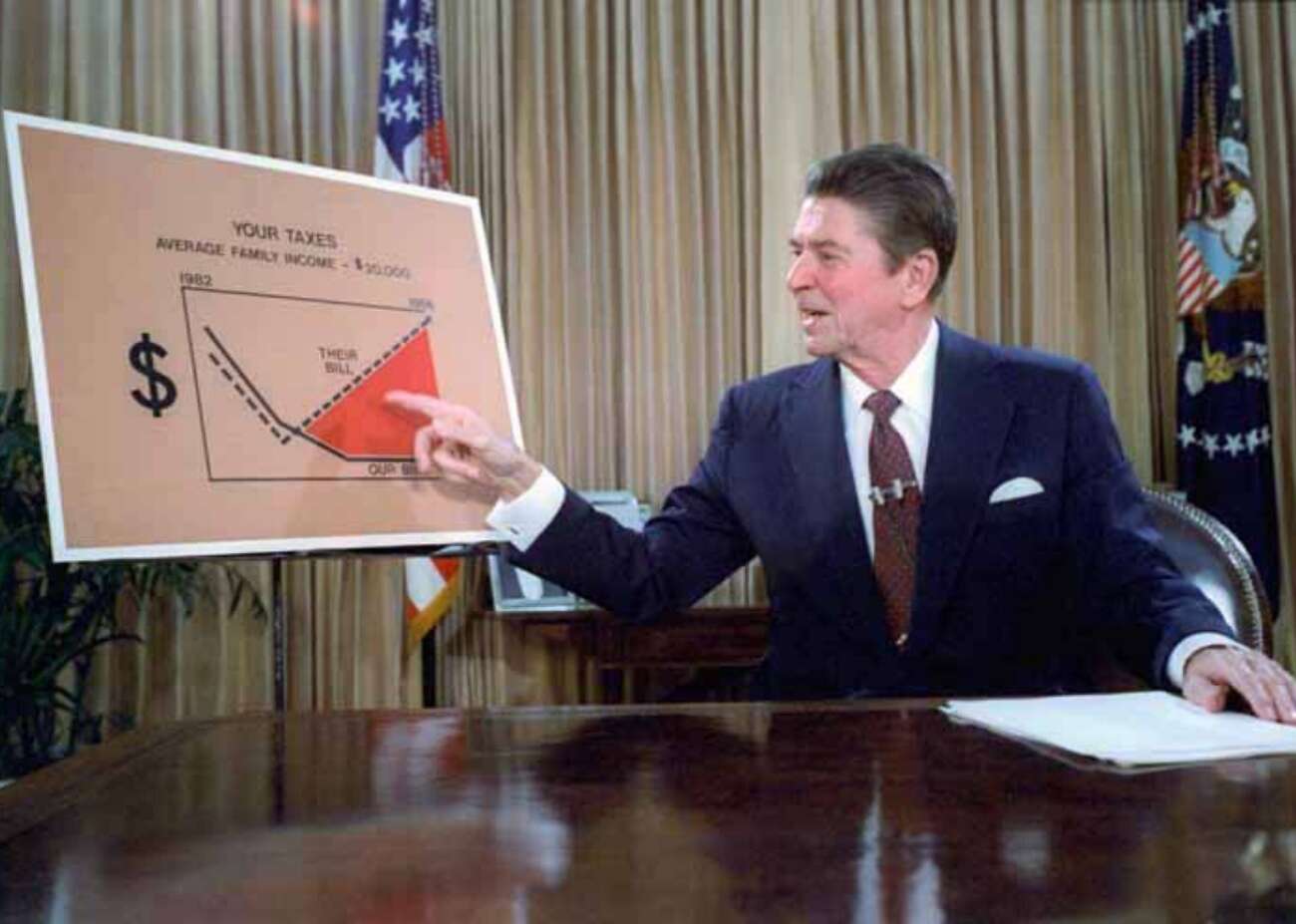

JOHNSTON: It was accepted. And basically the idea was that once you’ve got x dollars of income, it’s enough. And if you want to spend more than that, the society is going to take a share of that, because it’s the society that makes this surplus possible for you. It’s because we’re such a big market. You know, Warren Buffett once said to me, Americans think they’re so smart; if you transplanted us all to Bangladesh, we wouldn’t be rich. We’re rich ’cause we got the rules right. Well, the rules that we’re following now are the rules that say, if you already got yours, we’re going to protect it; not, oh, how do we create new fortunes? If you go to Google and watch the whole seven-minute “Joe the plumber” Wurzelbacher confrontation with candidate Obama on the streets of Toledo–which, by the way, almost word for word comes out of my book Free Lunch, what President Obama said–he keeps trying to explain to him that you would, under Obama’s plan, be able to save more money and have paid a lower tax rate, so that you could build up the capital to start your own business. And Wurzelbacher can’t hear this. He’s completely deaf and blind to this. When Ronald Reagan put in his Tax Reform Act in 1986, it lowered the top tax rate to 28 percent.

JAY: From 90.

JOHNSTON: Well, when he came into office it was 70. He got it lowered to 50, and then to 28 as the top rate. Now the–the Republicans are now trying to get it back down to 25. Well, it didn’t change my income taxes one bit. But people I know who made lots and lots–.

JAY: Now, just to be clear, here we’re talking income tax, not estate tax.

JOHNSTON: Income tax in 1986. Because when you lowered the rate to 28 percent, all the benefits of that went to people who were way up the income ladder. The news media kept writing about, oh, we’re going to lower the rate to 28 percent. So I’m suddenly paying 28 percent, the same rate as the Rockefellers.

…

So let me switch to income tax for a second here. Ronald Reagan got the income tax rate that had been 91 percent under Eisenhower and then came down to 70 percent under Kennedy and Johnson, he got it down to 50. And then he got it lowered all the way down to 28 percent. And the news media [are all full of (?)] oh, we’ve lowered the tax rate. Not for about 90 percent of the public. Didn’t lower my taxes at all. Didn’t save me a penny. And oh, by the way, they took away the interest deduction for car loans and credit cards and a whole bunch of other rules. And then Reagan got these 11, quote, revenue enhancers, tax increases on ordinary people. And we’ve shifted the burden in this country enormously.

JAY: I want to go back, ’cause this is now into the realm of income tax, which I want to get to, but I want to go back–.

JOHNSTON: You want to stick to estate tax.

JAY: I want to stick to estate tax.

JOHNSTON: Okay.

JAY: What was the estate tax under Eisenhower?

JOHNSTON: Basically a little over half.

Okay, let me go back. So the estate tax back in the Eisenhower days, it came in at a very low level–a couple of hundred thousand dollars, maybe $2 million in today’s money, and the government basically took half of everything above that. And yet wealthy people didn’t suddenly end up not being wealthy people, because it’s porous. So just as the Romneys had this device to pass money to their kids, all these wealthy families pass their monies to their kids. And the only ones who didn’t pass their fortunes were the ones who blew their fortunes. They either didn’t recognize the business they were in was coming to an end ’cause of technology or social changes and invest in something else–. But the Du Ponts have been wealthy from the founding of the republic. They’re still fabulously wealthy. And think how many generations and how many Du Ponts there are now compared to then. The Rockefellers are still wealthy. The Kennedys are still wealthy. This was never a confiscatory tax. And there was a very good book written about it in the ’50s by a law professor who called it, accurately, a voluntary tax. It was paid mostly by small businesspeople. They’re the ones who got hit with the tax, you know, your local car dealer, your local metal-bending factory.

JAY: Why? ‘Cause the rich found ways to avoid it.

JOHNSTON: That’s right. And the devices–.

JAY: It was part of this, foundations and other things.

JOHNSTON: And the devices that were available cost a lot of money to pull off. I mean, there are all sorts of tax avoidance devices I could tell you about and you and I could do legally. The problem is that the legal fees to do it’ll run $1 million. So, first you have to have so much money that a million-dollar legal fee is insignificant to your wealth. And this is fundamental to understanding that. So you want to have turnover of wealth.

JAY: Can I just interrupt for just one sec? When I looked at some of the actual numbers of estate tax that was pre year 2000, like, around 1999, 2000–we were looking at Wisconsin in particular. While I take your point that it was porous, they actually still did raise a significant amount of money. And then, during the Bush administration, and then into the Obama administration, even that much was greatly reduced.

JOHNSTON: Right. Well, they cut estate tax rates, they increased the amount exempt from tax, and they radically cut enforcement. Eighty-five percent of gift tax returns (where you make a gift your children) that were audited were shown to have substantial cheating. People were cheating. They didn’t expect to be audited. So they would say, this is worth x; it was really worth maybe 10 times x, so they didn’t have to pay the tax on it.

So if you don’t have rigorous enforcement of the tax laws–and remember, the IRS are the tax police, just like the blue suits are the street police. And we’ve developed this culture where we go, oh, IRS, they’re terrible. You know, the IRS did this or that. No. The IRS just administered the laws Congress passed. And we have radically cut their numbers, so that by 1999 you were more likely to be audited by the IRS if you were poor than if you were rich.

JAY: From the Bush years and then the deal that President Obama finally made with the Republicans during his administration, most state estate taxes are done. There’s only a few states, if I understand it, that still even have estate taxes. A handful still do. The federal estate tax was greatly reduced. And very little said about it all. Like, the media barely paid attention to it.

JOHNSTON: Well, I would disagree about that. I think there was a lot of coverage of this–not so much at the state level. But the real story at the state level is that pre-George Bush, the federal and state income taxes were integrated, so any money you paid to the state government reduced your burden to the federal government. Bush ended that. George Bush’s plan actually raised estate taxes on millions of people who have moderate wealth who now fell into their state system and paid more to their state government.

Now, Canada, the country where you were born, has what I think is a much more elegant system for this. If you sell your ExxonMobil stock to buy Apple, you have to pay taxes on the gain, because you’ve made a transfer. Well, in Canada they got rid of the estate tax, but they now have capital gains at death, because when you go, as you will some day, if you have Exxon stock, it’s going to go to somebody else, so you had to settle up and pay your estate tax. And I would simply have a rule that says that if you do that, there should be a longevity factor. That is, if you had 50 years you held your Exxon stock, you should probably pay a little higher tax; if you owned it for two years, a lower tax. But you should have to pay the capital gains tax at death.

What we do now is we have a system called stepped-up basis, and the simple explanation is wealthy people get to pass the stock on to their kids, and they can sell it and pay no tax. You bought it for a dollar. It’s now worth $1,000. Kid sells it for $1001, no tax due. That’s how the wealthy perpetuate their wealth. That is the single biggest [rule (?)].

JAY: So what’s the consequence of this? We’ve gone from where there was at least some chipping away at some of the big estates–I take your point; it was porous, it wasn’t ever big chipping away. The big estates remain very big. But even that much chipping away is more or less gone now. What does that mean to country?

JOHNSTON: Well, what it means is the reason people don’t have jobs, the reason that the median wage is stuck at the same level since 1998 and the average income of the bottom 90 percent of Americans has fallen back to the level of 1966–look at my gray hair; I was in high school in 1966, and that’s where 90 percent of Americans have fallen back to–is this incredible concentration of wealth in very, very few hands at the top. We have created a system does that isn’t trickle-down. The Democrats invented that to denigrate Nixon, it’ll trickle down. No, it’s Amazon-up. We take from the many to give to the super-rich.

JAY: Alright. That’s the subject of the next segment of the interview. We did estate tax. Now we’re going to talk about income tax, and we’re going to take on this idea that what’s wrong with taxation is we’re taking from the working people and giving to undeserving poor. In fact, the story is we’re taking from working people and giving to what they think are deserving rich.

Please join us for the next segment of our interview with David Cay Johnston on The Real News Network.

Never miss another story

Subscribe to theAnalysis.news – Newsletter

“David Cay Boyle Johnston is an American investigative journalist and author, a specialist in economics and tax issues, and winner of the 2001 Pulitzer Prize for Beat Reporting.”