For African countries, the potential effects of an economic crisis unfolding from the Covid-19 pandemic would be even more disastrous under the Pan-African project of a monetary union. For background on why, we feature a talk by Riaz K. Tayob

TRANSCRIPT

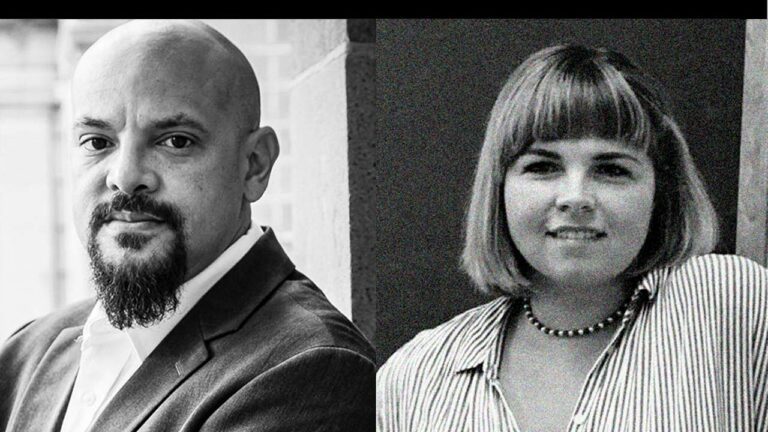

LYNN FRIES: Why is Pan-Africanism in its African Union form being denounced as neoliberal? This newsdoc explores that question. A symposium in honor of an eminent economist, the late Samir Amin, recently took place in Senegal. Professor Amin’s approach to development as an economist of the people came into sharp contrast with that of the current approach of the African Union. Notably, AU plans to create an African Monetary Union and an African Central Bank. This newsdoc features clips of that symposium as Riaz Tayob presents his views on all this. Riaz Tayob is a researcher at SEATINI – South Africa.

RIAZ TAYOB: I would like to say that we lost Samir Amin at a time when Pan-Africanism in its African Union form is neoliberal. The African Union Commission plans for finance are basically neoliberal. The plan for the Africa Monetary Union to be established by 2045 – that is a single currency with a central bank and regional banks – would basically reduce African policy space. The space we have to pursue policies that are supportive of development from three options in times of crisis to only one.

So the three options would be: if a country has a financial crisis you can devalue your currency; you can have deflation; or you can impose direct controls. That is capital controls, tariff controls or non-tariff barrier controls. The African Union along with the Association of African Bankers wants to make those three options into one.

Now let’s just put this into perspective when Greece had its financial crisis the solution from the Troika – the IMF, the EU all that bunch of brilliant intellectuals yet idiots. Intellectual yet idiot is a term coined by Nassim Taleb that means technocrats know what they are doing and they pretend to know what they are doing yet their models don’t work. So that’s the definition of idiot, so intellectual yet idiot. And it is very important but you have to understand what the African Union Commission is actually doing. They are taking away two options and leaving us with one. Let’s look at Greece. When the Nazis occupied Greece in World War II, they did not achieve a drop in GDP to the level that the Troika achieved in Greece. The Troika achieved a 30% decrease in Greece’s GDP. And this is the Pan-European project, a neoliberal project run out of Frankfurt and the Bundestag. I mean that is what it is about.

So what we are faced with is a neoliberal African Union Commission funded by the Association of African Central Bankers who in the Constitution for the establishment of the African Monetary Union want an African Monetary Institute who can take money from anyone whose budget will be unaccountable to the people of Africa or to the Parliaments that are represented in the African Union. This is very, very serious. Basically what we are talking about here is the entire Continent, if I made a metaphor or a simile, is being turned into a mortgage backed security so that all the debt can be pulled so that we can pay back our debt with everyone converting their natural resources to meet the compounding interest of debt taken in the past. We are a big CDP . And you know what these mortgage backed securities did in 2007.

So I want to link it to the idea of Samir Amin. And the particular idea that I would like to link to are basically the link between sovereignty and auto-centered development as well as the concept of delinking and put it in the context of financialization. Samir Amin was very clear we auto-centered development which basically means national accumulation. It means structural change from a primary commodities economy into a manufacturing economy. And the most important is that we finance our development locally. The Africa Union stands against that. So this new Pan-Africanism needs to be attacked with the same vigor as our forefathers and foremothers did.

So, why auto-centered development? It is because even a bourgeois economist like Keynes would say let finance be national because you cannot have resources from outside developing you because it creates instability. It is classical transfer problem. How do you get hard currency to pay for your necessary imports? Now when we look at this, we have to say auto-centered development is for structural change. And I am mentioning this because there was some rather fuzzy interpretation of Amin’s work at this meeting and I am not tolerant of that because I am here for our intellectual theorist. So he is not interested in industries. Amin was talking about industrial systems. The difference being that in industries basically you are in the global value chains and you are outsourcing production. And Amin’s definition of an industrial system is that outputs from one industry are inputs to the next.

So a position of most of our African countries supporting foreign direct investment (FDI) and linking into global value chains is necessarily unstable. And if you want a modern example of this just look at China and how it developed, it moved up the value chain. It started in certain positions but now it has an industrial system which is the definition of structural change according to Amin. We cannot take a view that production and accumulation can be on a global scale. We have to focus at the national scale. Because Amin analyzed flows he came to the conclusion of delinking. And one needs maybe some nuance in this. It’s basically that we want selective delinking. That we cannot just become autarkic. So it’s selective delinking in an age of financialization.

Now let me come to the point around the single currency. We will lose two options out of three if we pursue the African Monetary Union. The CFA zone is in a different situation because they haven’t achieved even nominal monetary sovereignty because of their relationship with France. I am not an expert in this but there are three positions in West Africa that I have read and people like Ndongo are more expert at this and can address it. The one would be extend and pretend. Let’s take the CFA as it is and let more countries join it. The other position is: let’s take a tactical approach and get parts of CFA under our control and then get full monetary sovereignty. And the third position is Amin’s position. A monetary union at this level of development is disastrous. It is disastrous because the CFA has shown us that per capita incomes now are lower than at the start of the union. And a national currency gives you the full three options of direct controls, devaluation and deflation. Right, so it is about maximizing our policy options whereas the AU and the central bankers want to minimize our policy options. And I think we need to push the Amin option. We need to have a tactical as well as a strategic position on this. The enemy is within and without. This is a problem.

The nice thing about the African Union Commission and the African Central Bank position is that they make the IMF and the World Bank look good. Africans are doing this. But there is a difference in this. If we do it with the IMF once we pay up we can get out but how are we going to move Senegal out of Africa if you are part of the Africa Monetary Union? The situation is very, very desperate. They want convergence criteria that will make structural change impossible. And they have Continental legitimacy. The new Pan-Africanism is neoliberal.

Let’s talk about the North-South thing. We specialize in activities that known as diminishing return activities. That is mining and agriculture. After a certain point a needed input or resource is no longer available at the same quality or price. So if you start mining gold, it’s wonderful when it is 10 meters under the ground. When you are 4 kilometers under the ground, you keep putting in more capital to stand still and your R-to-I goes down – that is diminishing returns. Increasing returns are what the Chinese specialize in. They said we are not developing mining or agriculture. We’re going for increasing returns: as you expand production, costs go down. African countries are locked into specialization into diminishing returns. You exchange products whose cost goes up as you specialize for products that go down for manufactured goods. This is untenable. This is absolutely untenable. What we expect from the AU is concordance with Amin’s position. As well as, what’s the point of being united if you cannot stand up and say we are African? We are exceptional. We host the most number of LDCs and we want exceptions in the World Bank or IMF Agreements and the WTO. If you are getting together and just partying in Addis, it is not good enough. We want African exceptionalism because we are poor. And we are poor because we have been made poor.

Samir Amin is more relevant than ever. May he rest in peace, may the Christians, may the Muslims, may the Hindus, all of us claim Samir Amin for ourselves.

LYNN FRIES: We have to leave it there. Thank you for your interest in this segment of GPEnewsdocs coming to you from Geneva, Switzerland.

End of transcript

RIAZ K. TAYOB is a researcher at the Southern & East African Institute (SEATINI) – South Africa chapter, a regional organization with offices also in Nairobi, Zimbabwe and Uganda. He holds a masters in law covering international trade law. Previously, he was the African correspondent for Third World Network in Geneva covering the World Trade Organization and the United Nations institutions.